- Singapore

- /

- Diversified Financial

- /

- SGX:I49

IFS Capital Limited's (SGX:I49) Share Price Not Quite Adding Up

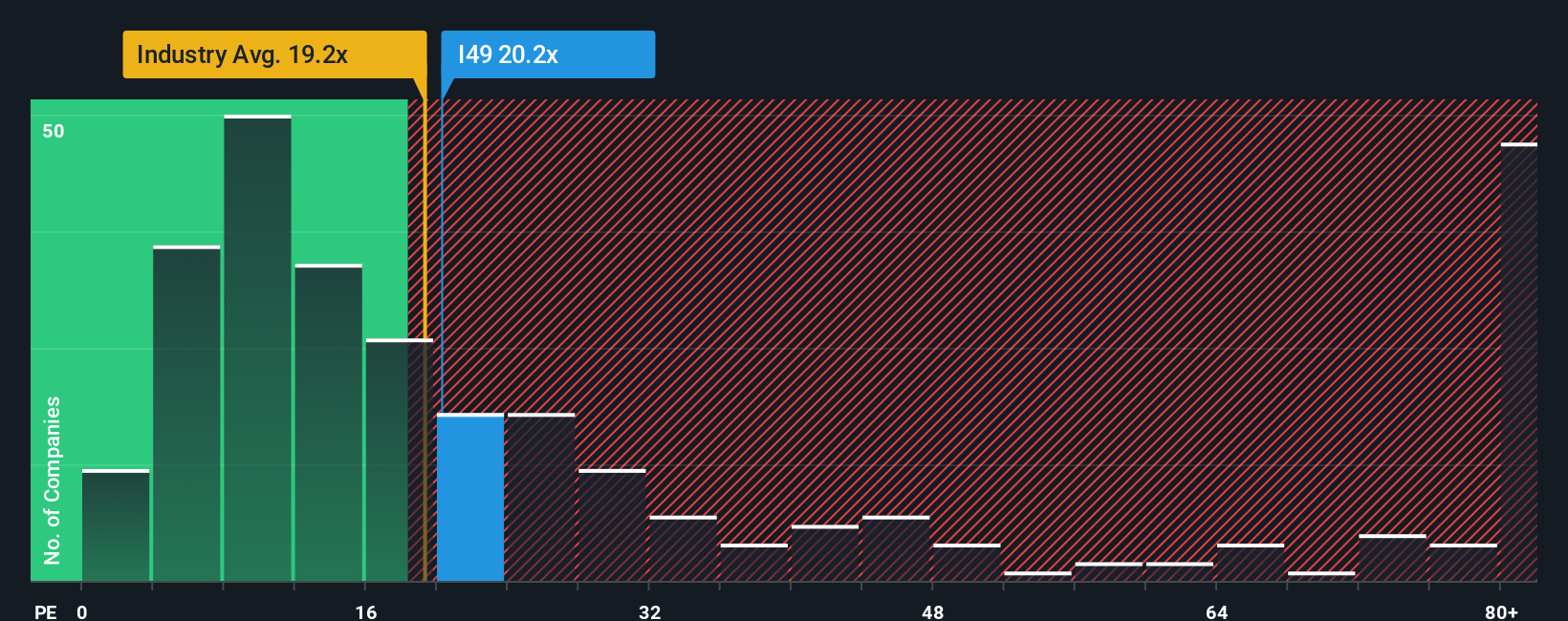

IFS Capital Limited's (SGX:I49) price-to-earnings (or "P/E") ratio of 20.2x might make it look like a sell right now compared to the market in Singapore, where around half of the companies have P/E ratios below 13x and even P/E's below 8x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

For example, consider that IFS Capital's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for IFS Capital

Is There Enough Growth For IFS Capital?

The only time you'd be truly comfortable seeing a P/E as high as IFS Capital's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 57% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 13% shows it's an unpleasant look.

In light of this, it's alarming that IFS Capital's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of IFS Capital revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 6 warning signs for IFS Capital (2 can't be ignored!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:I49

IFS Capital

Provides commercial, alternative, and structured finance services in Singapore, Thailand, Malaysia, and Indonesia.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives