The Singapore market has been navigating a landscape of economic resilience and cautious optimism, with the Straits Times Index reflecting a stable yet vigilant investor sentiment. Amidst this backdrop, dividend stocks have garnered significant attention for their potential to provide steady income streams and capital preservation. In such an environment, identifying robust dividend stocks can be crucial for investors seeking both stability and consistent returns. Here are three SGX-listed dividend stocks that stand out in the current market climate.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.99% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.69% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.26% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.17% | ★★★★★☆ |

| QAF (SGX:Q01) | 6.10% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 9.90% | ★★★★☆☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.17% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.68% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.67% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Hour Glass (SGX:AGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited, an investment holding company with a market cap of SGD1.02 billion, is involved in the retailing and distribution of watches, jewelry, and other luxury products across Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam.

Operations: The company's revenue from retailing and distributing watches, jewelry, and other luxury products amounts to SGD1.13 billion.

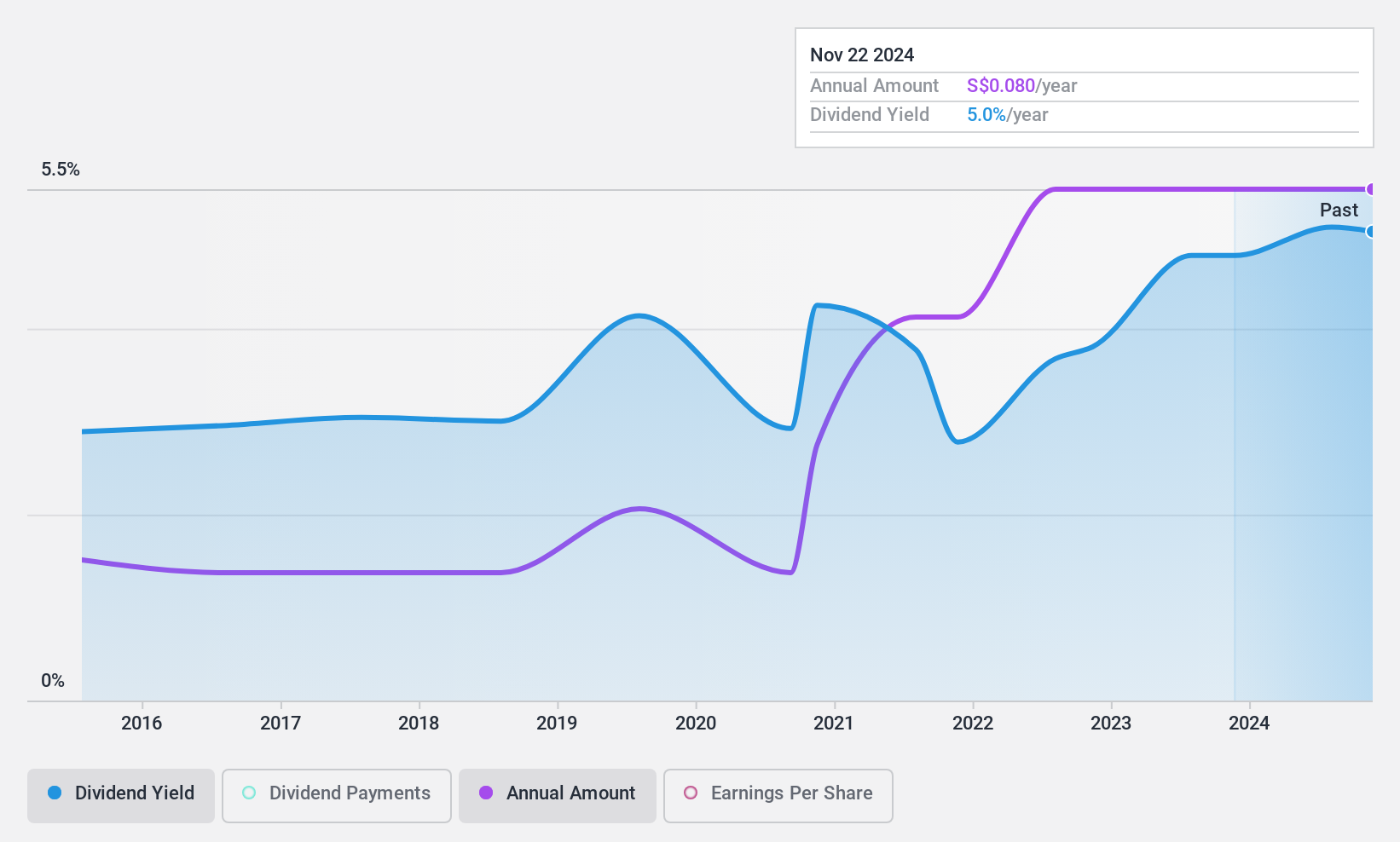

Dividend Yield: 5.1%

The Hour Glass Limited recently approved a final dividend of S$0.06 per share, indicating consistent payouts covered by earnings (payout ratio: 33.5%) and cash flows (cash payout ratio: 46.2%). However, its dividends have been volatile over the past decade, with periods of significant drops. The company also initiated a share repurchase program authorized to buy back up to 64.83 million shares, enhancing shareholder value despite its relatively low dividend yield compared to top-tier payers in Singapore.

- Unlock comprehensive insights into our analysis of Hour Glass stock in this dividend report.

- According our valuation report, there's an indication that Hour Glass' share price might be on the cheaper side.

Delfi (SGX:P34)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delfi Limited, with a market cap of SGD510.32 million, manufactures, markets, distributes, and sells chocolate and chocolate confectionery products in Indonesia, the Philippines, Malaysia, Singapore, and internationally.

Operations: Delfi Limited generates revenue of $349.57 million from Indonesia and $183.30 million from its Regional Markets segment.

Dividend Yield: 6.7%

Delfi Limited has a dividend yield of 6.67%, placing it in the top 25% of Singapore's market, but its payments have been volatile over the past decade. The recent interim dividend decreased slightly to S$0.0272 per share for H1 2024. Despite a reasonable payout ratio (57.2%), high cash payout ratios (750.7%) indicate dividends are not well covered by free cash flows, raising concerns about sustainability amid declining earnings and sales figures for H1 2024.

- Click to explore a detailed breakdown of our findings in Delfi's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Delfi shares in the market.

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market cap of SGD419.58 million.

Operations: China Sunsine Chemical Holdings Ltd.'s revenue segments include Rubber Chemicals (CN¥4.39 billion), Heating Power (CN¥202.99 million), and Waste Treatment (CN¥25.06 million).

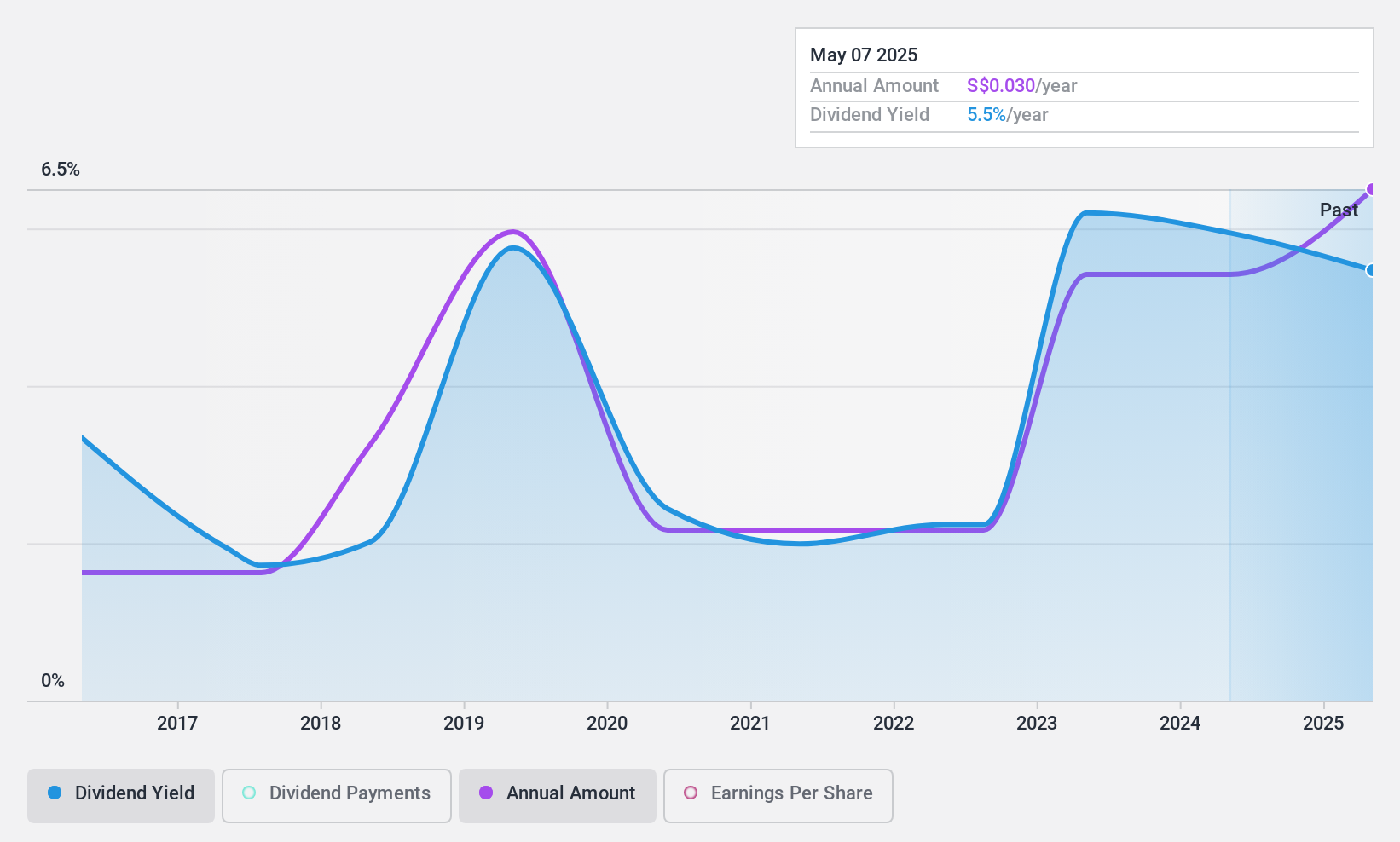

Dividend Yield: 5.5%

China Sunsine Chemical Holdings reported H1 2024 earnings with sales of CNY 1.75 billion and net income of CNY 188.8 million, slightly down from the previous year. The company's dividends are well-covered by earnings (21.1% payout ratio) and cash flows (34% cash payout ratio), though its dividend history has been volatile over the past decade. Trading at a significant discount to estimated fair value, it offers a lower yield compared to top-tier dividend payers in Singapore.

- Dive into the specifics of China Sunsine Chemical Holdings here with our thorough dividend report.

- Upon reviewing our latest valuation report, China Sunsine Chemical Holdings' share price might be too pessimistic.

Next Steps

- Investigate our full lineup of 20 Top SGX Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Delfi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P34

Delfi

An investment holding company, manufactures, markets, distributes, and sells chocolate, chocolate confectionery, and consumer products in Indonesia, Philippines, Malaysia, Singapore, and internationally.

Flawless balance sheet and fair value.