Fuxing China Group Limited (SGX:AWK) Surges 36% Yet Its Low P/E Is No Reason For Excitement

Fuxing China Group Limited (SGX:AWK) shareholders are no doubt pleased to see that the share price has bounced 36% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

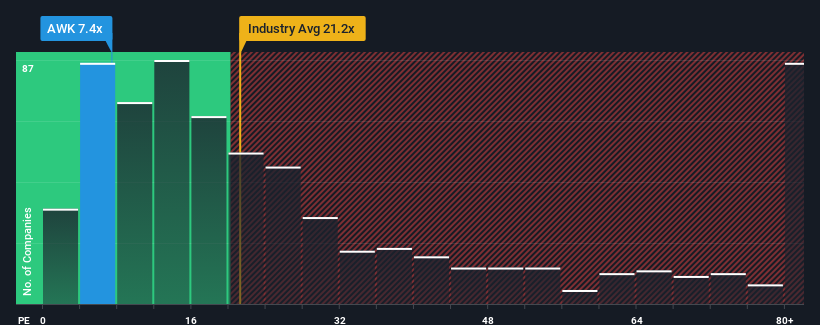

Although its price has surged higher, Fuxing China Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.4x, since almost half of all companies in Singapore have P/E ratios greater than 12x and even P/E's higher than 21x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Fuxing China Group's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Fuxing China Group

Is There Any Growth For Fuxing China Group?

There's an inherent assumption that a company should underperform the market for P/E ratios like Fuxing China Group's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 12%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the market, which is predicted to deliver 7.7% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Fuxing China Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Despite Fuxing China Group's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Fuxing China Group revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Fuxing China Group (2 are a bit unpleasant) you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:AWK

Fuxing China Group

An investment holding company, engages in production and sale of zipper products in the People’s Republic of China and Hong Kong.

Excellent balance sheet slight.

Market Insights

Community Narratives