- Singapore

- /

- Hospitality

- /

- SGX:S85

Shareholders May Not Be So Generous With Straco Corporation Limited's (SGX:S85) CEO Compensation And Here's Why

Key Insights

- Straco to hold its Annual General Meeting on 17th of April

- Salary of S$992.0k is part of CEO Hsioh Kwang Wu's total remuneration

- The total compensation is 367% higher than the average for the industry

- Straco's EPS grew by 33% over the past three years while total shareholder return over the past three years was 1.3%

CEO Hsioh Kwang Wu has done a decent job of delivering relatively good performance at Straco Corporation Limited (SGX:S85) recently. As shareholders go into the upcoming AGM on 17th of April, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Straco

Comparing Straco Corporation Limited's CEO Compensation With The Industry

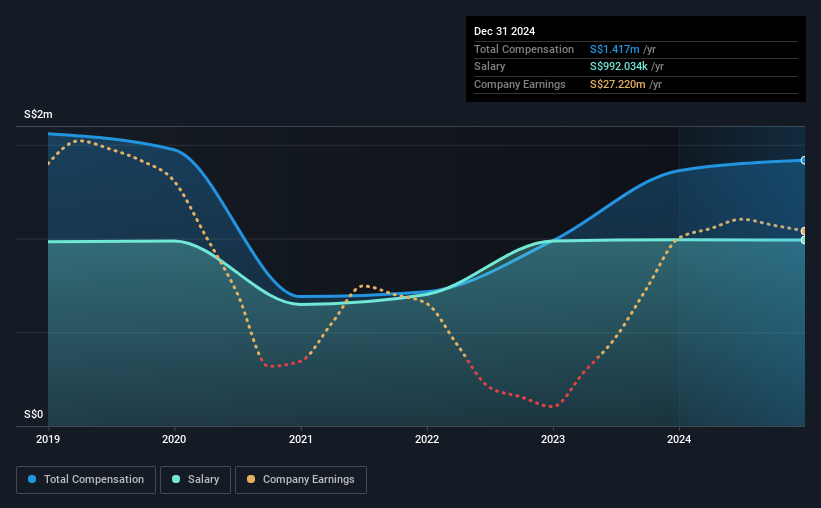

According to our data, Straco Corporation Limited has a market capitalization of S$338m, and paid its CEO total annual compensation worth S$1.4m over the year to December 2024. That's just a smallish increase of 4.1% on last year. We note that the salary portion, which stands at S$992.0k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the Singapore Hospitality industry with market capitalizations between S$134m and S$534m, we discovered that the median CEO total compensation of that group was S$303k. This suggests that Hsioh Kwang Wu is paid more than the median for the industry. Moreover, Hsioh Kwang Wu also holds S$3.5m worth of Straco stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | S$992k | S$994k | 70% |

| Other | S$425k | S$367k | 30% |

| Total Compensation | S$1.4m | S$1.4m | 100% |

Talking in terms of the industry, salary represented approximately 78% of total compensation out of all the companies we analyzed, while other remuneration made up 22% of the pie. Straco sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Straco Corporation Limited's Growth Numbers

Over the past three years, Straco Corporation Limited has seen its earnings per share (EPS) grow by 33% per year. The trailing twelve months of revenue was pretty much the same as the prior period.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Straco Corporation Limited Been A Good Investment?

Straco Corporation Limited has generated a total shareholder return of 1.3% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for Straco that investors should look into moving forward.

Important note: Straco is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:S85

Straco

Develops and operates tourism-related businesses in Singapore and China.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026