- Singapore

- /

- Hospitality

- /

- SGX:BQD

The 12% return this week takes Envictus International Holdings' (SGX:BQD) shareholders three-year gains to 118%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Envictus International Holdings Limited (SGX:BQD) share price has soared 118% in the last three years. How nice for those who held the stock! It's also good to see the share price up 63% over the last quarter.

The past week has proven to be lucrative for Envictus International Holdings investors, so let's see if fundamentals drove the company's three-year performance.

See our latest analysis for Envictus International Holdings

SWOT Analysis for Envictus International Holdings

- No major strengths identified for BQD.

- Interest payments on debt are not well covered.

- Shareholders have been diluted in the past year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Significant insider buying over the past 3 months.

- Lack of analyst coverage makes it difficult to determine BQD's earnings prospects.

- Debt is not well covered by operating cash flow.

Because Envictus International Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Envictus International Holdings saw its revenue grow at 4.1% per year. Considering the company is losing money, we think that rate of revenue growth is uninspiring. In comparison, the share price rise of 30% per year over the last three years is pretty impressive. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. It may be that the market is pretty optimistic about Envictus International Holdings if you look to the bottom line.

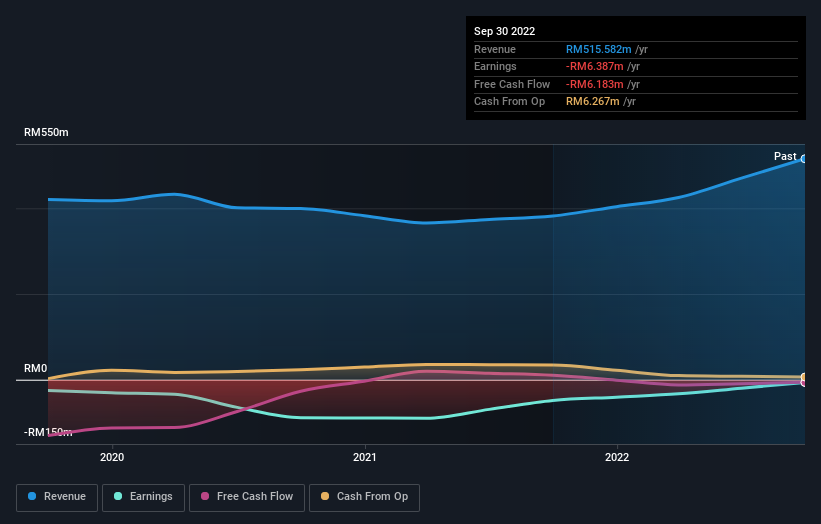

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that Envictus International Holdings shareholders have received a total shareholder return of 70% over the last year. That certainly beats the loss of about 3% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Envictus International Holdings better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Envictus International Holdings you should be aware of, and 1 of them doesn't sit too well with us.

Envictus International Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

If you're looking to trade Envictus International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Envictus International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BQD

Envictus International Holdings

An investment holding company, engages in the sale of food and beverage products in Malaysia, Africa, ASEAN countries, and the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives