Investors Interested In Golden Agri-Resources Ltd's (SGX:E5H) Revenues

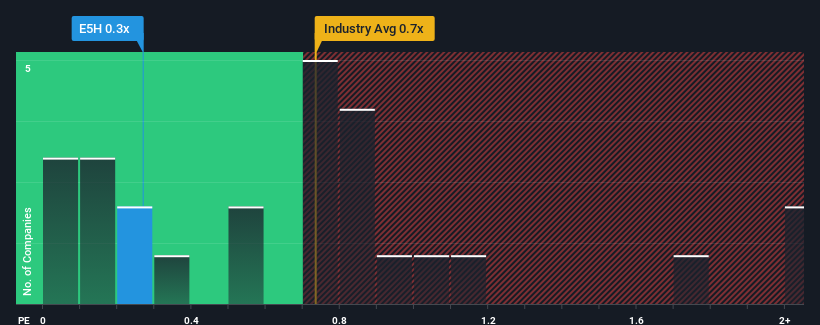

It's not a stretch to say that Golden Agri-Resources Ltd's (SGX:E5H) price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" for companies in the Food industry in Singapore, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Golden Agri-Resources

How Has Golden Agri-Resources Performed Recently?

With revenue that's retreating more than the industry's average of late, Golden Agri-Resources has been very sluggish. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Golden Agri-Resources' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Golden Agri-Resources?

In order to justify its P/S ratio, Golden Agri-Resources would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 7.4% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 23% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 3.0% over the next year. That's shaping up to be similar to the 2.9% growth forecast for the broader industry.

With this information, we can see why Golden Agri-Resources is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Golden Agri-Resources' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Golden Agri-Resources' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Food industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about these 2 warning signs we've spotted with Golden Agri-Resources (including 1 which shouldn't be ignored).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:E5H

Golden Agri-Resources

An investment holding company, operates as an integrated palm oil plantation company in Singapore, India, Pakistan, China, rest of Asia, the United States, Europe, and the Middle East.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026