- United Arab Emirates

- /

- Aerospace & Defense

- /

- ADX:ADSB

Discovering Opportunities Abu Dhabi Ship Building PJSC Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have recently experienced significant movements, with U.S. stocks rallying to record highs following a "red sweep" in the elections, indicating investor optimism about potential economic growth and tax reforms. Amidst these developments, investors are increasingly looking beyond traditional large-cap stocks to explore opportunities in smaller companies, often referred to as penny stocks. Although the term "penny stock" may seem outdated, it still captures the essence of investing in smaller or less-established firms that can offer substantial value and growth potential when backed by solid financials and clear strategic direction.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR351.85M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR136.84M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.29B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$144.95M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.04 | THB1.67B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6075 | A$72.68M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.63 | £190.08M | ★★★★★★ |

Click here to see the full list of 5,758 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Abu Dhabi Ship Building PJSC (ADX:ADSB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Abu Dhabi Ship Building PJSC, along with its subsidiaries, specializes in the construction, maintenance, repair, and overhaul of commercial and military ships and vessels in the United Arab Emirates, with a market cap of AED839.49 million.

Operations: The company's revenue segments include New Build and Engineering at AED1.12 billion, Military Repairs and Maintenance at AED175.30 million, Small Boats at AED50.06 million, Mission Systems at AED21.26 million, and Commercial Repairs and Maintenance at AED29.77 million.

Market Cap: AED839.49M

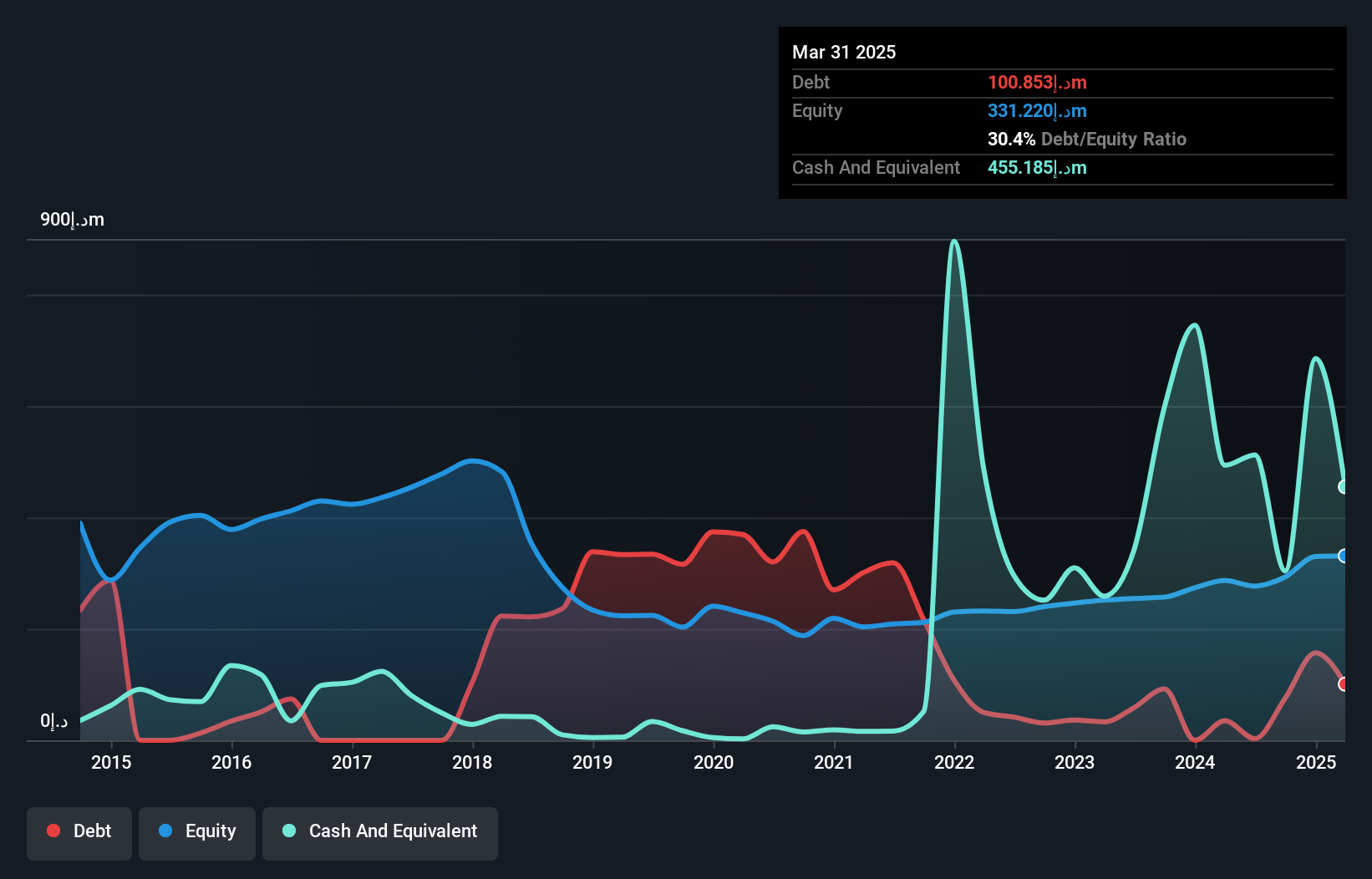

Abu Dhabi Ship Building PJSC has demonstrated consistent profitability growth over the past five years, with earnings increasing by 71.7% annually. The company maintains a strong financial position, with cash exceeding total debt and short-term assets surpassing both short and long-term liabilities. Despite a decline in net profit margins from 4.3% to 3.1%, ADSB remains undervalued by approximately 47.5% compared to its estimated fair value. Recent strategic partnerships, such as the integration of SIATT's missile system into their vessels, highlight ongoing enhancements in operational capabilities without additional costs, positioning ADSB for potential future growth within its sector.

- Unlock comprehensive insights into our analysis of Abu Dhabi Ship Building PJSC stock in this financial health report.

- Explore historical data to track Abu Dhabi Ship Building PJSC's performance over time in our past results report.

CapAllianz Holdings (Catalist:594)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CapAllianz Holdings Limited is an investment holding company involved in the exploration, development, production, and drilling of oil and gas in Singapore and Thailand with a market capitalization of S$9.20 million.

Operations: The company generates revenue from two segments: Oil and Gas, contributing $2.74 million, and Technical Services, contributing $1.35 million.

Market Cap: SGD9.2M

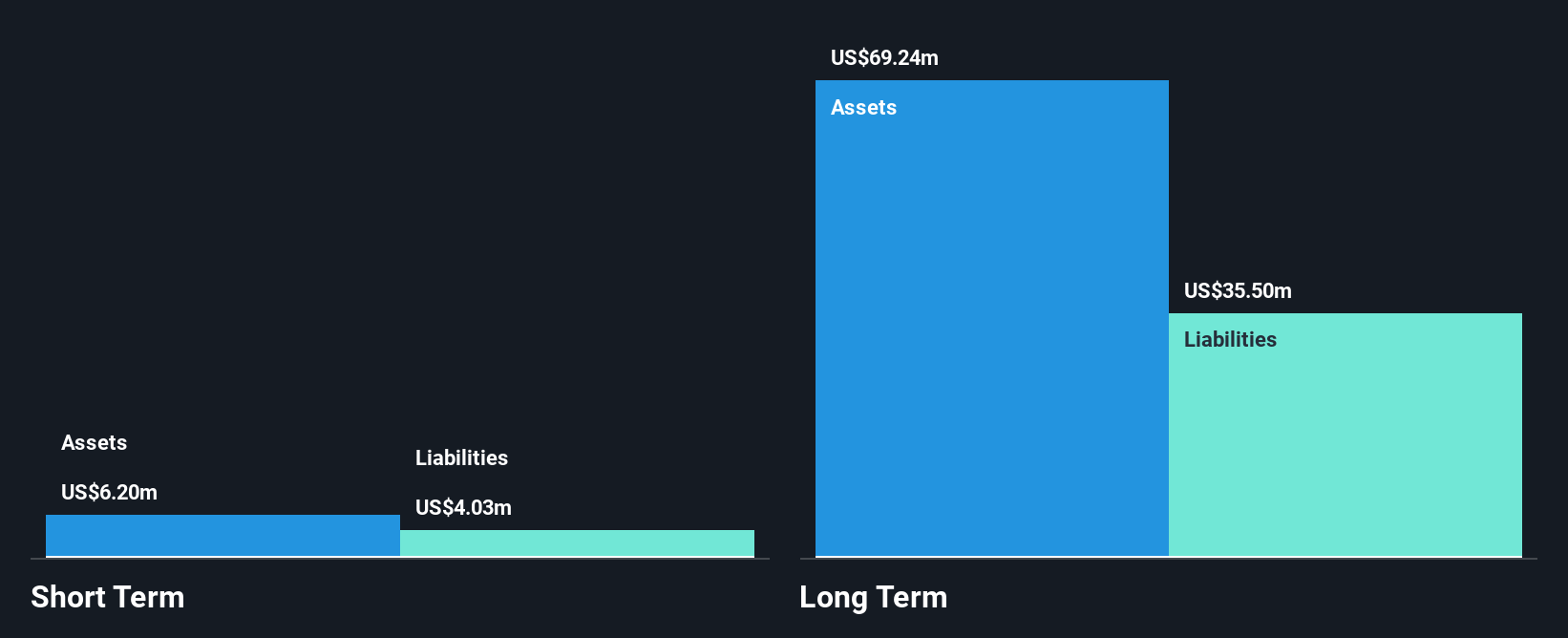

CapAllianz Holdings Limited, with a market capitalization of S$9.20 million, operates in the oil and gas sector in Singapore and Thailand. Despite generating US$4.16 million in revenue for the year ending June 30, 2024, it remains unprofitable with a net loss of US$0.433 million, though losses have decreased from the previous year. The company has no debt but faces significant long-term liabilities not covered by short-term assets. Recent executive changes include the resignation of its Financial Controller, potentially impacting financial management stability as it navigates high share price volatility and shareholder dilution challenges over the past year.

- Navigate through the intricacies of CapAllianz Holdings with our comprehensive balance sheet health report here.

- Gain insights into CapAllianz Holdings' past trends and performance with our report on the company's historical track record.

Peijia Medical (SEHK:9996)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Peijia Medical Limited focuses on the research and development of transcatheter valve therapeutic and neuro interventional procedural medical devices, with a market cap of HK$2.51 billion.

Operations: The company's revenue is derived from its Neurointerventional Business, which generated CN¥309.30 million, and its Transcatheter Valve Therapeutic Business, contributing CN¥208.16 million.

Market Cap: HK$2.51B

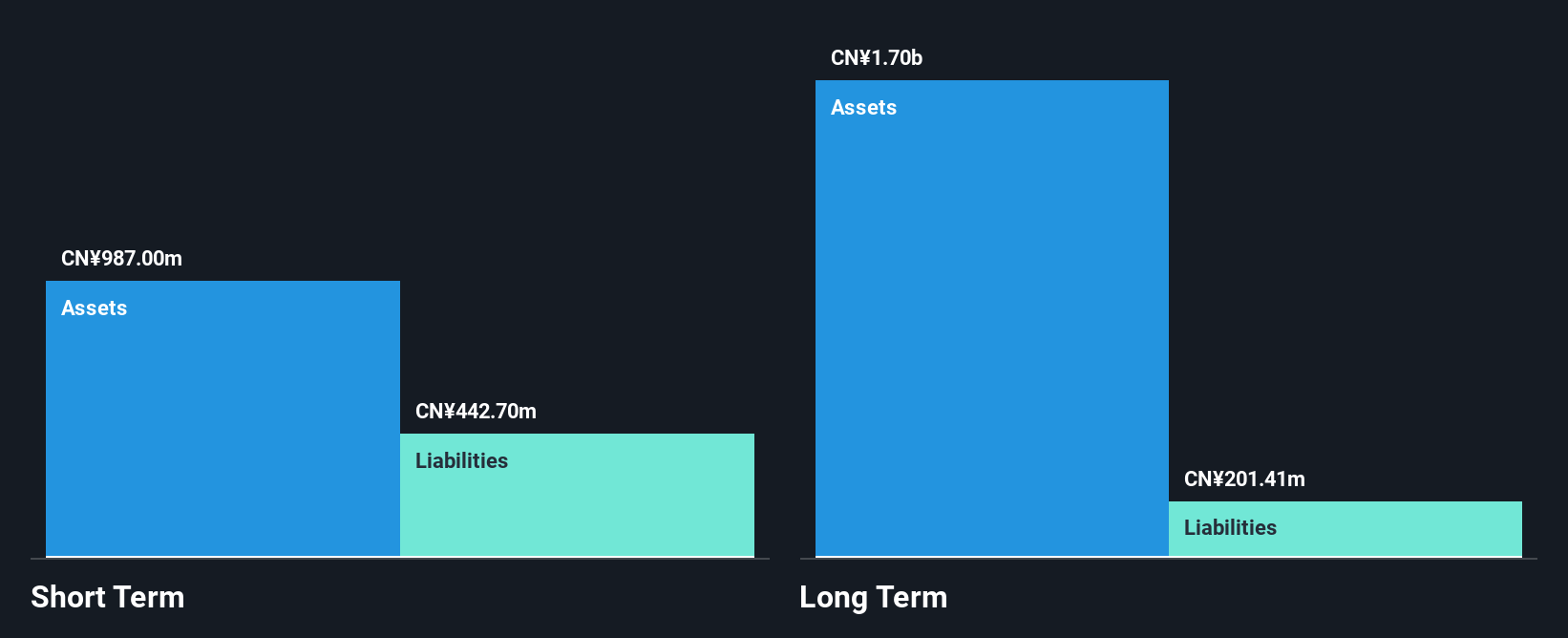

Peijia Medical Limited, with a market cap of HK$2.51 billion, is focused on transcatheter valve therapeutic and neuro interventional devices. Despite being unprofitable, it has reduced losses significantly over the past five years and boasts a strong cash position exceeding its total debt. The company's revenue streams from its Neurointerventional Business (CN¥309.30 million) and Transcatheter Valve Therapeutic Business (CN¥208.16 million) highlight its operational focus. Recent board changes include Dr. Yu Zhiyun's resignation as a non-executive director to prioritize other commitments while remaining as a consultant for Peijia Medical Limited.

- Click here to discover the nuances of Peijia Medical with our detailed analytical financial health report.

- Gain insights into Peijia Medical's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Click this link to deep-dive into the 5,758 companies within our Penny Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:ADSB

Abu Dhabi Ship Building PJSC

Engages in the construction, maintenance, repair, and overhaul of commercial and military ships and vessels in the United Arab Emirates.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives