Is Dukang Distillers Holdings (SGX:BKV) Weighed On By Its Debt Load?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Dukang Distillers Holdings Limited (SGX:BKV) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Dukang Distillers Holdings

What Is Dukang Distillers Holdings's Net Debt?

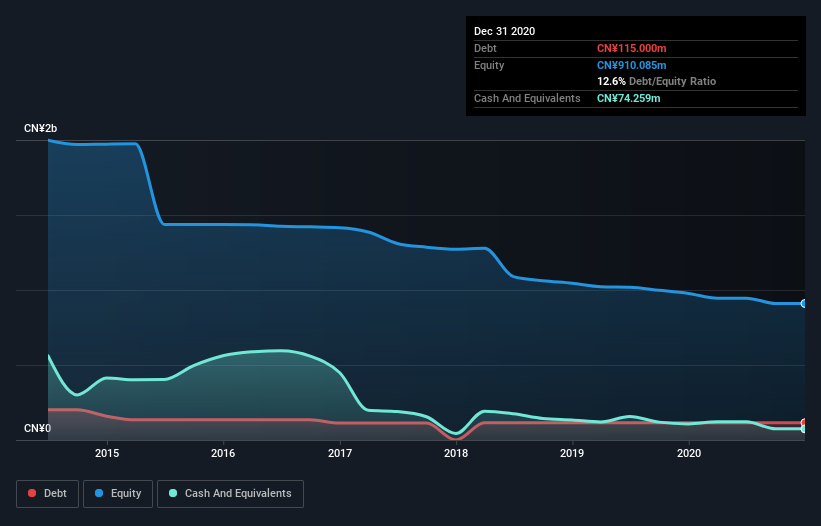

As you can see below, Dukang Distillers Holdings had CN¥115.0m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, it does have CN¥74.3m in cash offsetting this, leading to net debt of about CN¥40.7m.

How Strong Is Dukang Distillers Holdings' Balance Sheet?

According to the last reported balance sheet, Dukang Distillers Holdings had liabilities of CN¥292.6m due within 12 months, and liabilities of CN¥10.7m due beyond 12 months. Offsetting these obligations, it had cash of CN¥74.3m as well as receivables valued at CN¥696.0k due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥228.3m.

This deficit casts a shadow over the CN¥74.3m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Dukang Distillers Holdings would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But it is Dukang Distillers Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Dukang Distillers Holdings had a loss before interest and tax, and actually shrunk its revenue by 22%, to CN¥109m. That makes us nervous, to say the least.

Caveat Emptor

Not only did Dukang Distillers Holdings's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable CN¥62m at the EBIT level. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely, given it is low on liquid assets, and burned through CN¥28m in the last year. So we consider this a high risk stock and we wouldn't be at all surprised if the company asks shareholders for money before long. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Dukang Distillers Holdings (at least 1 which is concerning) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Dukang Distillers Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About Catalist:BKV

China Shenshan Orchard Holdings

An investment holding company, focusing on the planting, cultivating, and sale of kiwi fruit in China.

Moderate risk and overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026