- Singapore

- /

- Healthcare Services

- /

- SGX:BSL

Is Now The Time To Put Raffles Medical Group (SGX:BSL) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Raffles Medical Group (SGX:BSL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Raffles Medical Group

Raffles Medical Group's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Raffles Medical Group has grown EPS by 32% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

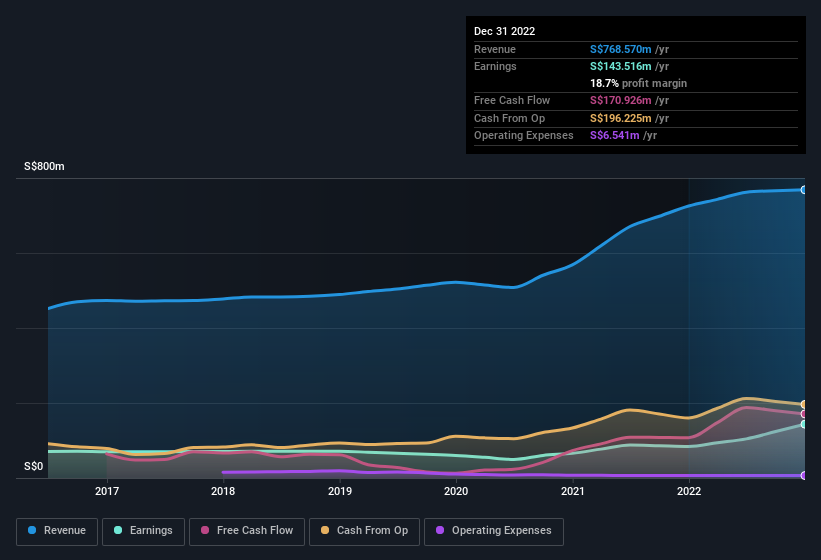

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Raffles Medical Group is growing revenues, and EBIT margins improved by 11.5 percentage points to 28%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Raffles Medical Group's future profits.

Are Raffles Medical Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The first bit of good news is that no Raffles Medical Group insiders reported share sales in the last twelve months. But the important part is that Executive Chairman & CEO Choon Yong Loo spent S$435k buying stock, at an average price of S$1.23. Purchases like this can offer an insight into the faith of the company's management - and it seems to be all positive.

The good news, alongside the insider buying, for Raffles Medical Group bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth S$337m. Coming in at 13% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Looking very optimistic for investors.

Does Raffles Medical Group Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Raffles Medical Group's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. Even so, be aware that Raffles Medical Group is showing 2 warning signs in our investment analysis , and 1 of those can't be ignored...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Raffles Medical Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BSL

Raffles Medical Group

Provides integrated private healthcare services primarily in Singapore, Greater China, Vietnam, Cambodia, and Japan.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives