Uncovering Fraser And Neave Plus 2 Other Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

In recent weeks, global markets have experienced volatility amid tariff uncertainties and softer-than-expected U.S. job growth, with major indices like the S&P 500 seeing slight declines. Despite these challenges, small-cap stocks often present unique opportunities for investors seeking companies with strong fundamentals that can weather economic fluctuations. In this article, we explore three such promising small-cap stocks, including Fraser And Neave, which stand out for their robust financial health and potential resilience in today's market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Golden House | 32.13% | -0.58% | 14.32% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Terminal X Online | 20.33% | 18.40% | 20.81% | ★★★★★☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Fraser and Neave (SGX:F99)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fraser and Neave, Limited operates in the food and beverage as well as publishing and printing sectors across Singapore, Malaysia, Thailand, Vietnam, and internationally with a market capitalization of SGD1.88 billion.

Operations: Fraser and Neave generates revenue primarily from its food and beverage sector, supplemented by its publishing and printing operations. The company's net profit margin is a key financial metric to consider when evaluating its performance.

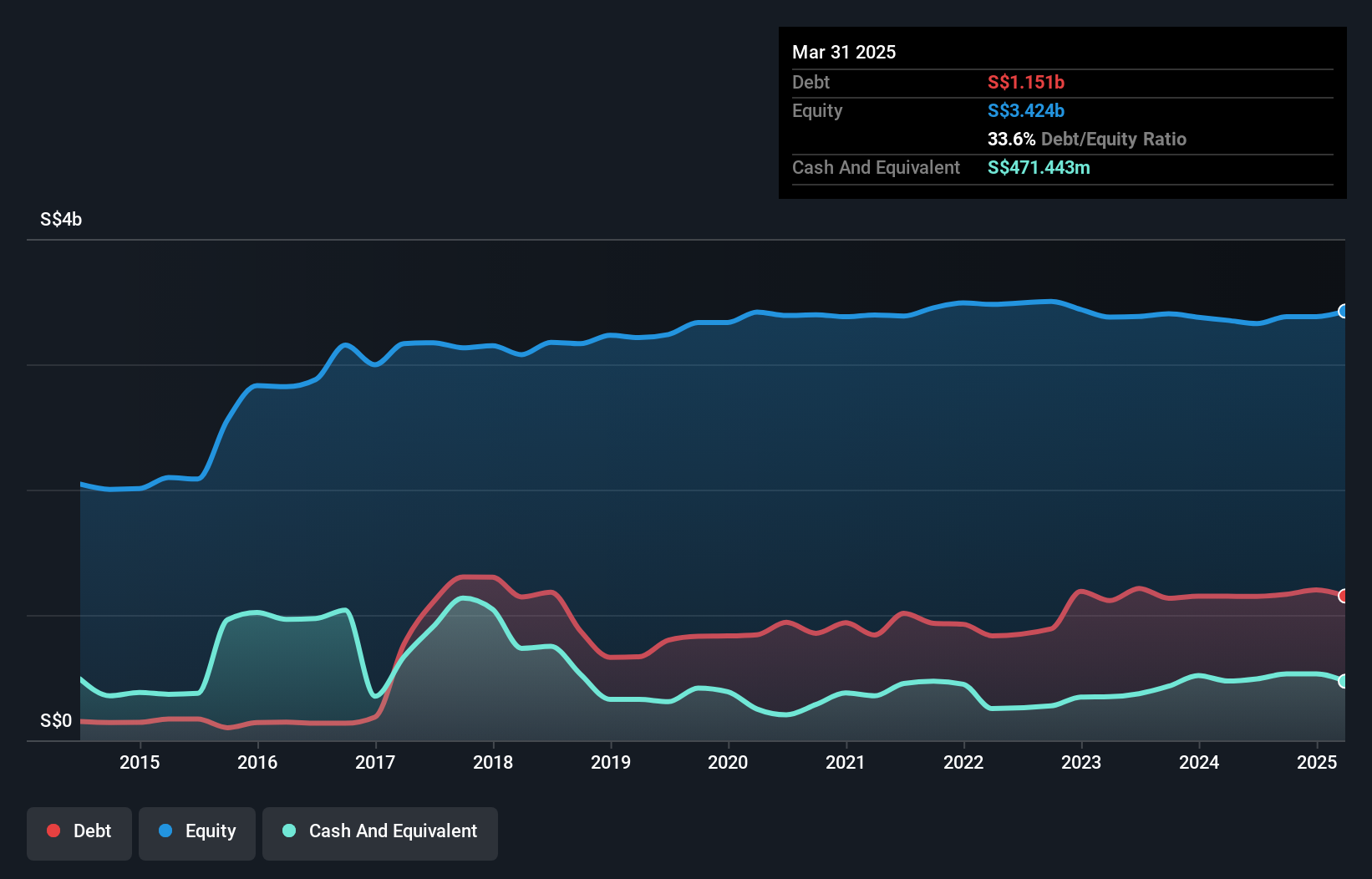

Fraser and Neave, a notable player in the food industry, reported strong first-quarter sales of S$618 million, up from S$531.6 million last year, with net income rising to S$52 million. Despite a 0.5% annual earnings decline over five years, recent growth outpaced the industry's -10.4% drop. The company boasts high-quality earnings and trades at 22% below estimated fair value. Interest payments are well covered by EBIT at 7.5x coverage, and its net debt to equity ratio is satisfactory at 18.8%. Recent board changes include Mr. Koh Poh Tiong as Chairman following Mr. Charoen Sirivadhanabhakdi's retirement.

Youcare Pharmaceutical Group (SHSE:688658)

Simply Wall St Value Rating: ★★★★★★

Overview: Youcare Pharmaceutical Group Co., Ltd. focuses on the research, development, manufacture, distribution, and sale of pharmaceutical products with a market capitalization of CN¥6.70 billion.

Operations: The company generates revenue primarily through the sale of pharmaceutical products. It has a market capitalization of approximately CN¥6.70 billion.

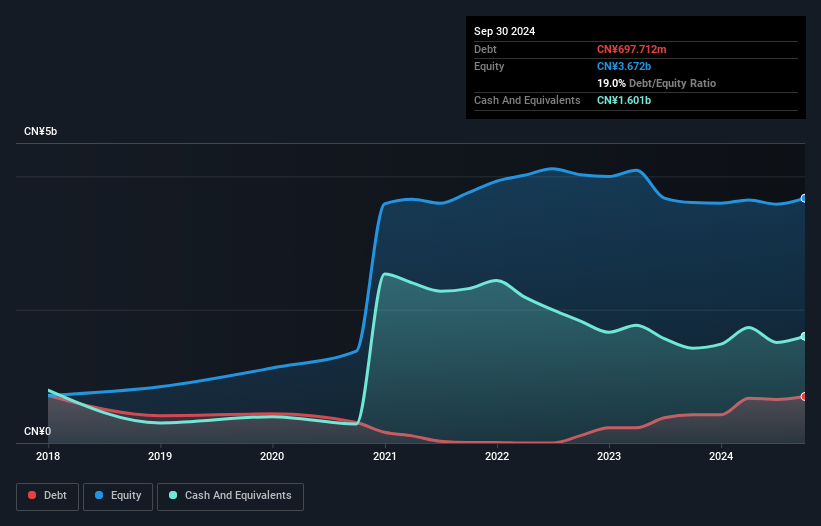

Youcare Pharmaceutical Group is making waves with impressive financials and strategic positioning. Recent earnings growth of 59% far outpaces the pharmaceutical industry's -2.5%, highlighting its robust performance. The company trades at a significant discount, about 90% below fair value estimates, suggesting potential upside for investors. Its debt management is commendable, with cash exceeding total debt and a debt-to-equity ratio reduced from 41% to 19% over five years. Interest payments are comfortably covered by EBIT at an impressive 262 times coverage. With high-quality earnings and positive free cash flow, Youcare seems well-positioned for future growth prospects in the sector.

Suzhou Hesheng Special Material (SZSE:002290)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Hesheng Special Material Co., Ltd. operates in the specialized materials industry and has a market capitalization of CN¥4.15 billion.

Operations: The company generates revenue primarily through its specialized materials segment. It has a market capitalization of CN¥4.15 billion, reflecting its scale in the industry.

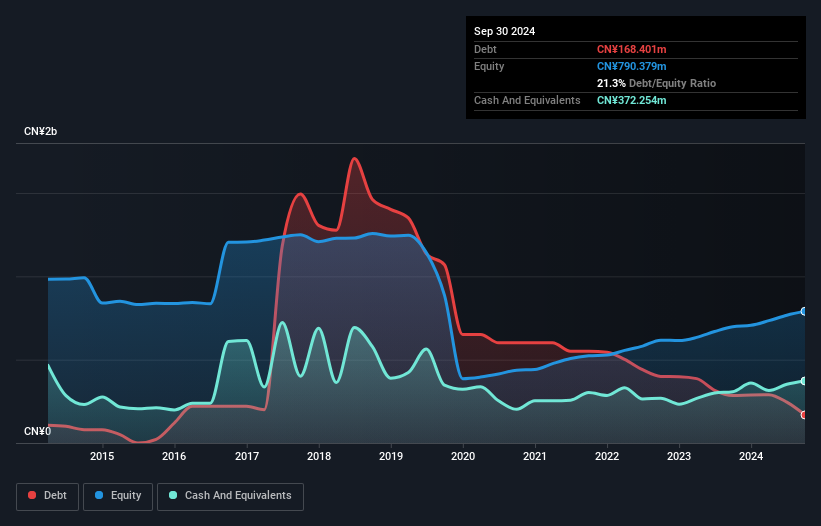

With a keen eye on the future, Suzhou Hesheng Special Material is navigating the market with impressive financial health. Over five years, its debt to equity ratio has dramatically improved from 120.6% to 21.3%, showcasing effective management of liabilities. The company is trading at an attractive valuation, being 8.6% below estimated fair value, which might catch the eye of discerning investors. Earnings have seen a steady increase of 4.4% in the past year, outpacing industry growth rates and highlighting robust performance in challenging times for metals and mining sectors.

Summing It All Up

- Click through to start exploring the rest of the 4714 Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:F99

Fraser and Neave

Engages in the food and beverage, and publishing and printing businesses in Singapore, Malaysia, Thailand, Vietnam, and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives