The Singapore market has been navigating a landscape of digital transformation, with platforms like Primary Portal streamlining equity capital market processes and enhancing connectivity between asset managers and banks. In such an evolving environment, dividend stocks can offer stability and consistent returns, making them a valuable addition to any portfolio.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.99% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.72% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.47% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.90% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.72% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.57% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.52% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.95% | ★★★★★☆ |

| Civmec (SGX:P9D) | 4.86% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited, an investment holding company with a market cap of SGD245.96 million, distributes information technology products in Singapore, Greater China, Australia, India, and internationally.

Operations: Multi-Chem Limited generates revenue from distributing information technology products in various regions, including SGD372.78 million from Singapore's IT Business, SGD54.60 million from Australia's IT Business, SGD40.56 million from India's IT Business, and SGD34.96 million from Greater China's IT Business, alongside SGD1.79 million from Singapore's PCB Business.

Dividend Yield: 8.9%

Multi-Chem Limited's dividend payments are covered by earnings (payout ratio: 80.7%) and cash flows (cash payout ratio: 88.1%), though they have been volatile over the past decade. Recent board changes, including the appointment of Chong Teck Sin as Chairman, may impact governance positively. Despite a strong earnings growth of 35.6% last year and a high dividend yield in Singapore's market, its dividend reliability remains questionable due to historical volatility.

- Get an in-depth perspective on Multi-Chem's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Multi-Chem shares in the market.

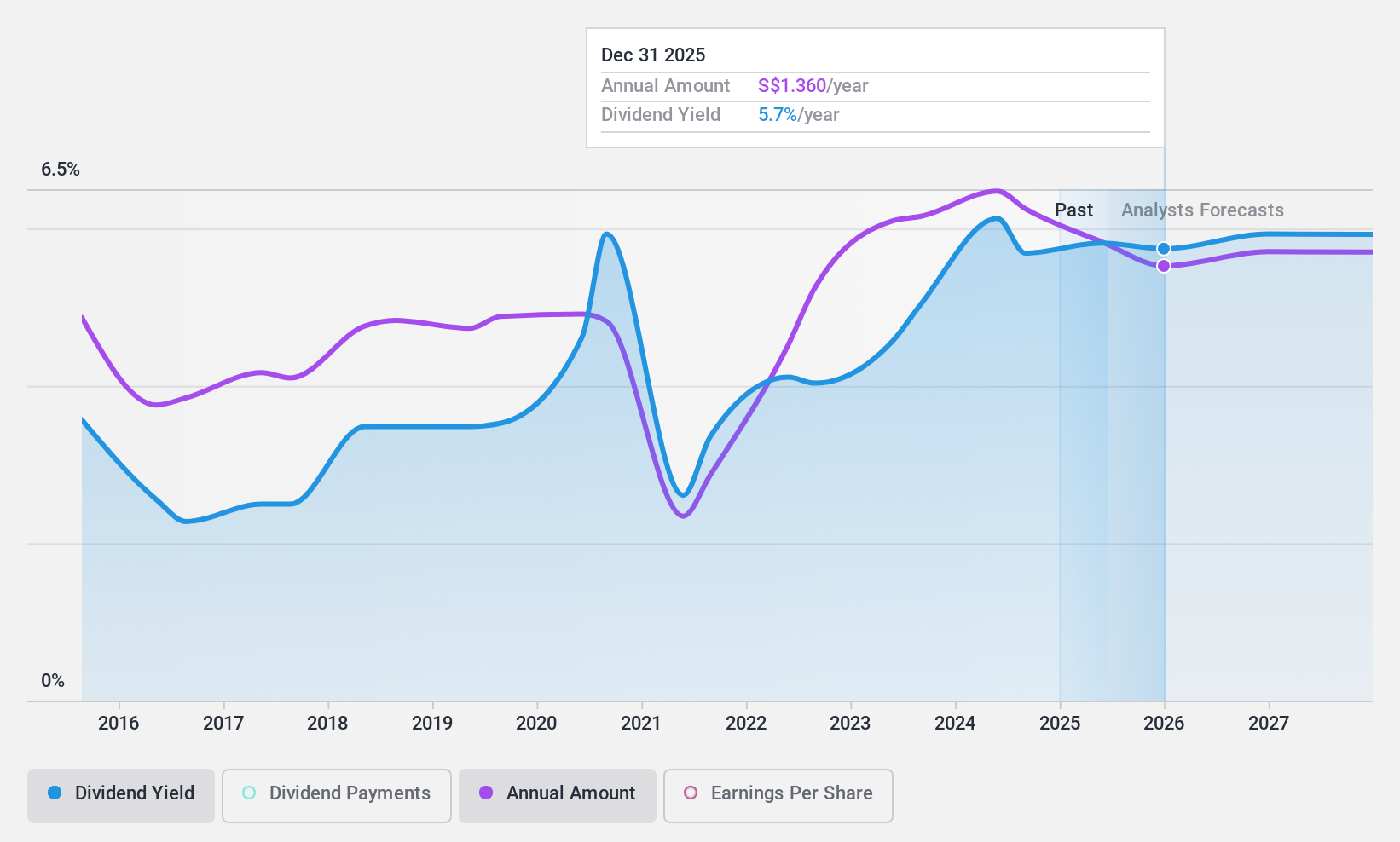

Jardine Cycle & Carriage (SGX:C07)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jardine Cycle & Carriage Limited, an investment holding company, operates in financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property sectors in Indonesia and internationally with a market cap of SGD9.98 billion.

Operations: Jardine Cycle & Carriage Limited generates revenue primarily from its Astra segment, which accounts for $20.61 billion, and its Direct Motor Interests segment, contributing $1.63 billion.

Dividend Yield: 6.3%

Jardine Cycle & Carriage's dividends are well covered by earnings (payout ratio: 38.4%) and cash flows (cash payout ratio: 49.7%), but they have been volatile over the past decade. Despite a high dividend yield in Singapore's market, the company's forecasted earnings decline of 4.1% per year for the next three years raises concerns about future sustainability. Recent board changes, including John Witt's appointment as Chairman effective August 2024, may impact governance positively.

- Unlock comprehensive insights into our analysis of Jardine Cycle & Carriage stock in this dividend report.

- Our valuation report here indicates Jardine Cycle & Carriage may be undervalued.

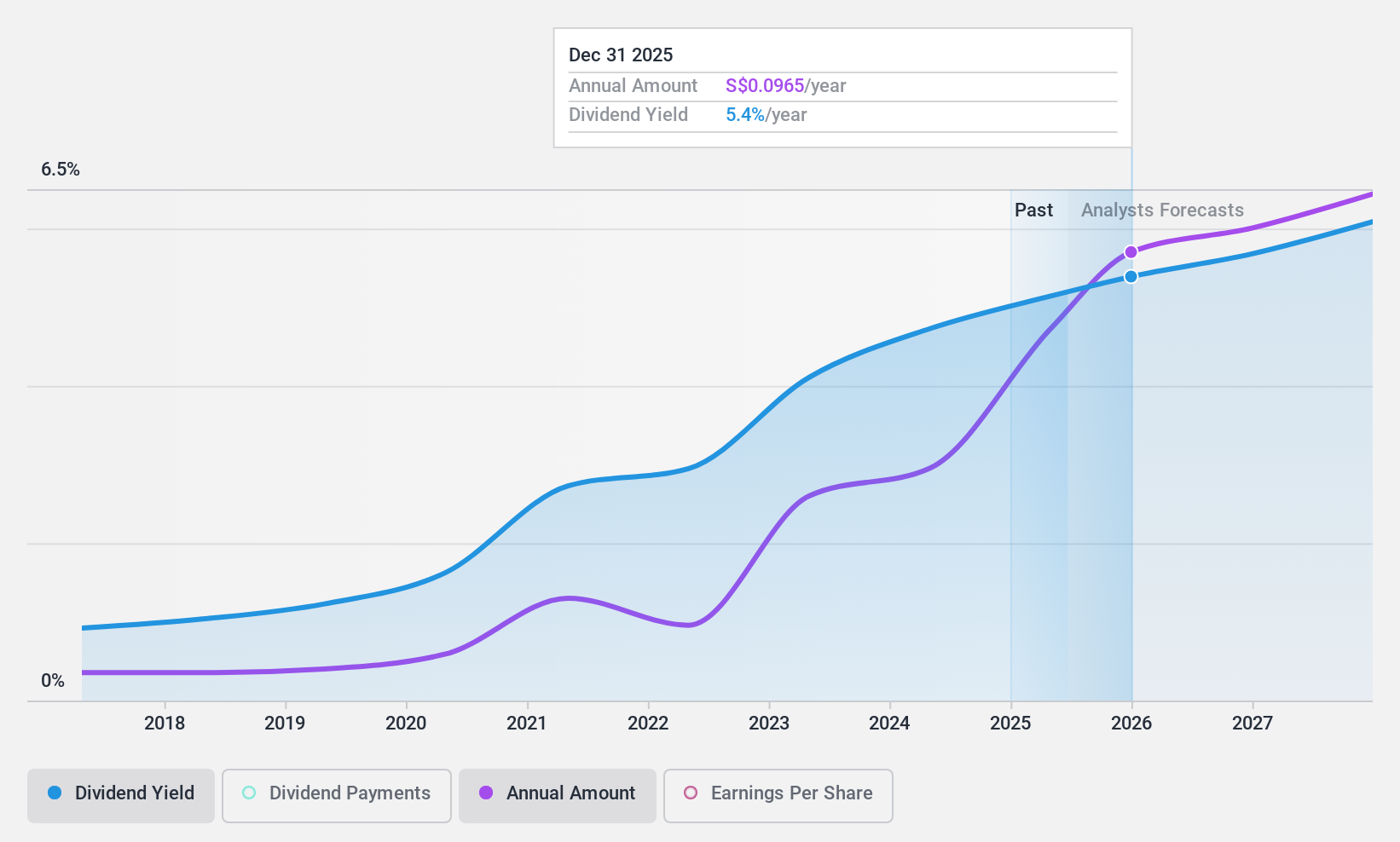

Food Empire Holdings (SGX:F03)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Food Empire Holdings Limited, with a market cap of SGD526.17 million, is an investment holding company that manufactures and distributes food and beverages in Russia, Ukraine, Kazakhstan and CIS markets, South-East Asia, South Asia, and internationally.

Operations: Food Empire Holdings Limited generates revenue from several key regions, including Russia ($152.42 million), South-East Asia ($239.74 million), South Asia ($68.36 million), and Ukraine, Kazakhstan and CIS markets ($110.74 million).

Dividend Yield: 4.9%

Food Empire Holdings' dividends are well covered by earnings (payout ratio: 35.2%) and cash flows (cash payout ratio: 50.6%), but have been volatile over the past decade. The company recently announced a special dividend of S$0.05 per share for FY2023 and has ongoing business expansion plans, including a new coffee-mix production facility in Kazakhstan with an initial investment of US$30 million, potentially enhancing future revenue streams.

- Dive into the specifics of Food Empire Holdings here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Food Empire Holdings is trading behind its estimated value.

Where To Now?

- Embark on your investment journey to our 22 Top SGX Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:F03

Food Empire Holdings

An investment holding company, operates as a food and beverage manufacturing and distribution company in Russia, Ukraine, Kazakhstan and CIS markets, South-East Asia, South Asia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives