- Singapore

- /

- Capital Markets

- /

- Catalist:42T

3 Promising Penny Stocks With Market Caps Over US$40M

Reviewed by Simply Wall St

As global markets navigate the complexities of policy shifts and economic signals, investors are increasingly exploring diverse opportunities to optimize their portfolios. Penny stocks, often representing smaller or newer companies, continue to capture attention despite their vintage moniker. In this article, we explore three penny stocks that stand out for their financial resilience and potential for growth in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.485 | MYR2.41B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.84 | THB1.49B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6025 | A$70.63M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

Click here to see the full list of 5,799 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Trendlines Group (Catalist:42T)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Trendlines Group Ltd. is an innovation commercialization company and venture capital firm focusing on various stages of investment, with a market cap of SGD55.34 million.

Operations: The company generates revenue from its segment of creating and investing in innovation, amounting to -$27.00 million.

Market Cap: SGD55.34M

Trendlines Group Ltd., with a market cap of SGD55.34 million, operates as an innovation commercialization company and venture capital firm. It is currently pre-revenue, generating less than US$1 million. The company's management team is experienced, boasting an average tenure of 5.7 years, though its board of directors is relatively new with an average tenure of 2.4 years. Despite being unprofitable and having increased losses over the past five years by 52.9% annually, Trendlines has a cash runway for nine months after raising additional capital and maintains more cash than total debt, indicating prudent financial management amidst shareholder dilution concerns from last year’s increase in shares outstanding by 6.7%.

- Navigate through the intricacies of Trendlines Group with our comprehensive balance sheet health report here.

- Understand Trendlines Group's track record by examining our performance history report.

Pera Yatirim Holding Anonim Sirketi (IBSE:PEHOL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pera Yatirim Holding Anonim Sirketi, operating as PERA Gayrimenkul Yatirim Ortakligi AS, is a publicly owned real estate investment trust with a market capitalization of TRY1.77 billion.

Operations: The company generates revenue of TRY26.57 million from creating and developing a real estate portfolio.

Market Cap: TRY1.77B

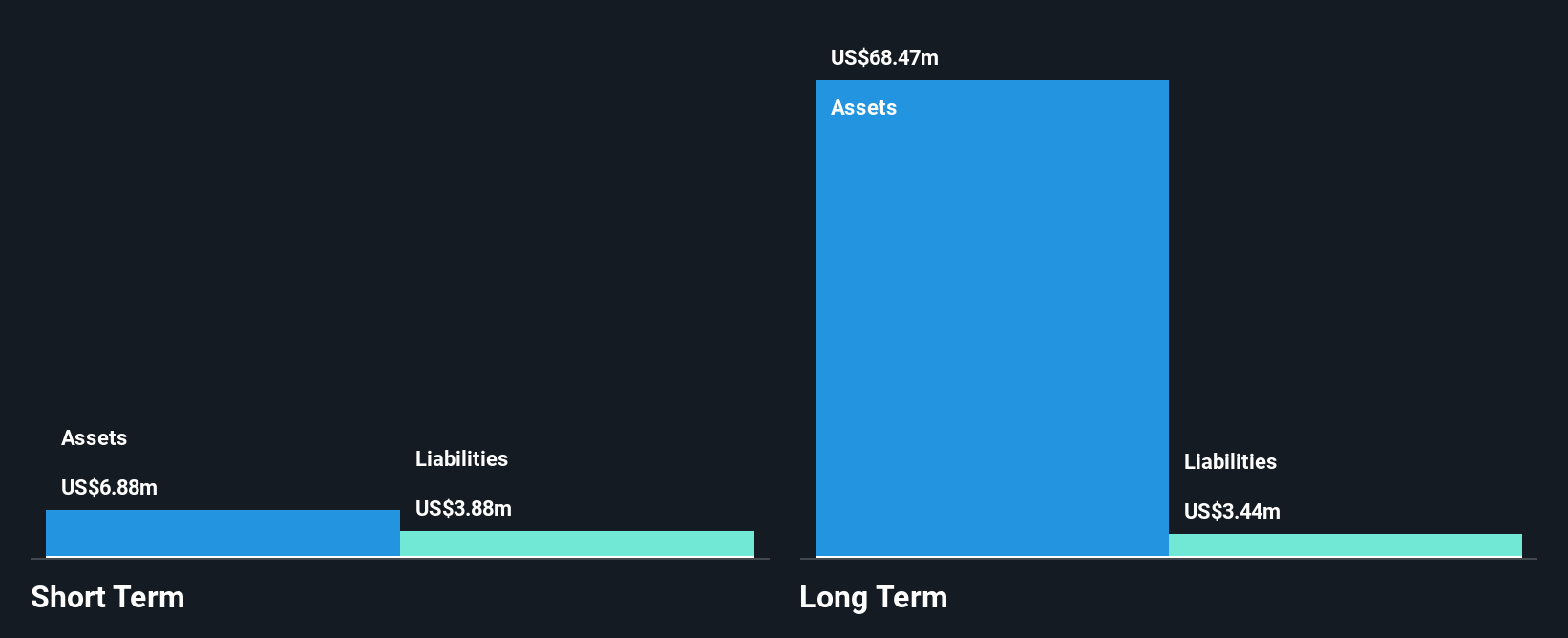

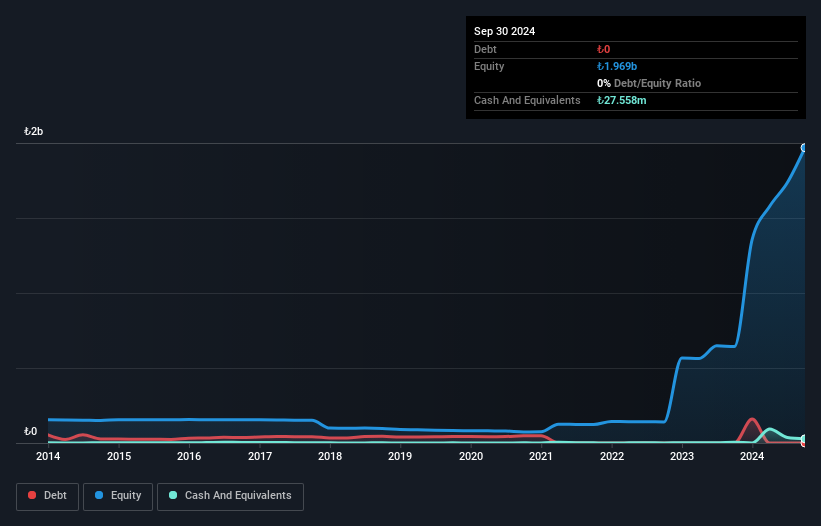

Pera Yatirim Holding Anonim Sirketi, with a market cap of TRY1.77 billion, is debt-free and maintains a low price-to-earnings ratio of 4.2x compared to the TR market average. Despite stable weekly volatility, its share price has been highly volatile recently. The company's short-term assets (TRY66.5 million) fall short of covering both short-term and long-term liabilities, totaling TRY76.8 million and TRY311.1 million respectively. Recent earnings reports indicate declining sales but significant net income growth for the third quarter due to high non-cash earnings, despite negative earnings growth over the past year at -30.6%.

- Click to explore a detailed breakdown of our findings in Pera Yatirim Holding Anonim Sirketi's financial health report.

- Review our historical performance report to gain insights into Pera Yatirim Holding Anonim Sirketi's track record.

Eternal Energy (SET:EE-R)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eternal Energy Public Company Limited operates in Thailand, focusing on the plantation, extraction, processing, distribution, import, and export of hemp, marijuana, and cannabis with a market cap of THB556 million.

Operations: Eternal Energy Public Company Limited has not reported any specific revenue segments.

Market Cap: THB556M

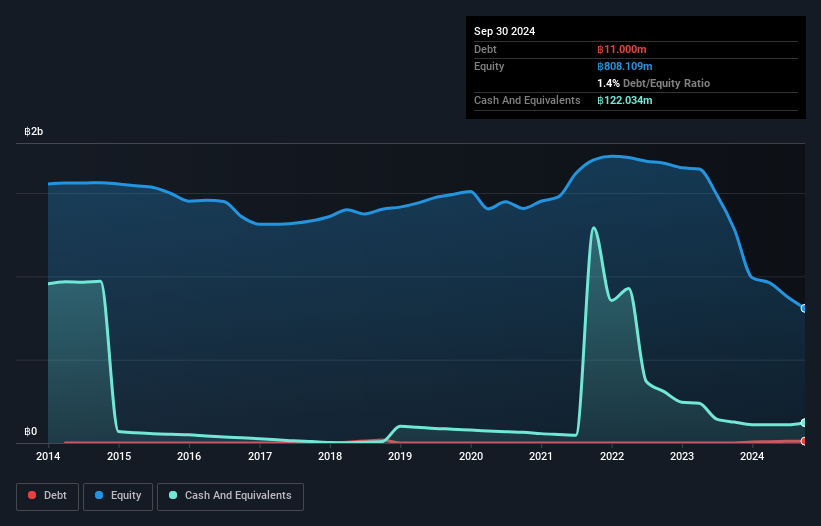

Eternal Energy Public Company Limited, with a market cap of THB556 million, operates in the cannabis sector and remains pre-revenue, reporting sales under US$1 million. Despite having short-term assets of THB138.8 million that cover both its short- and long-term liabilities, the company is unprofitable with increasing losses over five years at 71.1% annually. Its share price has been highly volatile recently, although weekly volatility has stabilized somewhat over the past year. Eternal Energy's cash reserves exceed its debt levels, providing a runway exceeding three years despite declining free cash flow and recent executive changes in financial leadership.

- Take a closer look at Eternal Energy's potential here in our financial health report.

- Evaluate Eternal Energy's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Access the full spectrum of 5,799 Penny Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trendlines Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About Catalist:42T

Trendlines Group

An innovation commercialization company and a private equity and venture capital firm specializing in incubation, seed, start-up, early venture and late venture investments.

Slight with mediocre balance sheet.