- Singapore

- /

- Food and Staples Retail

- /

- SGX:K03

We're Hopeful That Khong Guan (SGX:K03) Will Use Its Cash Wisely

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether Khong Guan (SGX:K03) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Khong Guan

How Long Is Khong Guan's Cash Runway?

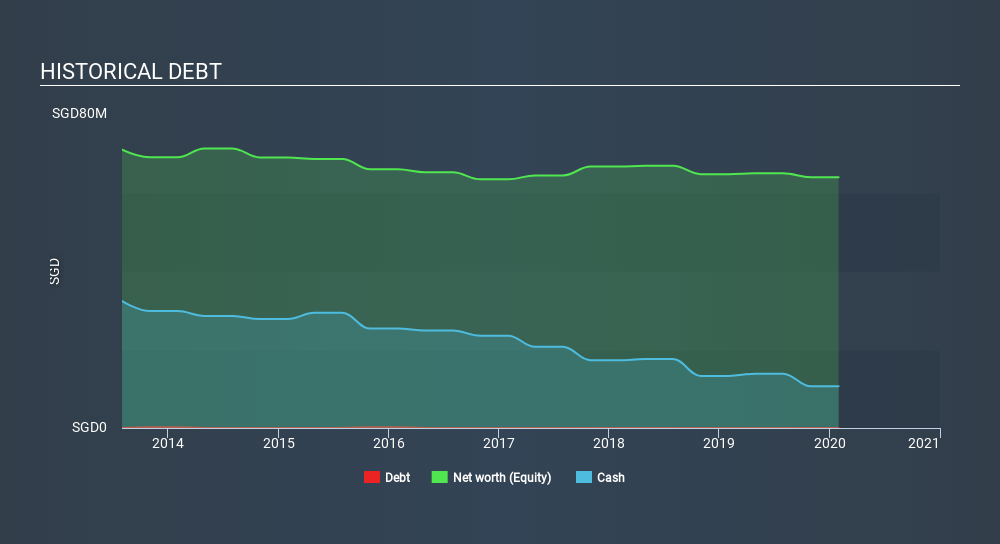

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In January 2020, Khong Guan had S$11m in cash, and was debt-free. Importantly, its cash burn was S$1.6m over the trailing twelve months. Therefore, from January 2020 it had 6.8 years of cash runway. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Khong Guan Growing?

Notably, Khong Guan actually ramped up its cash burn very hard and fast in the last year, by 121%, signifying heavy investment in the business. As if that's not bad enough, the operating revenue also dropped by 7.8%, making us very wary indeed. Considering both these metrics, we're a little concerned about how the company is developing. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Khong Guan is building its business over time.

How Hard Would It Be For Khong Guan To Raise More Cash For Growth?

Even though it seems like Khong Guan is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash to fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Khong Guan has a market capitalisation of S$43m and burnt through S$1.6m last year, which is 3.7% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is Khong Guan's Cash Burn Situation?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Khong Guan's cash runway was relatively promising. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, we conducted an in-depth investigation of the company, and identified 2 warning signs for Khong Guan (1 is a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:K03

Khong Guan

An investment holding company, engages in trading of wheat flour and other edible products in Singapore and Malaysia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives