- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3010

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and near-record highs in stock indexes, investors are keenly observing the impact of these dynamics on their portfolios. In such an environment, dividend stocks can offer a compelling option for those seeking income stability amidst market volatility, as they typically provide regular payouts regardless of market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.95% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.41% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.69% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.15% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1995 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

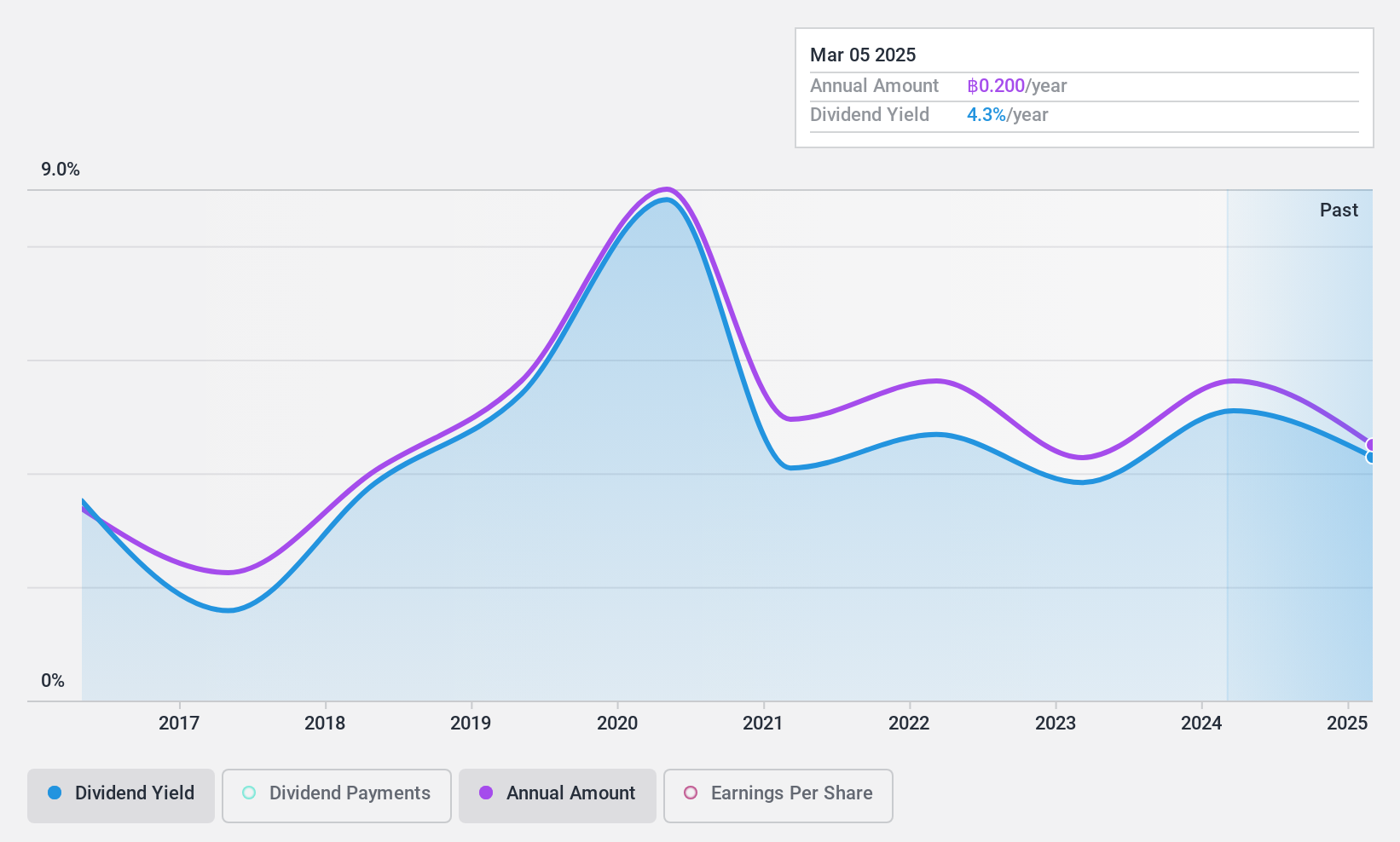

Lam Soon (Thailand) (SET:LST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lam Soon (Thailand) Public Company Limited manufactures and distributes palm oil in Thailand, with a market cap of THB4.05 billion.

Operations: Lam Soon (Thailand) Public Company Limited generates revenue primarily from Palm Oil, amounting to THB9.20 billion, and Processed Fruits and Vegetables, contributing THB2.90 billion.

Dividend Yield: 5.1%

Lam Soon (Thailand) trades at 33% below its estimated fair value, offering potential value for investors. However, its dividend payments have been unreliable and volatile over the past decade. The recent proposed dividend of THB 0.20 per share reflects a decrease and awaits shareholder approval. Despite this, dividends are covered by earnings with a payout ratio of 40% and cash flows at 51.5%. Its dividend yield is lower than Thailand's top-tier payers.

- Navigate through the intricacies of Lam Soon (Thailand) with our comprehensive dividend report here.

- Our valuation report unveils the possibility Lam Soon (Thailand)'s shares may be trading at a discount.

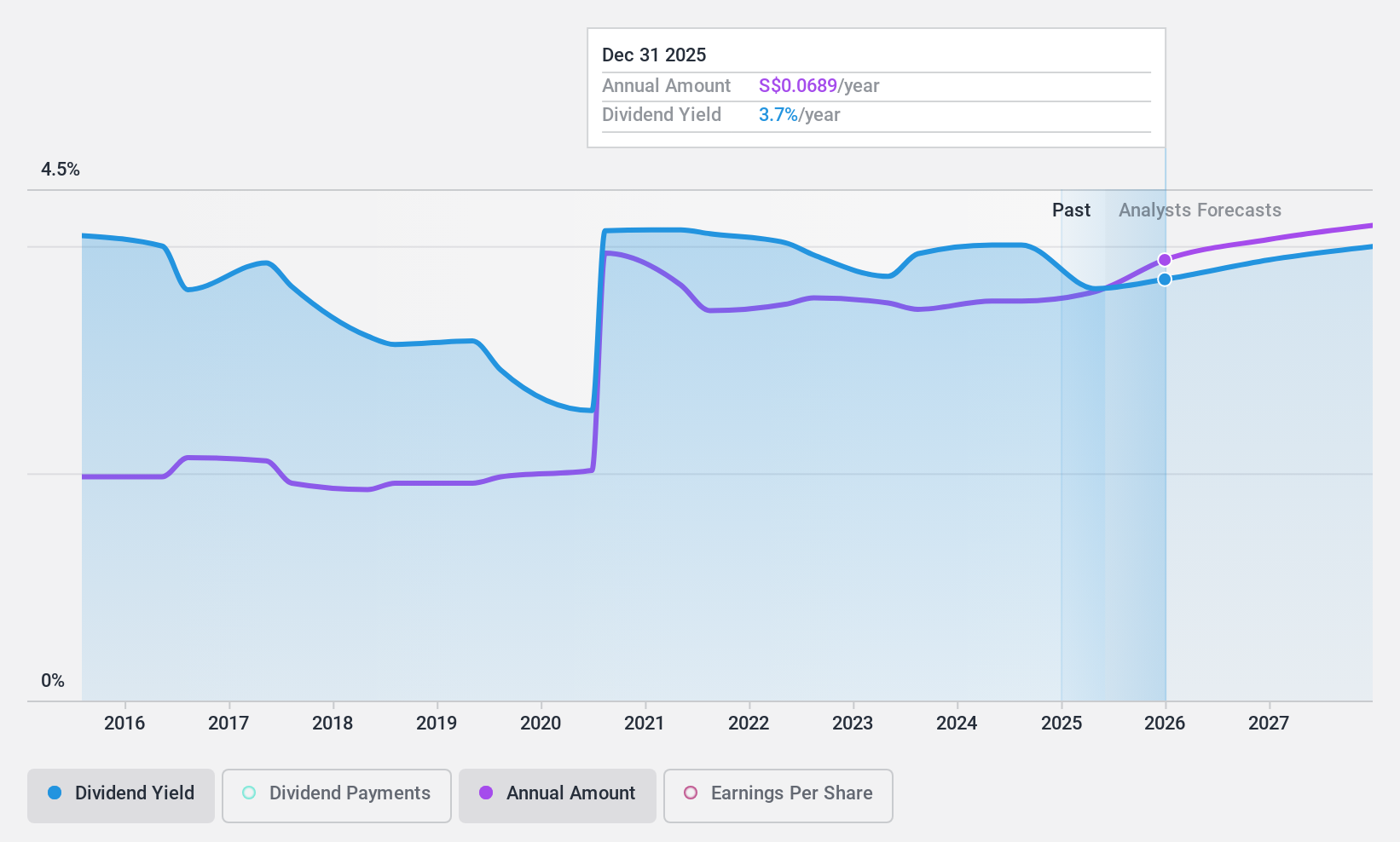

Sheng Siong Group (SGX:OV8)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore with a market cap of SGD2.48 billion.

Operations: Sheng Siong Group Ltd generates revenue from its supermarket operations selling consumer goods, amounting to SGD1.41 billion.

Dividend Yield: 3.8%

Sheng Siong Group's dividend reliability is mixed, with volatile payments over the past decade. Despite this, dividends are covered by earnings and cash flows, with payout ratios of 67.5% and 51.3%, respectively. The dividend yield of 3.79% is below Singapore's top payers, though the company trades at a significant discount to its estimated fair value. Earnings have grown annually by 7.4% over five years, supporting potential future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Sheng Siong Group.

- Our expertly prepared valuation report Sheng Siong Group implies its share price may be lower than expected.

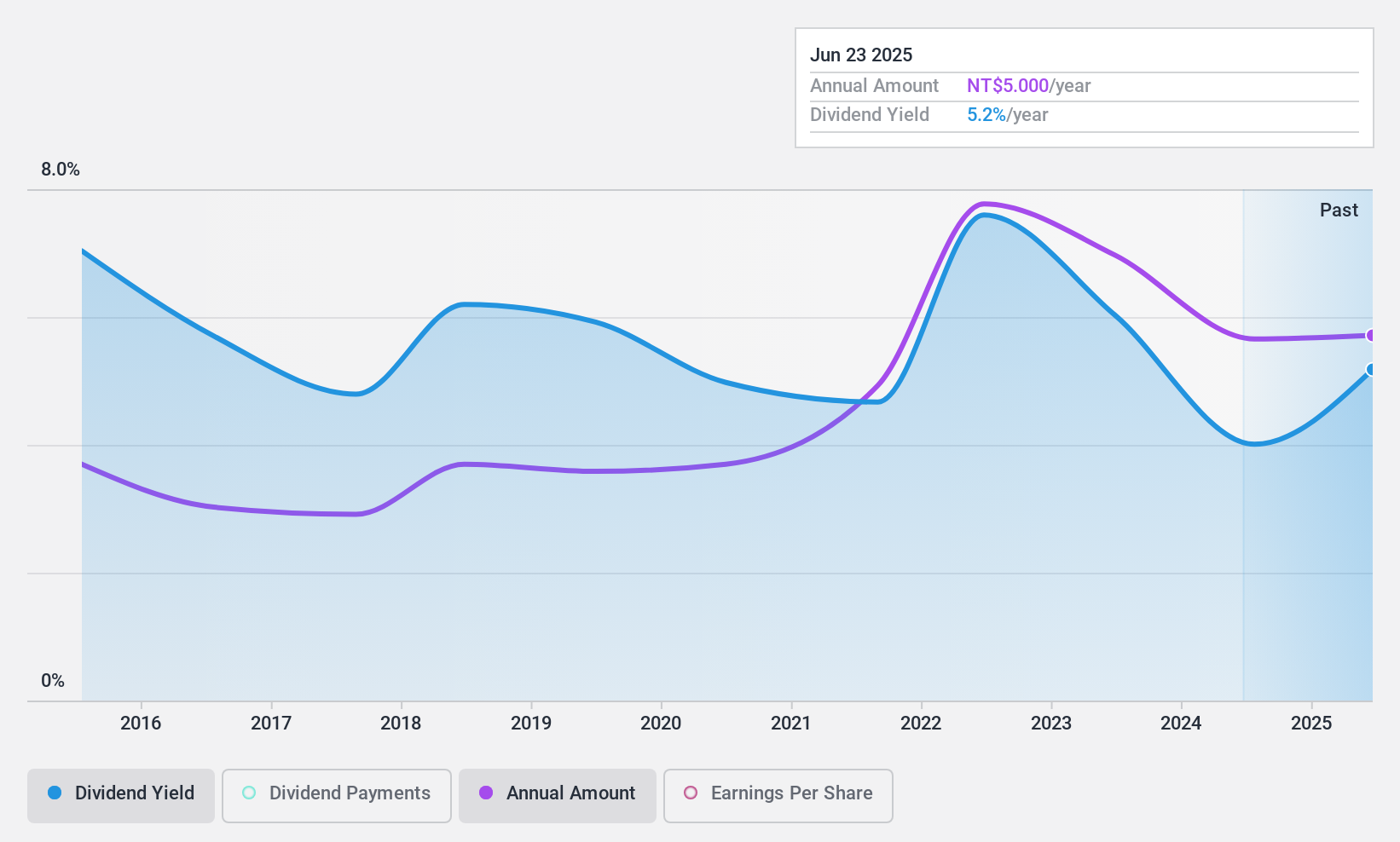

Wah Lee Industrial (TWSE:3010)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wah Lee Industrial Corporation operates in Taiwan, focusing on the manufacturing of materials, engineering and functional plastics, semiconductor process materials, and printed circuit boards with a market cap of NT$30.74 billion.

Operations: Wah Lee Industrial Corporation's revenue segments include NT$45.19 billion from the company, NT$13.60 billion from China Hong Kong, and NT$15.02 billion from Shanghai Yikang.

Dividend Yield: 4.2%

Wah Lee Industrial's dividend stability is notable, with consistent growth and reliability over the past decade. However, its 4.18% yield lags behind Taiwan's top payers and is not well supported by free cash flows due to a high cash payout ratio of 453.9%. The payout ratio of 57% indicates dividends are covered by earnings, but sustainability concerns persist given the disconnect with cash flow coverage. Its price-to-earnings ratio of 14.3x offers relative value against the market average.

- Click here to discover the nuances of Wah Lee Industrial with our detailed analytical dividend report.

- Our valuation report here indicates Wah Lee Industrial may be overvalued.

Key Takeaways

- Access the full spectrum of 1995 Top Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wah Lee Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3010

Wah Lee Industrial

Engages in the manufacturing of materials, engineering and functional plastics, semiconductor process materials, and printed circuit boards in Taiwan.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives