3 Undervalued Small Caps In Asian Markets With Insider Buying

Reviewed by Simply Wall St

Amidst escalating geopolitical tensions and fluctuating trade dynamics, Asian markets have been navigating a complex landscape, with key indices reflecting mixed performances. As investors seek opportunities in this environment, small-cap stocks with insider buying can offer intriguing prospects due to their potential for growth and resilience in uncertain times.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.2x | 1.0x | 40.47% | ★★★★★★ |

| East West Banking | 3.0x | 0.7x | 35.89% | ★★★★★☆ |

| Lion Rock Group | 5.0x | 0.4x | 49.95% | ★★★★☆☆ |

| Dicker Data | 18.0x | 0.6x | -10.93% | ★★★★☆☆ |

| Atturra | 26.9x | 1.1x | 36.52% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 38.61% | ★★★★☆☆ |

| Select Harvests | 19.4x | 1.7x | -48.39% | ★★★★☆☆ |

| PWR Holdings | 33.9x | 4.7x | 25.11% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 12.5x | 20.22% | ★★★☆☆☆ |

| AInnovation Technology Group | NA | 2.4x | 46.49% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Nuix (ASX:NXL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nuix is a technology company specializing in software and programming solutions, with a focus on data analytics and cybersecurity, and has a market capitalization of A$0.43 billion.

Operations: Nuix generates revenue primarily from its Software & Programming segment, with recent figures reaching A$227.37 million. The company's gross profit margin has shown a trend of staying around 90% in recent periods, indicating a strong ability to manage costs relative to sales. Operating expenses are significant, driven by Sales & Marketing and R&D expenditures, which together account for a substantial portion of costs. Despite fluctuations in net income margins, the company has experienced both losses and modest profits over various periods.

PE: -1369.0x

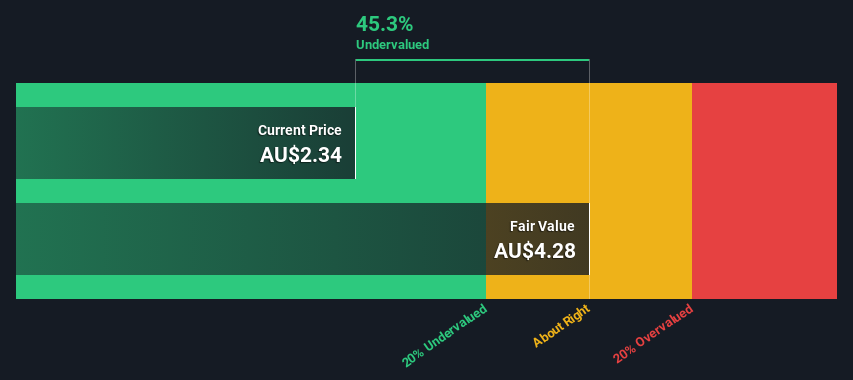

Nuix, recently added to the S&P/ASX 200 Index in March 2025, operates with a funding structure reliant solely on external borrowing, which carries inherent risks. However, insider confidence is evident through recent share purchases over the past year. The company projects significant earnings growth at nearly 54% annually. As a smaller player in Asia's tech landscape, these factors suggest potential for future expansion and value realization despite its riskier financial structure.

- Take a closer look at Nuix's potential here in our valuation report.

Examine Nuix's past performance report to understand how it has performed in the past.

Select Harvests (ASX:SHV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Select Harvests is an agribusiness company primarily engaged in the cultivation, processing, and marketing of almonds, with a market capitalization of approximately A$0.61 billion.

Operations: Select Harvests generates revenue primarily from its almond segment, with recent quarterly revenues reaching A$373.97 million. The company's cost structure is significantly impacted by the cost of goods sold (COGS), which was A$301.03 million in the latest quarter, leading to a gross profit margin of 19.50%. Operating expenses and non-operating expenses further affect profitability, with net income recorded at A$32.60 million for the same period and a net income margin of 8.72%.

PE: 19.4x

Select Harvests, a small cap in Asia, has shown promising financial performance with recent half-year sales reaching A$104.5 million, up from A$67.8 million the previous year. Net income swung to A$28.67 million from a loss of A$2.4 million, reflecting operational improvements. Insider confidence is evident with share purchases over the past year, signaling potential value recognition by those close to the company. Despite relying on external borrowing for funding, earnings are projected to grow 14% annually, suggesting room for future growth amidst current challenges.

- Dive into the specifics of Select Harvests here with our thorough valuation report.

Review our historical performance report to gain insights into Select Harvests''s past performance.

ValueMax Group (SGX:T6I)

Simply Wall St Value Rating: ★★★★☆☆

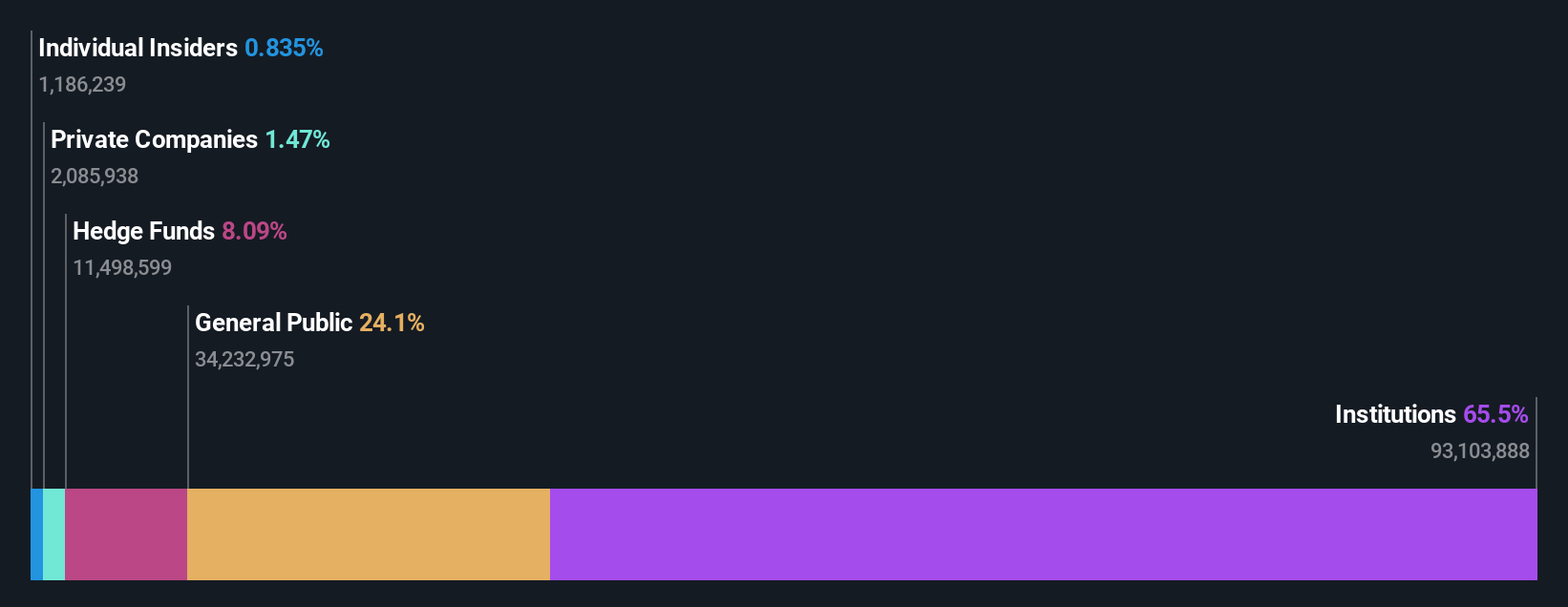

Overview: ValueMax Group is involved in pawnbroking, moneylending, and the retail and trading of jewellery and gold with a market capitalization of S$0.45 billion.

Operations: The company's revenue is primarily driven by the retail and trading of jewellery and gold, followed by pawnbroking and moneylending. Over recent periods, the gross profit margin has shown a notable increase, reaching 30.28% as of December 2024. Operating expenses have consistently risen alongside revenue growth, with general and administrative expenses being a significant component.

PE: 6.5x

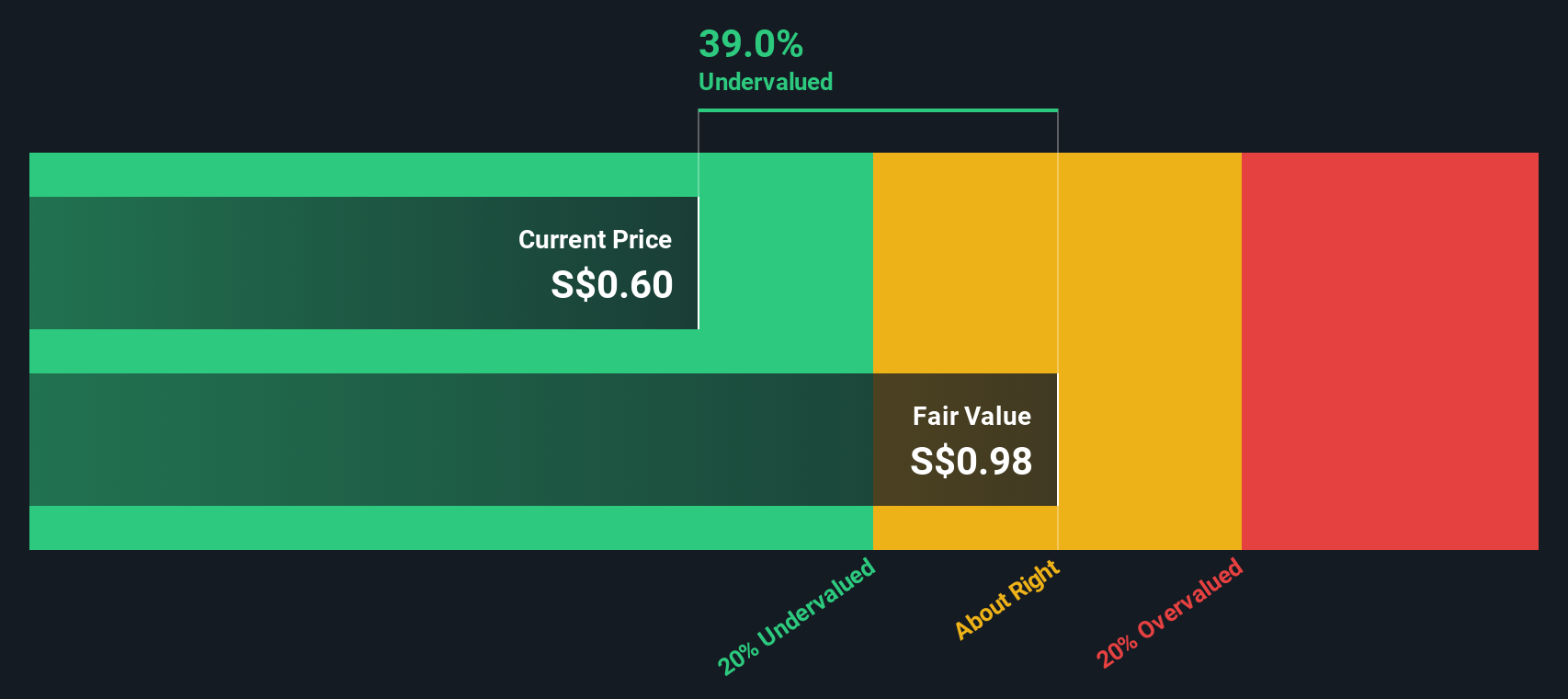

ValueMax Group, a small company in Asia, has captured attention with insider confidence shown through recent share purchases. Despite relying on external borrowing for funding, its financial position remains solid as operating cash flow adequately covers debt. In April 2025, they launched a new commercial paper series aiming to raise up to SG$25 million at 3.9% interest annually. The company also declared a final dividend of 2.68 cents per share for the year ending December 2024, reflecting potential future growth and investor appeal.

- Delve into the full analysis valuation report here for a deeper understanding of ValueMax Group.

Evaluate ValueMax Group's historical performance by accessing our past performance report.

Summing It All Up

- Click through to start exploring the rest of the 58 Undervalued Asian Small Caps With Insider Buying now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet and good value.

Market Insights

Community Narratives