- Singapore

- /

- Specialty Stores

- /

- SGX:AGS

Hour Glass And Two More SGX Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

Amidst the dynamic advancements in Singapore's financial technology sector, exemplified by Partior's recent successful funding round for enhancing global real-time financial transactions, investors continue to seek stable and potentially rewarding opportunities within the market. In this context, understanding the attributes that contribute to a stock’s resilience and potential for steady returns becomes particularly pertinent.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.78% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.81% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.21% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 7.89% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.68% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.64% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.75% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.47% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.83% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.49% | ★★★★★☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Hour Glass (SGX:AGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited is an investment holding company specializing in the retail and distribution of watches, jewelry, and other luxury products across Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market capitalization of SGD 1.05 billion.

Operations: The Hour Glass Limited generates SGD 1.13 billion from its core business of retailing and distributing luxury watches, jewelry, and related products.

Dividend Yield: 4.9%

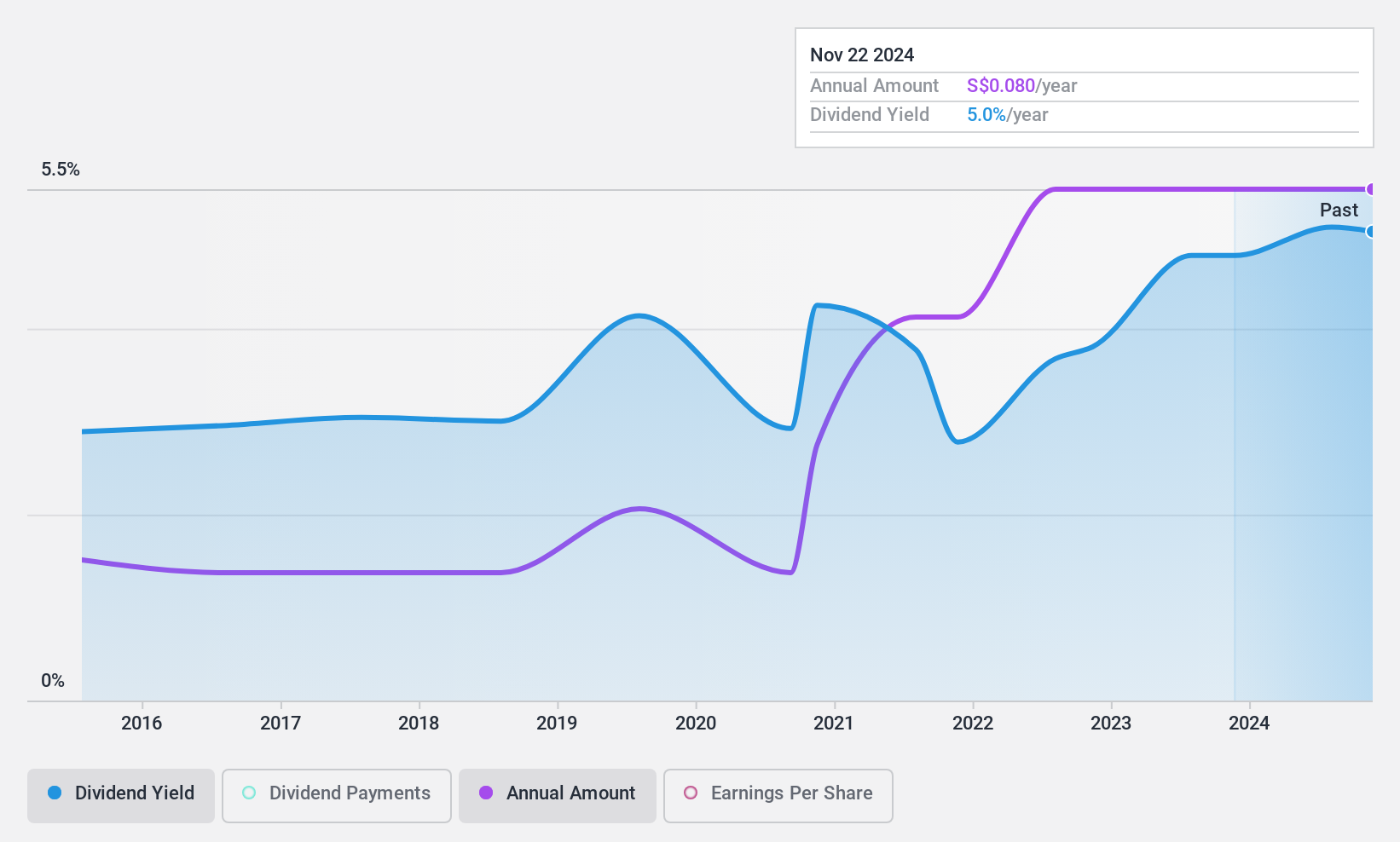

Hour Glass maintains a stable dividend payout, with a recent affirmation of a 6.00 cents per share final dividend for FY 2024, mirroring the previous year's distribution. Despite its earnings coverage (33.5%) and cash flow coverage (46.3%) suggesting sustainability, the company's dividends have shown volatility over the past decade, indicating some level of unpredictability in its payouts. Additionally, its Price-To-Earnings ratio at 6.7x sits well below the Singapore market average of 11.8x, potentially signaling good value amidst concerns over inconsistent dividend growth and lower yield (4.94%) compared to top SG market players (6.17%).

- Dive into the specifics of Hour Glass here with our thorough dividend report.

- Upon reviewing our latest valuation report, Hour Glass' share price might be too optimistic.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products across Singapore, Greater China, Australia, India, and other international markets, with a market capitalization of SGD 277.49 million.

Operations: Multi-Chem Limited generates revenue from its IT business in Singapore (SGD 372.78 million), Australia (SGD 54.60 million), India (SGD 40.56 million), Greater China (SGD 34.96 million), and other international markets (SGD 153.93 million), alongside a smaller PCB business in Singapore contributing SGD 1.79 million.

Dividend Yield: 7.9%

Multi-Chem's dividend sustainability is moderately supported with an earnings payout ratio of 80.7% and a cash payout ratio of 88.1%, indicating that most of its profit and cash flow are used for dividends, which may raise concerns about growth investment. Although the dividend yield stands at a competitive 7.89%, the company's history shows unstable dividend payments over the past decade, reflecting some risk in reliability for long-term investors seeking consistent income streams from dividends. Recent board changes could impact future financial strategies, potentially affecting dividend policies.

- Click to explore a detailed breakdown of our findings in Multi-Chem's dividend report.

- Our valuation report unveils the possibility Multi-Chem's shares may be trading at a discount.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company engaged in stockbroking, futures broking, structured lending, and other financial services across Singapore, Hong Kong, Thailand, Malaysia, and internationally, with a market cap of approximately SGD 1.26 billion.

Operations: UOB-Kay Hian Holdings Limited generates revenue primarily through securities and futures broking and related services, amounting to SGD 539.01 million.

Dividend Yield: 6.8%

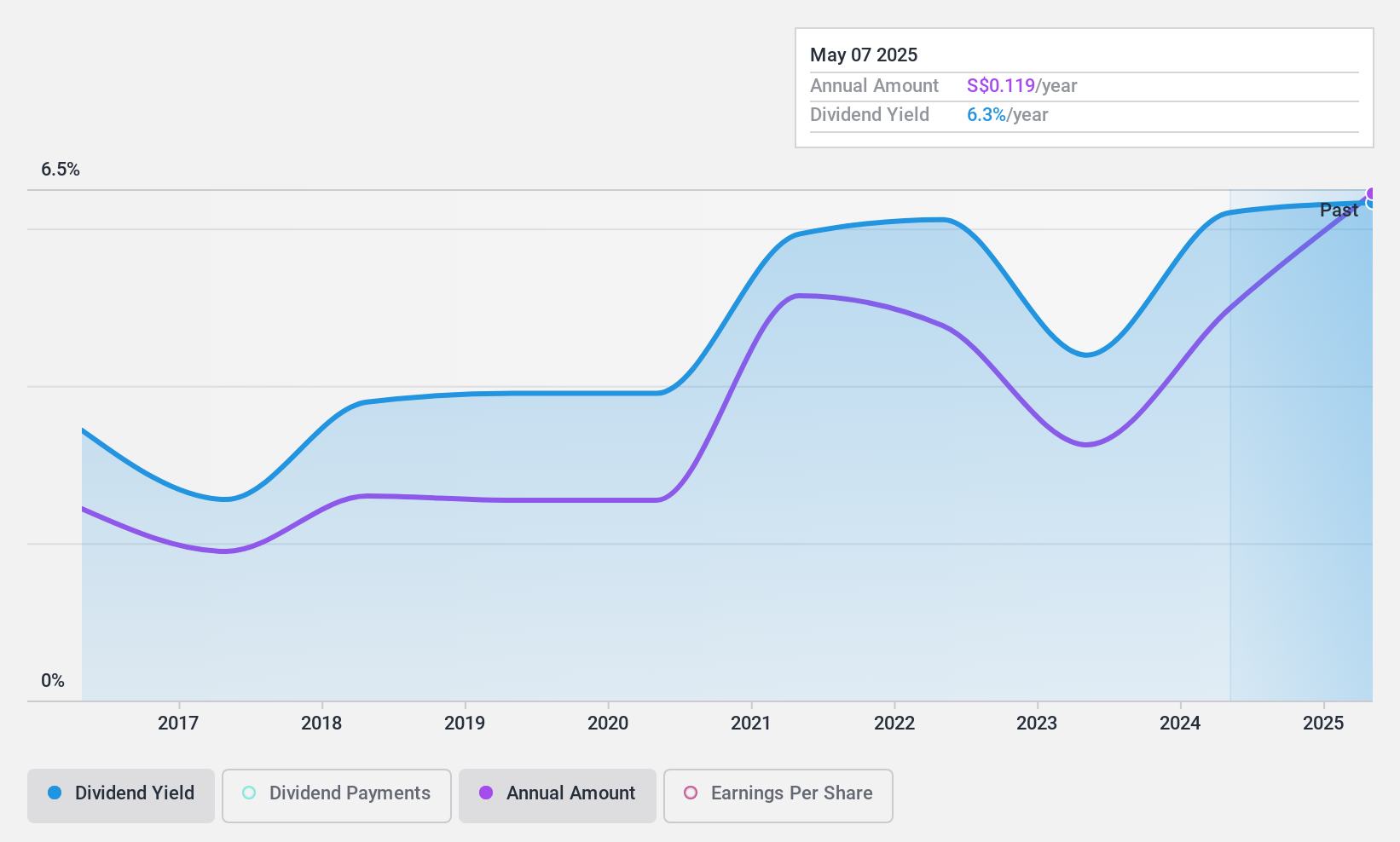

UOB-Kay Hian Holdings, despite a volatile dividend history over the past decade, has shown improvements with a recent increase in its annual dividend to S$0.092 per share. The company's dividends are well-supported by both earnings and cash flows, with payout ratios of 48.2% and 22.7% respectively, suggesting sustainability in its current distributions. However, significant insider selling recently and shareholder dilution over the past year may raise concerns about future dividend stability and growth prospects.

- Delve into the full analysis dividend report here for a deeper understanding of UOB-Kay Hian Holdings.

- Insights from our recent valuation report point to the potential undervaluation of UOB-Kay Hian Holdings shares in the market.

Key Takeaways

- Dive into all 20 of the Top SGX Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hour Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AGS

Hour Glass

An investment holding company, engages in the retailing and distribution of watches, jewellry, and other luxury products in Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives