- Singapore

- /

- Professional Services

- /

- SGX:5MZ

Here's Why Kingsmen Creatives (SGX:5MZ) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Kingsmen Creatives (SGX:5MZ). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kingsmen Creatives with the means to add long-term value to shareholders.

See our latest analysis for Kingsmen Creatives

Kingsmen Creatives' Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Kingsmen Creatives to have grown EPS from S$0.0058 to S$0.034 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. This could point to the business hitting a point of inflection.

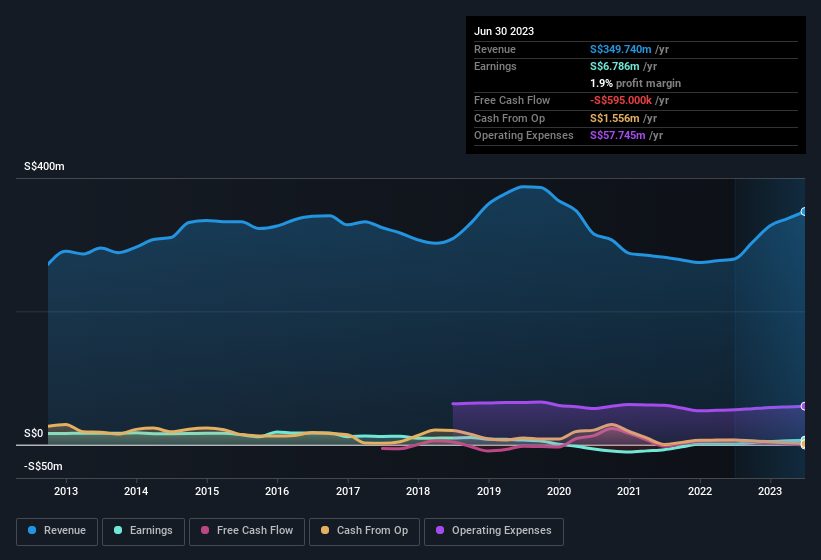

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Kingsmen Creatives achieved similar EBIT margins to last year, revenue grew by a solid 26% to S$350m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Kingsmen Creatives is no giant, with a market capitalisation of S$58m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Kingsmen Creatives Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Kingsmen Creatives shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Co-Founder & Deputy Executive Chairman Chin Sim Ong bought S$47k worth of shares at an average price of around S$0.23. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Kingsmen Creatives.

Does Kingsmen Creatives Deserve A Spot On Your Watchlist?

Kingsmen Creatives' earnings have taken off in quite an impressive fashion. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this is the case, then keeping a watch over Kingsmen Creatives could be in your best interest. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Kingsmen Creatives (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Kingsmen Creatives isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kingsmen Creatives might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:5MZ

Kingsmen Creatives

An investment holding company, engages in the provision of corporate marketing and related services in South Asia, North Asia, the Middle East, the United States, Canada, Europe, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives