- Singapore

- /

- Energy Services

- /

- SGX:NO4

Dyna-Mac Holdings Ltd. (SGX:NO4) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Dyna-Mac Holdings Ltd. (SGX:NO4) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 18%.

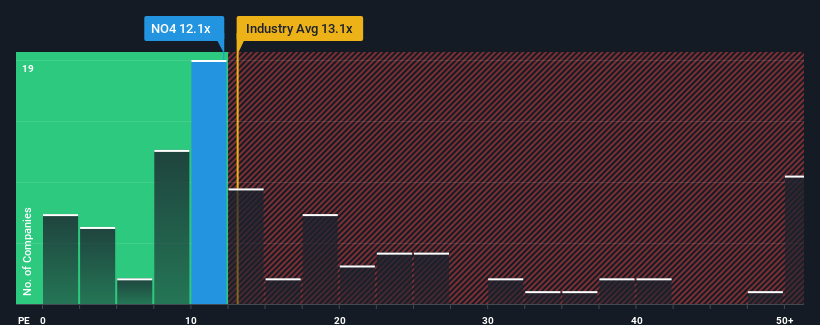

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Dyna-Mac Holdings' P/E ratio of 12.1x, since the median price-to-earnings (or "P/E") ratio in Singapore is also close to 12x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Dyna-Mac Holdings certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Dyna-Mac Holdings

How Is Dyna-Mac Holdings' Growth Trending?

The only time you'd be comfortable seeing a P/E like Dyna-Mac Holdings' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 227% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 10% per year during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the market is forecast to only expand by 5.6% per year, which is noticeably less attractive.

In light of this, it's curious that Dyna-Mac Holdings' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Dyna-Mac Holdings' P/E

Following Dyna-Mac Holdings' share price tumble, its P/E is now hanging on to the median market P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Dyna-Mac Holdings currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Dyna-Mac Holdings with six simple checks.

Of course, you might also be able to find a better stock than Dyna-Mac Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:NO4

Dyna-Mac Holdings

An investment holding company, engineers, fabricates, and constructs offshore floating production storage offloading and floating storage offloading topside modules for the oil and gas industries.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026