As global markets react to the unfolding policies of the Trump 2.0 administration, investors are witnessing a mixed bag of sector performances, with financials and energy gaining while healthcare and EV shares face challenges. For those looking to invest in smaller or newer companies, penny stocks—despite the name's vintage feel—can still offer surprising value. In this article, we highlight several penny stocks that demonstrate financial strength and explore whether they have some long-term potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.23 | MYR346.22M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £827M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| CSE Global (SGX:544) | SGD0.43 | SGD303.74M | ★★★★★☆ |

Click here to see the full list of 5,795 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Lung Kee Group Holdings (SEHK:255)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lung Kee Group Holdings Limited is an investment holding company that manufactures and markets mold bases and related products both in the People’s Republic of China and internationally, with a market cap of HK$751.70 million.

Operations: The company generates revenue from its Metal Processors and Fabrication segment, amounting to HK$1.53 billion.

Market Cap: HK$751.7M

Lung Kee Group Holdings, with a market cap of HK$751.70 million, recently declared an interim dividend despite reporting a net loss of HK$23.92 million for the first half of 2024. The company remains debt-free, and its short-term assets significantly exceed both short- and long-term liabilities, indicating sound liquidity management. However, it has been unprofitable with declining earnings over the past five years at a rate of 40.8% annually and negative return on equity at -3.81%. Its shares have not been diluted recently but are trading significantly below estimated fair value by about 83.7%.

- Jump into the full analysis health report here for a deeper understanding of Lung Kee Group Holdings.

- Evaluate Lung Kee Group Holdings' historical performance by accessing our past performance report.

Global New Material International Holdings (SEHK:6616)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Global New Material International Holdings Limited is an investment holding company that produces and sells pearlescent pigment, functional mica filler, and related products in China and internationally, with a market cap of HK$4.46 billion.

Operations: The company's revenue primarily comes from its PRC business operation, which generated CN¥1.11 billion.

Market Cap: HK$4.46B

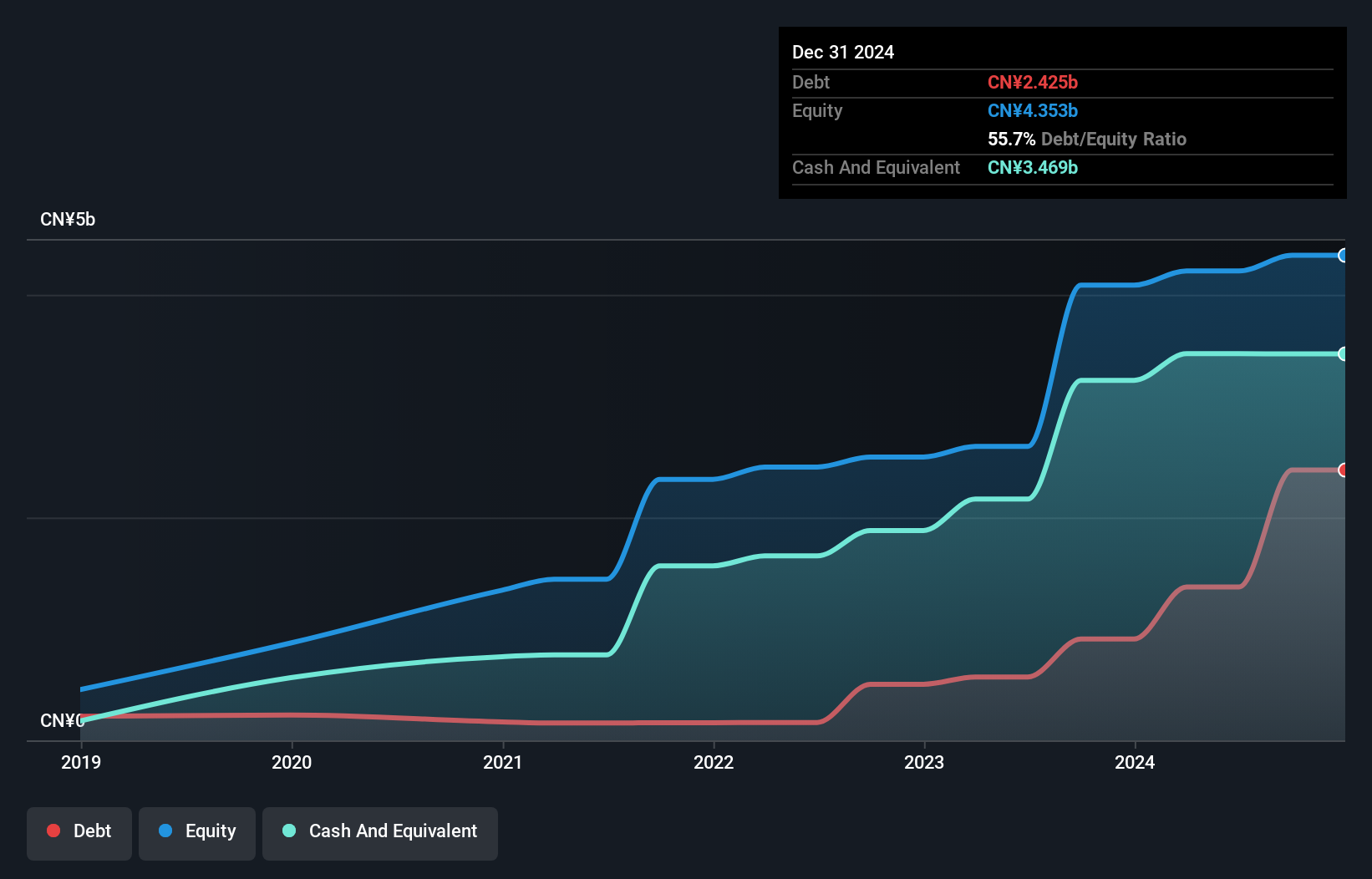

Global New Material International Holdings, with a market cap of HK$4.46 billion, has demonstrated solid financial health, evidenced by its CN¥4.3 billion in short-term assets surpassing both short- and long-term liabilities. The company's recent earnings growth of 0.9% over the past year outpaced the broader chemicals industry downturn, though it lags behind its five-year average growth rate of 9.9%. Despite a low return on equity at 6.2%, the company maintains high-quality earnings and well-covered debt obligations by operating cash flow (24.4%). Recent board changes include experienced leadership additions to bolster strategic direction.

- Get an in-depth perspective on Global New Material International Holdings' performance by reading our balance sheet health report here.

- Assess Global New Material International Holdings' future earnings estimates with our detailed growth reports.

Rex International Holding (SGX:5WH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Rex International Holding Limited is an investment holding company focused on oil exploration and production, with a market capitalization of SGD 148.46 million.

Operations: The company generates revenue primarily from its Oil and Gas segment, amounting to $258.28 million.

Market Cap: SGD148.46M

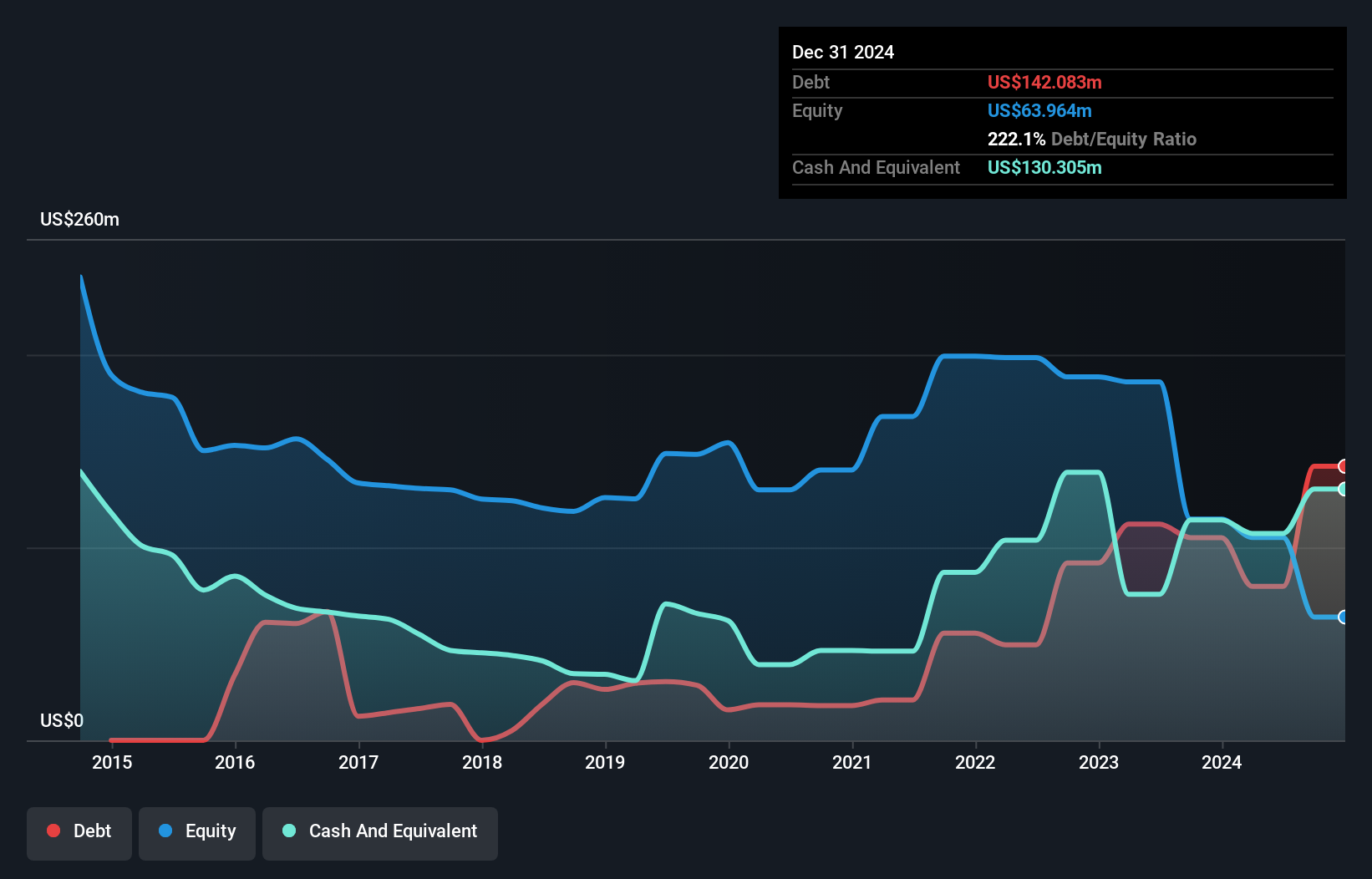

Rex International Holding Limited, with a market capitalization of SGD 148.46 million, focuses on oil exploration and production, generating revenue of $258.28 million from its Oil and Gas segment. Despite being unprofitable, the company has a seasoned management team with an average tenure of 9.1 years and maintains sufficient cash runway for over three years due to positive free cash flow growth. The company's strategic move includes a Joint Study Agreement to explore natural hydrogen in Oman alongside Helios Aragon, while recent challenges include being dropped from the S&P Global BMI Index amid increasing debt levels over the past five years.

- Dive into the specifics of Rex International Holding here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Rex International Holding's future.

Turning Ideas Into Actions

- Take a closer look at our Penny Stocks list of 5,795 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6616

Global New Material International Holdings

An investment holding company, produces and sells pearlescent pigment, functional mica filler, and related products in the People’s Republic of China and internationally.

Flawless balance sheet with high growth potential.