- Singapore

- /

- Metals and Mining

- /

- SGX:S20

Straits Trading (SGX:S20) Share Prices Have Dropped 20% In The Last Three Years

While it may not be enough for some shareholders, we think it is good to see the The Straits Trading Company Limited (SGX:S20) share price up 22% in a single quarter. But we must note it seems the three year returns are less impressive. To be specific, the share price is a full 13% lower, while the market is down , with a return of (-11%)..

View our latest analysis for Straits Trading

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

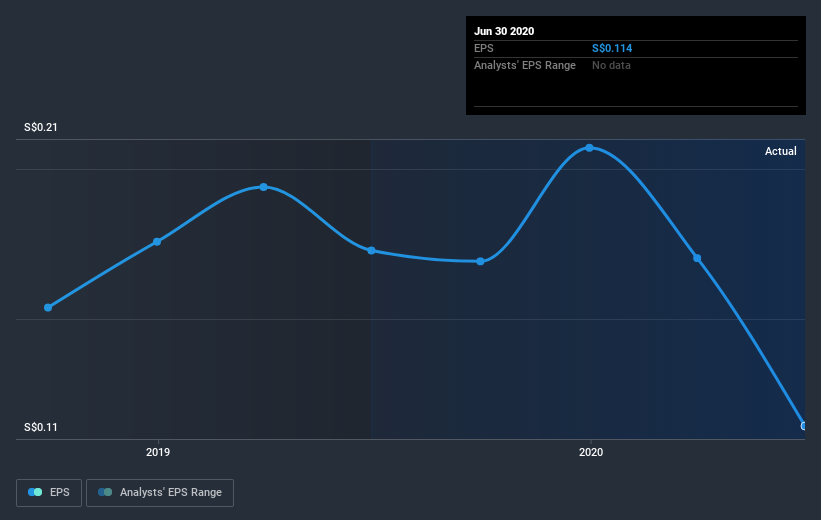

During the three years that the share price fell, Straits Trading's earnings per share (EPS) dropped by 12% each year. This fall in the EPS is worse than the 7% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Straits Trading's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Straits Trading the TSR over the last 3 years was -13%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While it's certainly disappointing to see that Straits Trading shares lost 8.7% throughout the year, that wasn't as bad as the market loss of 9.7%. Longer term investors wouldn't be so upset, since they would have made 0.5%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Straits Trading (1 is a bit concerning!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

When trading Straits Trading or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:S20

Straits Trading

A conglomerate-investment company, engages in the resources, property, and hospitality businesses.

Second-rate dividend payer with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026