- Japan

- /

- Healthcare Services

- /

- TSE:7840

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record-high U.S. indexes, geopolitical tensions, and fluctuating economic indicators, investors are increasingly looking for stable income sources amidst the uncertainty. In such an environment, dividend stocks can offer a reliable stream of income and potential for capital appreciation, making them an attractive option for those seeking to balance growth with stability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

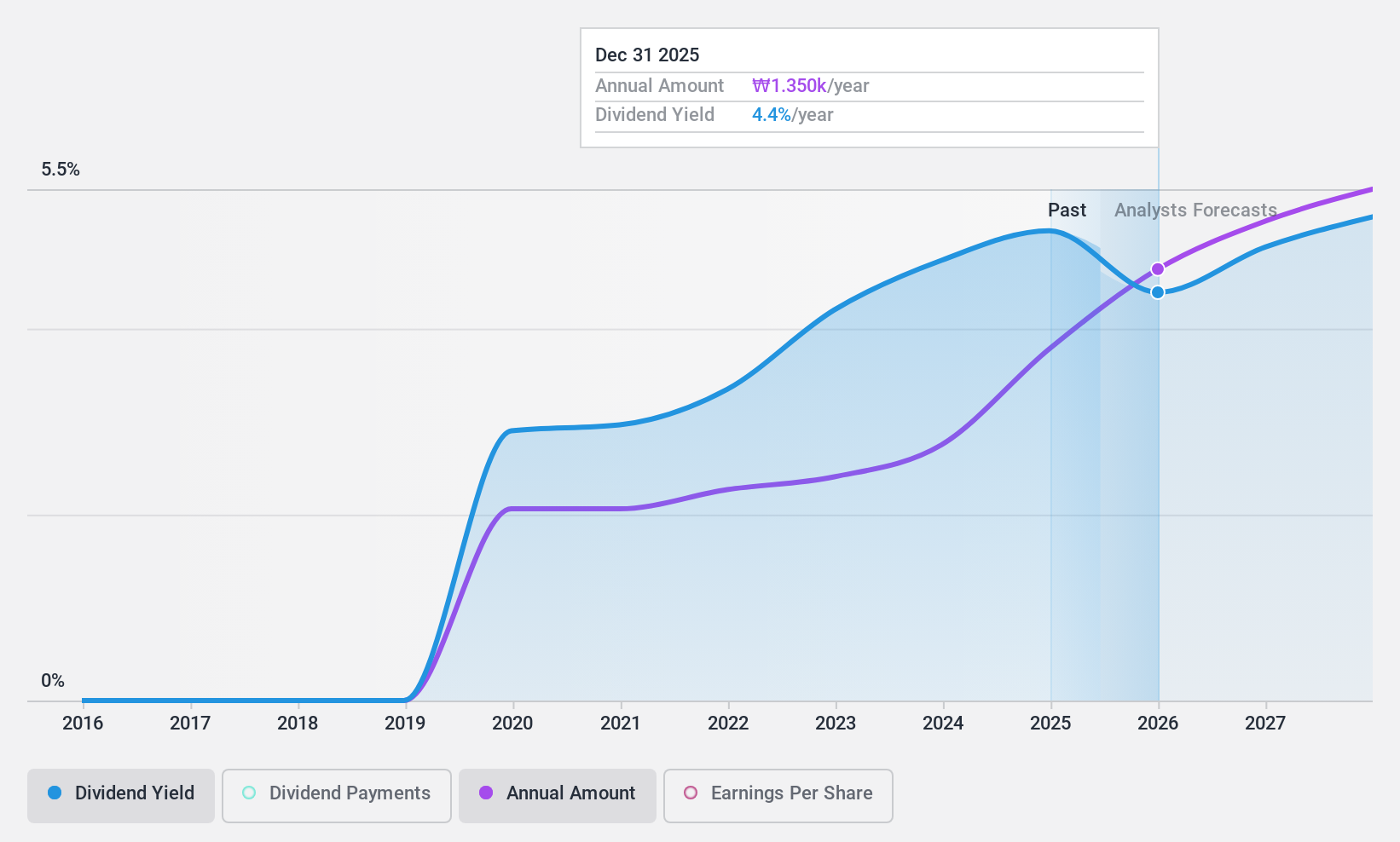

Cuckoo Holdings (KOSE:A192400)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cuckoo Holdings Co., Ltd., along with its subsidiaries, manufactures and sells electric heaters and daily necessities in South Korea and internationally, with a market cap of approximately ₩708.59 billion.

Operations: Cuckoo Holdings Co., Ltd. generates its revenue through the manufacturing and sale of electric heaters and daily necessities both domestically in South Korea and internationally.

Dividend Yield: 4.8%

Cuckoo Holdings' dividend payments are well-supported by both earnings and cash flows, with a payout ratio of 27% and a cash payout ratio of 50.2%. Despite only paying dividends for five years, the company has maintained stable and growing payouts. Its dividend yield is in the top 25% of the KR market at 4.8%, suggesting competitive returns for investors seeking income. The price-to-earnings ratio of 5.6x indicates potential value relative to the market average.

- Navigate through the intricacies of Cuckoo Holdings with our comprehensive dividend report here.

- Our valuation report here indicates Cuckoo Holdings may be overvalued.

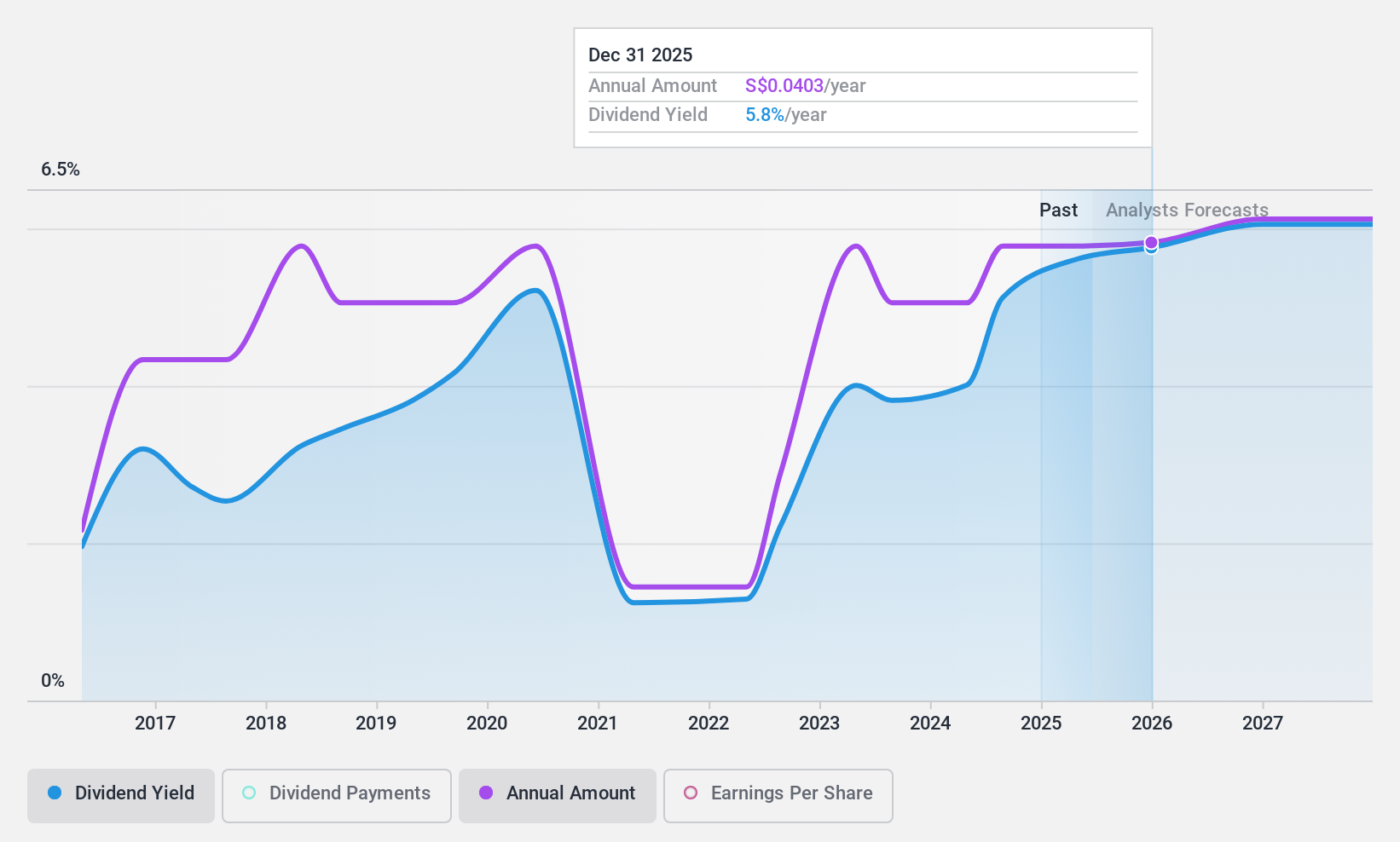

Genting Singapore (SGX:G13)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Genting Singapore Limited is an investment holding company that focuses on the construction, development, and operation of integrated resort destinations in Asia, with a market cap of SGD9.24 billion.

Operations: Genting Singapore Limited's revenue primarily stems from its integrated resort operations in Asia.

Dividend Yield: 5.2%

Genting Singapore's dividend payments are covered by earnings and cash flows, with payout ratios of 69.8% and 72.3%, respectively. However, its dividends have been volatile over the past decade, despite some growth in payments during this period. The current yield of 5.19% is below the top tier in Singapore's market. Recent changes include the departure of Andrew MacDonald from a key director role, potentially impacting casino operations at Resorts World Sentosa (RWS).

- Click here to discover the nuances of Genting Singapore with our detailed analytical dividend report.

- The analysis detailed in our Genting Singapore valuation report hints at an deflated share price compared to its estimated value.

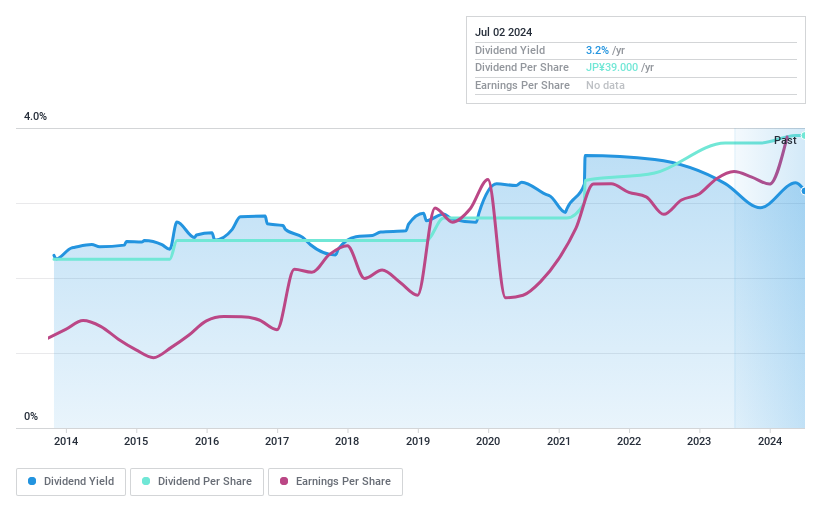

France Bed HoldingsLtd (TSE:7840)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: France Bed Holdings Co., Ltd. operates in Japan through its subsidiaries, focusing on medical services and home furnishing and health businesses, with a market cap of ¥42.68 billion.

Operations: France Bed Holdings Co., Ltd. generates revenue from its Medical Services segment, which accounts for ¥39.85 billion, and its Interior Health segment, contributing ¥19.90 billion.

Dividend Yield: 3.1%

France Bed Holdings Ltd. offers stable and reliable dividends, with payments consistently growing over the past decade. The company's dividends are well-covered by earnings and cash flows, evidenced by low payout ratios of 24.1% and 41.9%, respectively. Although the dividend yield of 3.13% is below Japan's top-tier payers, its valuation appears attractive at 23.6% below estimated fair value. Recently, it affirmed a JPY 17 per share dividend for Q2 FY2025, maintaining last year's level.

- Click here and access our complete dividend analysis report to understand the dynamics of France Bed HoldingsLtd.

- Upon reviewing our latest valuation report, France Bed HoldingsLtd's share price might be too pessimistic.

Seize The Opportunity

- Get an in-depth perspective on all 1970 Top Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7840

France Bed HoldingsLtd

Through its subsidiaries, engages in the medical services, and home furnishing and health businesses in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives