- Singapore

- /

- Industrials

- /

- SGX:J36

July 2024 Insights Into Three SGX Stocks Estimated Below Value

Reviewed by Simply Wall St

As Singapore's market navigates through a landscape of strategic acquisitions and technological integrations, exemplified by Chime's recent acquisition of Salt Labs, investors are keenly observing shifts that could highlight undervalued opportunities. In this context, understanding what constitutes a good stock involves looking at fundamentals, market position, and potential for growth amidst current economic activities.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Jardine Matheson Holdings (SGX:J36) | US$35.38 | US$40.44 | 12.5% |

| Singapore Technologies Engineering (SGX:S63) | SGD4.33 | SGD7.93 | 45.4% |

| LHN (SGX:41O) | SGD0.335 | SGD0.37 | 10.1% |

| Hongkong Land Holdings (SGX:H78) | US$3.23 | US$5.64 | 42.7% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.95 | SGD1.62 | 41.3% |

| Seatrium (SGX:5E2) | SGD1.38 | SGD2.31 | 40.4% |

| Digital Core REIT (SGX:DCRU) | US$0.57 | US$1.11 | 48.5% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.745 | SGD1.34 | 44.6% |

Let's review some notable picks from our screened stocks

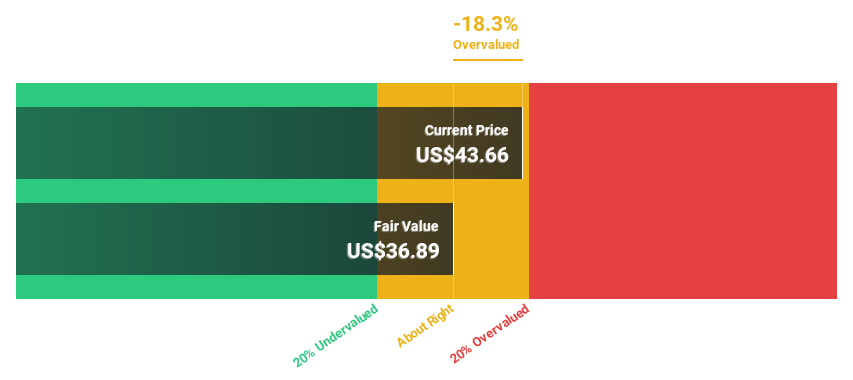

Jardine Matheson Holdings (SGX:J36)

Overview: Jardine Matheson Holdings Limited engages in diverse sectors including motor vehicles, property investment, food retailing, and more across China, Southeast Asia, and globally, with a market capitalization of approximately $10.28 billion.

Operations: The company's revenue is primarily generated from motor vehicles and related operations with $20.61 billion, followed by food retailing at $9.17 billion, while smaller contributions come from property investment and development at $1.84 billion, transport services at $2.14 billion, and other sectors including health and beauty, home furnishings, engineering and construction.

Estimated Discount To Fair Value: 12.5%

Jardine Matheson Holdings is trading at US$35.38, below the estimated fair value of US$40.44, indicating it may be undervalued based on discounted cash flows. Despite a dividend yield of 6.36%, its coverage by earnings is weak. Analyst consensus suggests a potential price increase of 27.1%. Earnings are expected to grow by 26.7% annually, outpacing the Singapore market's forecast growth rate. However, substantial insider selling and one-off items have impacted recent financial results negatively.

- Upon reviewing our latest growth report, Jardine Matheson Holdings' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Jardine Matheson Holdings with our detailed financial health report.

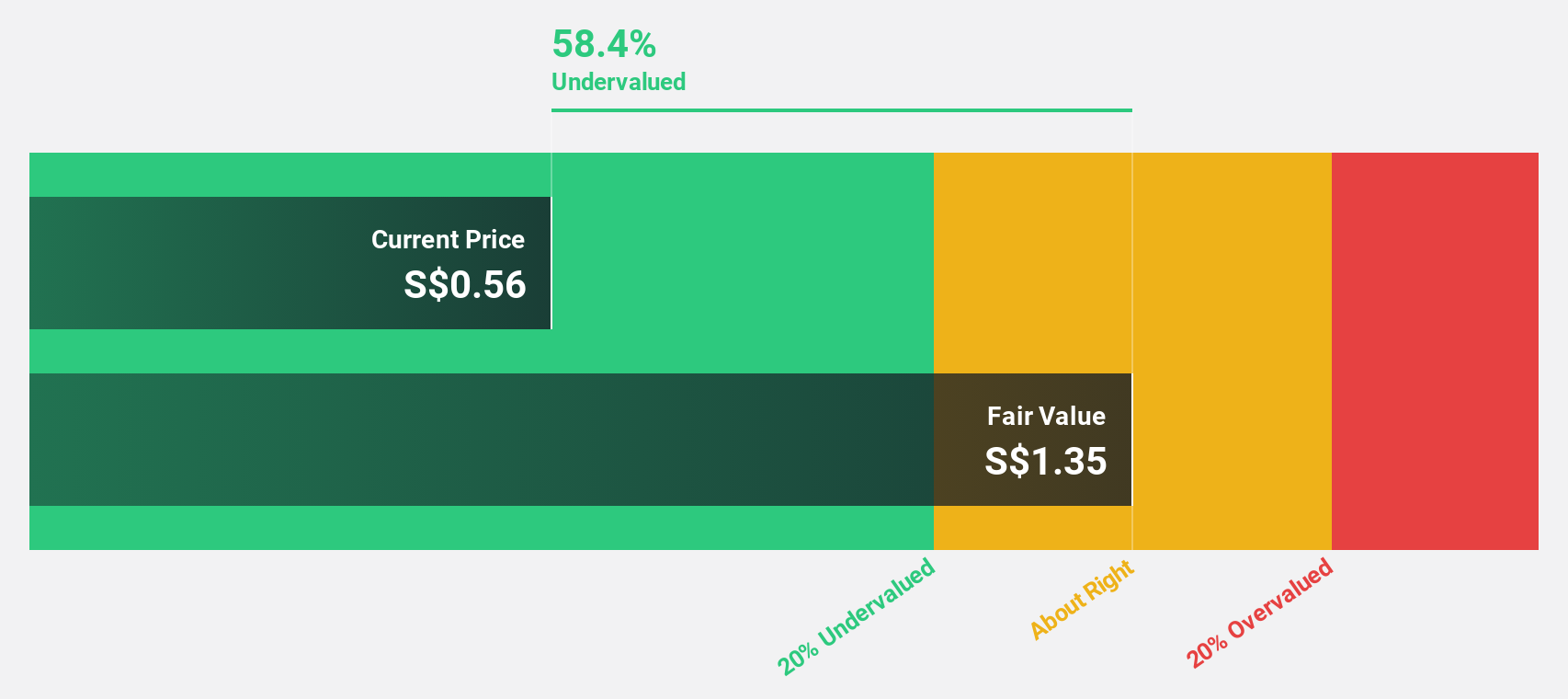

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited operates in the field of nanotechnology, offering solutions across Singapore, China, Japan, and Vietnam with a market capitalization of approximately SGD 485.00 million.

Operations: Nanofilm Technologies International's revenue is segmented into Sydrogen (SGD 1.05 million), Nanofabrication (SGD 16.05 million), Advanced Materials (SGD 141.54 million), and Industrial Equipment (SGD 37.17 million).

Estimated Discount To Fair Value: 44.6%

Nanofilm Technologies International, priced at SGD0.75, is considered undervalued with its trading value 44.6% below the estimated fair value of SGD1.34 based on discounted cash flow models. While the company’s profit margins have decreased from last year's 18.5% to 1.8%, it forecasts a significant earnings growth of 50.7% per year, outperforming the Singapore market's average of 9%. Recent corporate guidance confirms optimism for FY2024, expecting increased revenues and profits barring unforeseen events.

- Our earnings growth report unveils the potential for significant increases in Nanofilm Technologies International's future results.

- Navigate through the intricacies of Nanofilm Technologies International with our comprehensive financial health report here.

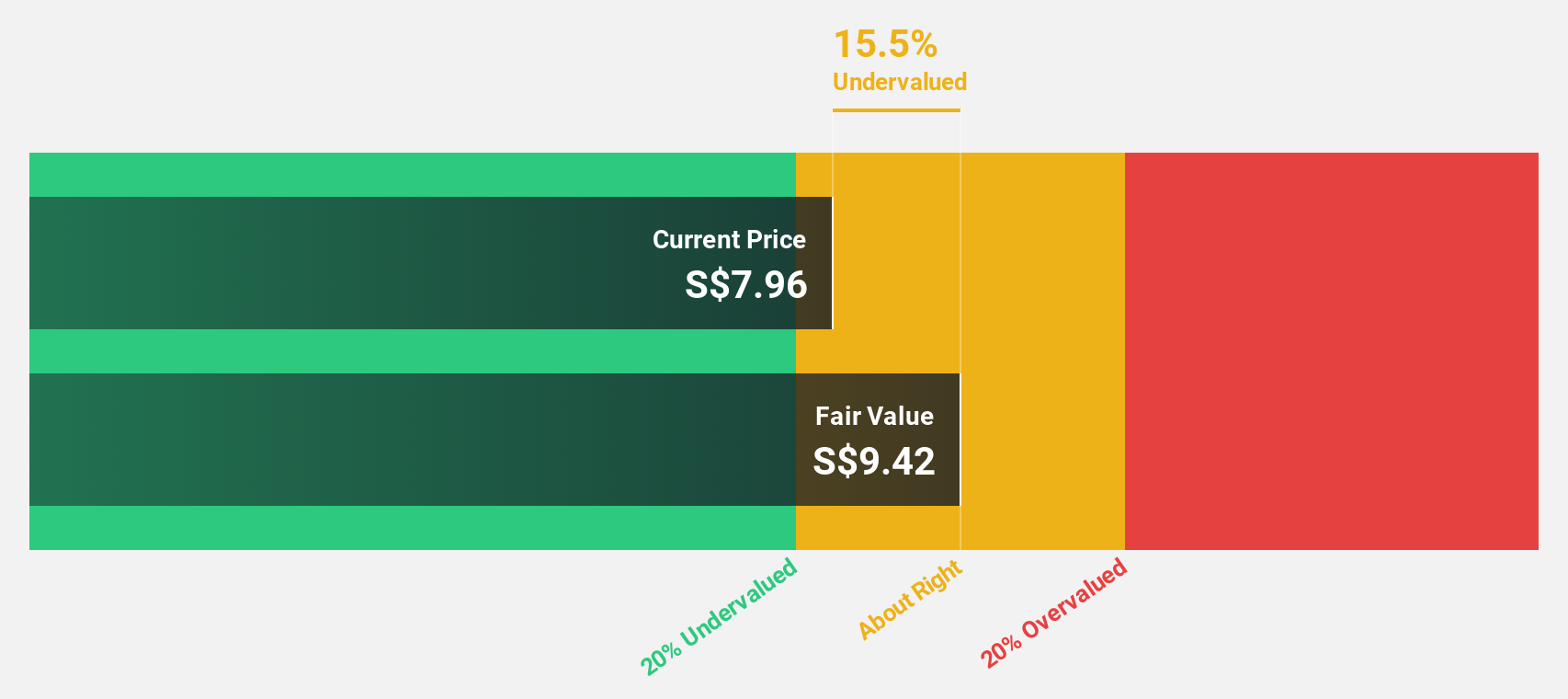

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defense, and engineering group with a market capitalization of SGD 13.50 billion.

Operations: The company's revenue is divided into three main segments: Commercial Aerospace contributing SGD 3.97 billion, Urban Solutions & Satcom at SGD 1.98 billion, and Defence & Public Security generating SGD 4.29 billion.

Estimated Discount To Fair Value: 45.4%

Singapore Technologies Engineering, with a current price of SGD4.33, trades significantly below its fair value estimated at SGD7.93, reflecting a potential undervaluation based on cash flows. Despite a high debt level and unstable dividend track record, the company is poised for robust earnings growth at 11.62% annually, outpacing the Singapore market's average. Recent strategic moves include share repurchases and consistent dividend payouts, signaling confidence in financial health and commitment to shareholder value.

- Our comprehensive growth report raises the possibility that Singapore Technologies Engineering is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Singapore Technologies Engineering.

Summing It All Up

- Unlock our comprehensive list of 8 Undervalued SGX Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:J36

Jardine Matheson Holdings

Through its subsidiaries, operates in motor vehicles and related operations, property investment and development, food retailing, health and beauty, home furnishings, engineering and construction, and transport businesses in China, Southeast Asia, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives