Asian Penny Stocks: Qingci Games And 2 Other Noteworthy Picks

Reviewed by Simply Wall St

As the Asian markets continue to navigate a complex global landscape, marked by economic fluctuations and geopolitical developments, investors are increasingly turning their attention to potential opportunities within smaller cap stocks. Penny stocks, often seen as remnants of bygone market eras, still hold significant allure due to their affordability and potential for growth. In this article, we explore three noteworthy penny stocks from Asia that stand out for their financial strength and promising prospects.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$3.05 | HK$2.48B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.41 | HK$889.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.12 | HK$3.66B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.40 | HK$2B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.455 | SGD184.41M | ✅ 4 ⚠️ 1 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.645 | SGD614.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.45 | SGD9.64B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.95 | THB1.38B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.24 | SGD48.53M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.55 | SGD973.94M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 970 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Qingci Games (SEHK:6633)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qingci Games Inc. is an investment holding company that develops, publishes, and operates mobile games across various international markets including China, Japan, the United States, and others with a market cap of approximately HK$2.26 billion.

Operations: The company's revenue is primarily generated from its Computer Graphics segment, amounting to CN¥627.96 million.

Market Cap: HK$2.26B

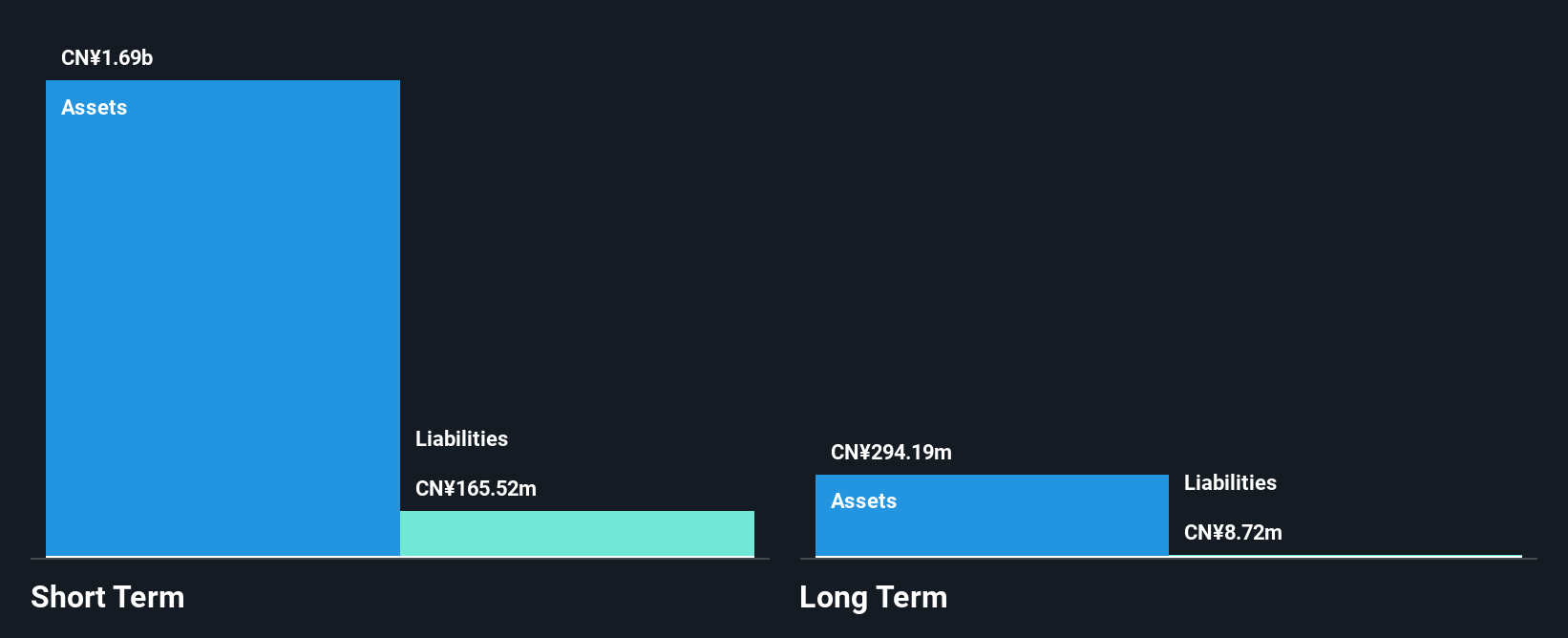

Qingci Games has shown financial improvement, becoming profitable over the past year with earnings growing at 6.3% annually over five years. The company's debt levels are well-managed, with operating cash flow covering 46.9% of its debt and more cash on hand than total debt. Its short-term assets of CN¥1.7 billion comfortably cover both short- and long-term liabilities, indicating strong liquidity. However, a Return on Equity of 2.6% is low, and recent results were impacted by a significant one-off gain of CN¥55.9 million, which may not reflect ongoing operational performance accurately.

- Jump into the full analysis health report here for a deeper understanding of Qingci Games.

- Examine Qingci Games' past performance report to understand how it has performed in prior years.

Genor Biopharma Holdings (SEHK:6998)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genor Biopharma Holdings Limited is a biopharmaceutical company that develops and commercializes oncology and autoimmune drugs in China and internationally, with a market cap of HK$1.40 billion.

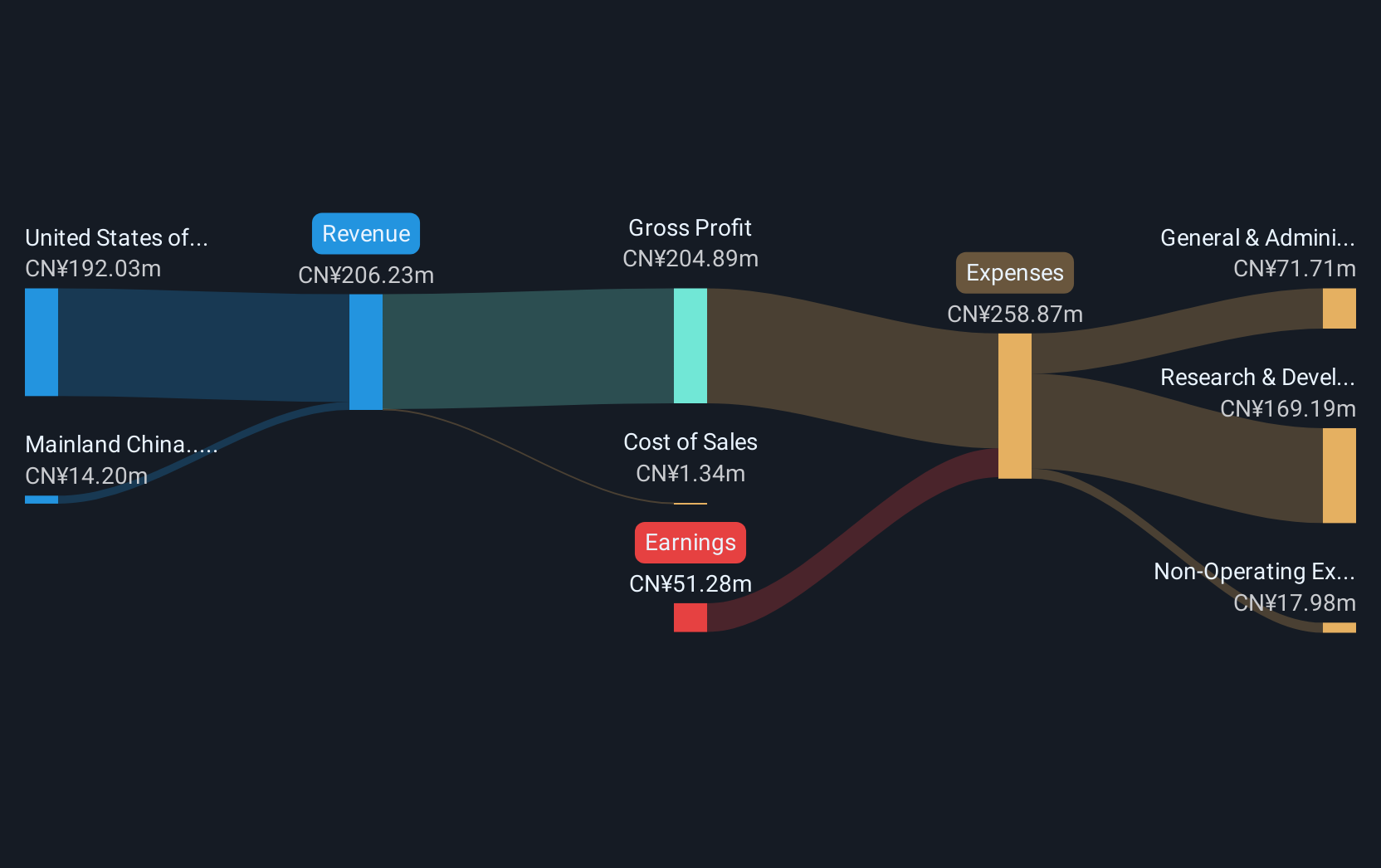

Operations: The company generates its revenue from the pharmaceuticals segment, amounting to CN¥206.23 million.

Market Cap: HK$1.4B

Genor Biopharma Holdings, with a market cap of HK$1.40 billion, is making strides in the biotech sector despite being unprofitable. The company recently secured approval from China's NMPA for Lerociclib (GB491), a promising treatment for HR+/HER2- breast cancer, marking a key milestone in its drug development efforts. Additionally, advancements in the clinical evaluation of GB261 for autoimmune diseases highlight ongoing innovation. Genor's financial stability is supported by CN¥1.1 billion in short-term assets covering liabilities and no debt burden, ensuring a substantial cash runway exceeding three years based on current free cash flow trends.

- Get an in-depth perspective on Genor Biopharma Holdings' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Genor Biopharma Holdings' track record.

Hong Leong Finance (SGX:S41)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Leong Finance Limited is a financial services company catering to consumer and SME markets in Singapore, with a market capitalization of SGD1.19 billion.

Operations: The company generates SGD233.57 million in revenue from its financing business segment.

Market Cap: SGD1.19B

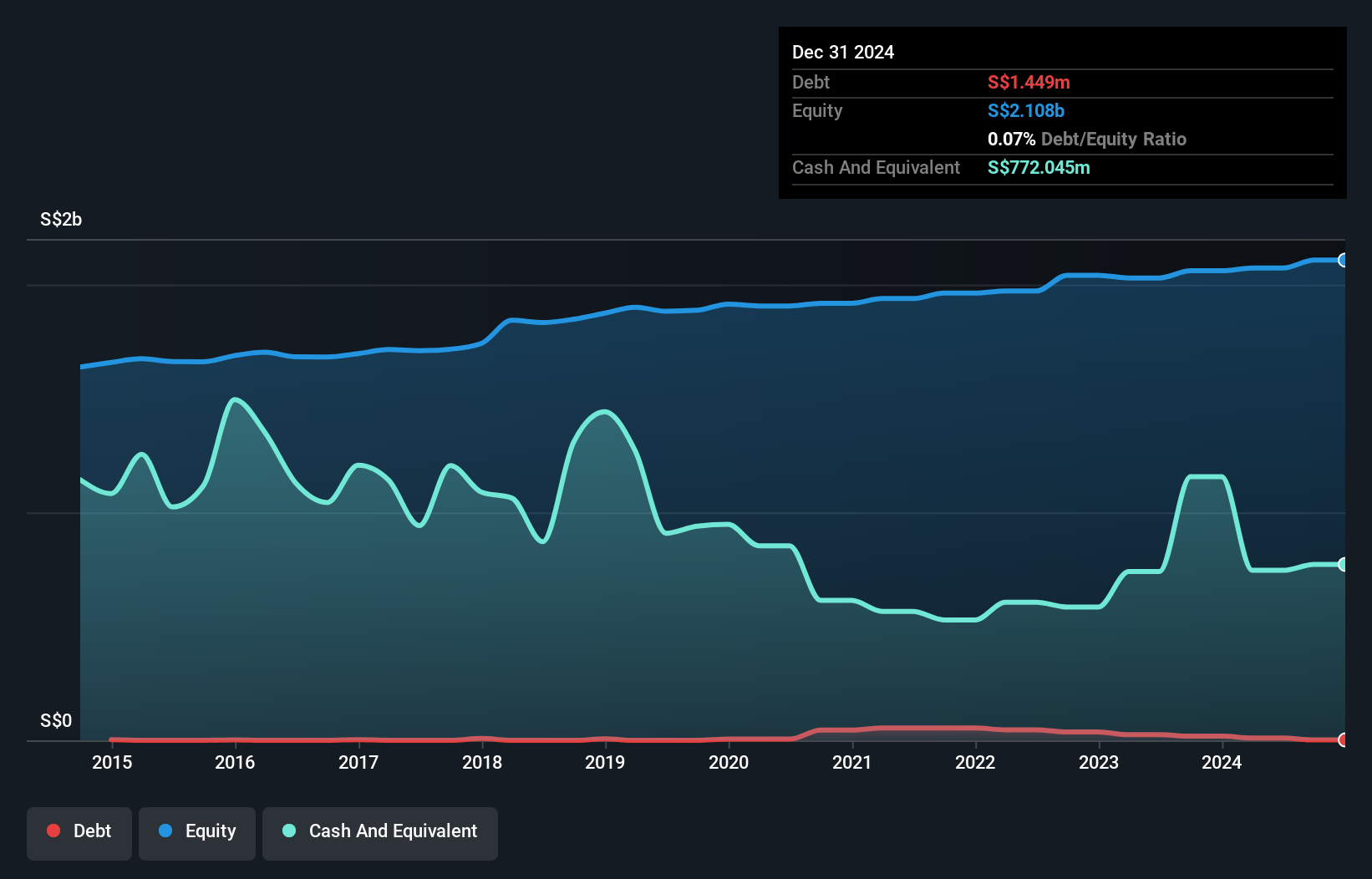

Hong Leong Finance Limited, with a market cap of SGD1.19 billion, demonstrates financial stability through primarily low-risk customer deposit funding and an appropriate loans-to-assets ratio of 80%. The company has shown consistent profit growth, with earnings increasing by 11.5% over the past year, surpassing industry averages. Despite a relatively low return on equity at 4.9%, Hong Leong maintains high-quality earnings and an experienced management team with an average tenure of 8.8 years. Recent strategic moves include being appointed as an independent financial adviser to Aoxin Q & M Dental Group Limited, enhancing its advisory credentials in the region.

- Click here and access our complete financial health analysis report to understand the dynamics of Hong Leong Finance.

- Learn about Hong Leong Finance's historical performance here.

Taking Advantage

- Click this link to deep-dive into the 970 companies within our Asian Penny Stocks screener.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6998

Genor Biopharma Holdings

A biopharmaceutical company, focuses on developing and commercializing oncology and autoimmune drugs in China and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives