- Singapore

- /

- Construction

- /

- SGX:1L2

Lacklustre Performance Is Driving Hiap Seng Industries Limited's (SGX:1L2) 50% Price Drop

Hiap Seng Industries Limited (SGX:1L2) shareholders won't be pleased to see that the share price has had a very rough month, dropping 50% and undoing the prior period's positive performance. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

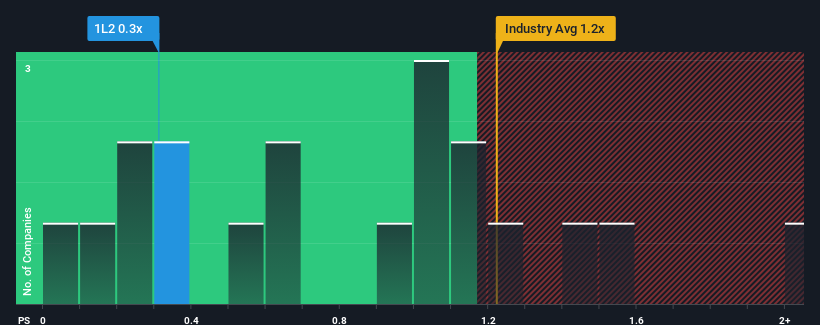

Following the heavy fall in price, it would be understandable if you think Hiap Seng Industries is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Singapore's Energy Services industry have P/S ratios above 0.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Hiap Seng Industries

How Has Hiap Seng Industries Performed Recently?

As an illustration, revenue has deteriorated at Hiap Seng Industries over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Hiap Seng Industries will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hiap Seng Industries will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Hiap Seng Industries?

The only time you'd be truly comfortable seeing a P/S as low as Hiap Seng Industries' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 4.6% decrease to the company's top line. As a result, revenue from three years ago have also fallen 76% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 15% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Hiap Seng Industries' P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Hiap Seng Industries' P/S

Hiap Seng Industries' P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Hiap Seng Industries maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Hiap Seng Industries that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hiap Seng Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:1L2

Hiap Seng Industries

An investment holding company, provides engineering, procurement, construction, and plant maintenance services for oil and gas, and energy sectors in Singapore.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives