Singapore Exchange Limited (SGX:S68) has announced that it will pay a dividend of S$0.08 per share on the 22nd of October. Based on this payment, the dividend yield will be 3.3%, which is fairly typical for the industry.

View our latest analysis for Singapore Exchange

Singapore Exchange's Dividend Is Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Before this announcement, Singapore Exchange was paying out 77% of earnings, but a comparatively small 67% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Earnings per share is forecast to rise by 1.3% over the next year. If the dividend continues growing along recent trends, we estimate the payout ratio could reach 78%, which is on the higher side, but certainly still feasible.

Singapore Exchange Has A Solid Track Record

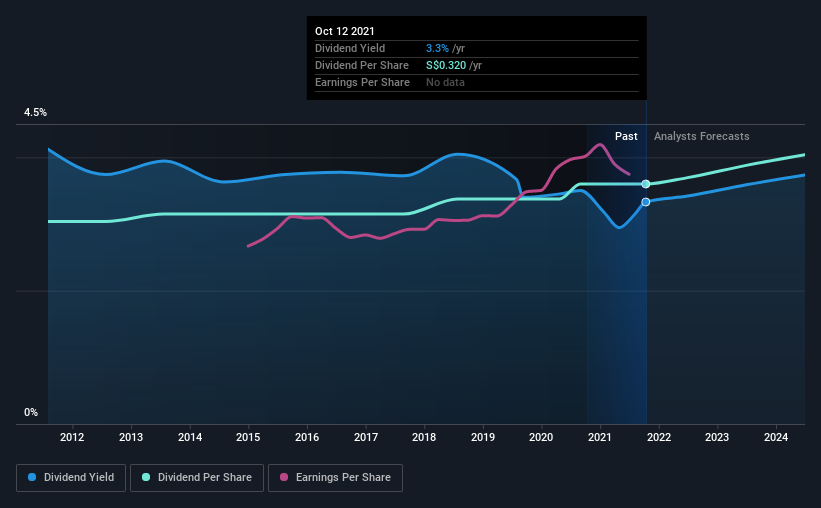

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from S$0.27 in 2011 to the most recent annual payment of S$0.32. This implies that the company grew its distributions at a yearly rate of about 1.7% over that duration. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

We Could See Singapore Exchange's Dividend Growing

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see Singapore Exchange has been growing its earnings per share at 5.0% a year over the past five years. Recently, the company has been able to grow earnings at a decent rate, but with the payout ratio on the higher end we don't think the dividend has many prospects for growth.

Our Thoughts On Singapore Exchange's Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for Singapore Exchange that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:S68

Singapore Exchange

An investment holding, engages in the operation of integrated securities and derivatives exchange, related clearing houses, and an electricity market in Singapore.

Solid track record with excellent balance sheet and pays a dividend.