- Singapore

- /

- Energy Services

- /

- SGX:NO4

With EPS Growth And More, Dyna-Mac Holdings (SGX:NO4) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Dyna-Mac Holdings (SGX:NO4). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Dyna-Mac Holdings

Dyna-Mac Holdings' Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Dyna-Mac Holdings to have grown EPS from S$0.0059 to S$0.019 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Dyna-Mac Holdings shareholders is that EBIT margins have grown from -0.6% to 3.4% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

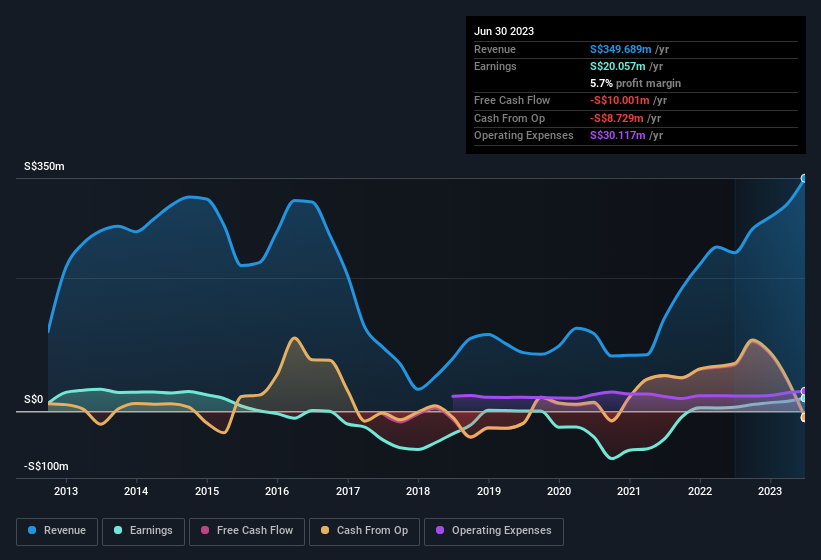

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Dyna-Mac Holdings' balance sheet strength, before getting too excited.

Are Dyna-Mac Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

With strong conviction, Dyna-Mac Holdings insiders have stood united by refusing to sell shares over the last year. But the real excitement comes from the S$94k that CEO & Executive Chairman Ah Cheng Lim spent buying shares (at an average price of about S$0.19). Strong buying like that could be a sign of opportunity.

On top of the insider buying, it's good to see that Dyna-Mac Holdings insiders have a valuable investment in the business. To be specific, they have S$33m worth of shares. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 7.9% of the shares on issue for the business, an appreciable amount considering the market cap.

Is Dyna-Mac Holdings Worth Keeping An Eye On?

Dyna-Mac Holdings' earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Dyna-Mac Holdings belongs near the top of your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Dyna-Mac Holdings is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Dyna-Mac Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:NO4

Dyna-Mac Holdings

An investment holding company, engineers, fabricates, and constructs offshore floating production storage offloading and floating storage offloading topside modules for the oil and gas industries.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026