The harsh reality for Dyna-Mac Holdings Ltd. (SGX:NO4) shareholders is that its auditors, Ernst & Young LLP, expressed doubts about its ability to continue as a going concern, in its reported results to December 2020. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

View our latest analysis for Dyna-Mac Holdings

What Is Dyna-Mac Holdings's Debt?

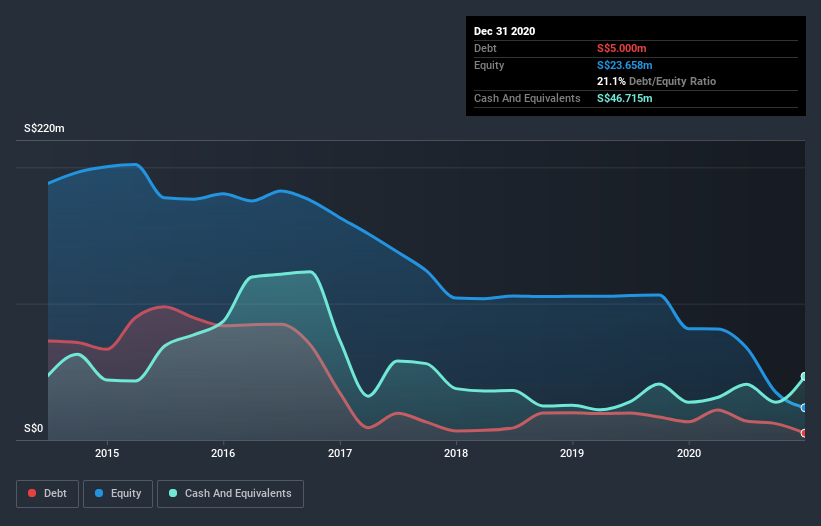

You can click the graphic below for the historical numbers, but it shows that Dyna-Mac Holdings had S$5.00m of debt in December 2020, down from S$13.3m, one year before. However, its balance sheet shows it holds S$46.7m in cash, so it actually has S$41.7m net cash.

How Strong Is Dyna-Mac Holdings' Balance Sheet?

We can see from the most recent balance sheet that Dyna-Mac Holdings had liabilities of S$111.3m falling due within a year, and liabilities of S$26.3m due beyond that. Offsetting this, it had S$46.7m in cash and S$47.4m in receivables that were due within 12 months. So it has liabilities totalling S$43.5m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Dyna-Mac Holdings is worth S$102.3m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. While it does have liabilities worth noting, Dyna-Mac Holdings also has more cash than debt, so we're pretty confident it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Dyna-Mac Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Dyna-Mac Holdings made a loss at the EBIT level, and saw its revenue drop to S$84m, which is a fall of 14%. We would much prefer see growth.

So How Risky Is Dyna-Mac Holdings?

While Dyna-Mac Holdings lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow S$21m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Dyna-Mac Holdings (2 are a bit concerning!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Dyna-Mac Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:NO4

Dyna-Mac Holdings

An investment holding company, engineers, fabricates, and constructs offshore floating production storage offloading and floating storage offloading topside modules for the oil and gas industries.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026