- Singapore

- /

- Construction

- /

- SGX:MR7

3 Top Dividend Stocks On SGX To Consider

Reviewed by Simply Wall St

The Singapore stock market has been navigating a period of volatility, with investors keenly observing economic indicators and corporate earnings reports. In such an environment, dividend stocks often attract attention for their potential to provide steady income streams. When considering dividend stocks on the SGX, it's essential to look at companies with strong financial health and a consistent track record of paying dividends.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.96% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.66% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.29% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.36% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.70% | ★★★★★☆ |

| Delfi (SGX:P34) | 7.13% | ★★★★☆☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.34% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 6.11% | ★★★★☆☆ |

| Nordic Group (SGX:MR7) | 4.61% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Hour Glass (SGX:AGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited (SGX:AGS) is an investment holding company that retails and distributes watches, jewelry, and other luxury products across Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of SGD991.57 million.

Operations: The company's primary revenue segment is the retailing and distribution of watches, jewelry, and other luxury products, generating SGD1.13 billion.

Dividend Yield: 5.2%

Hour Glass has a mixed dividend history, with payments being volatile over the past decade. However, its dividends are well-covered by earnings (payout ratio: 33.5%) and cash flows (cash payout ratio: 46.2%). The recent approval of a final dividend of S$0.06 per share for FY2024 underscores its commitment to returning value to shareholders despite an unstable track record. Additionally, recent board changes and a share repurchase program may impact future dividend stability and growth potential.

- Get an in-depth perspective on Hour Glass' performance by reading our dividend report here.

- Our valuation report unveils the possibility Hour Glass' shares may be trading at a discount.

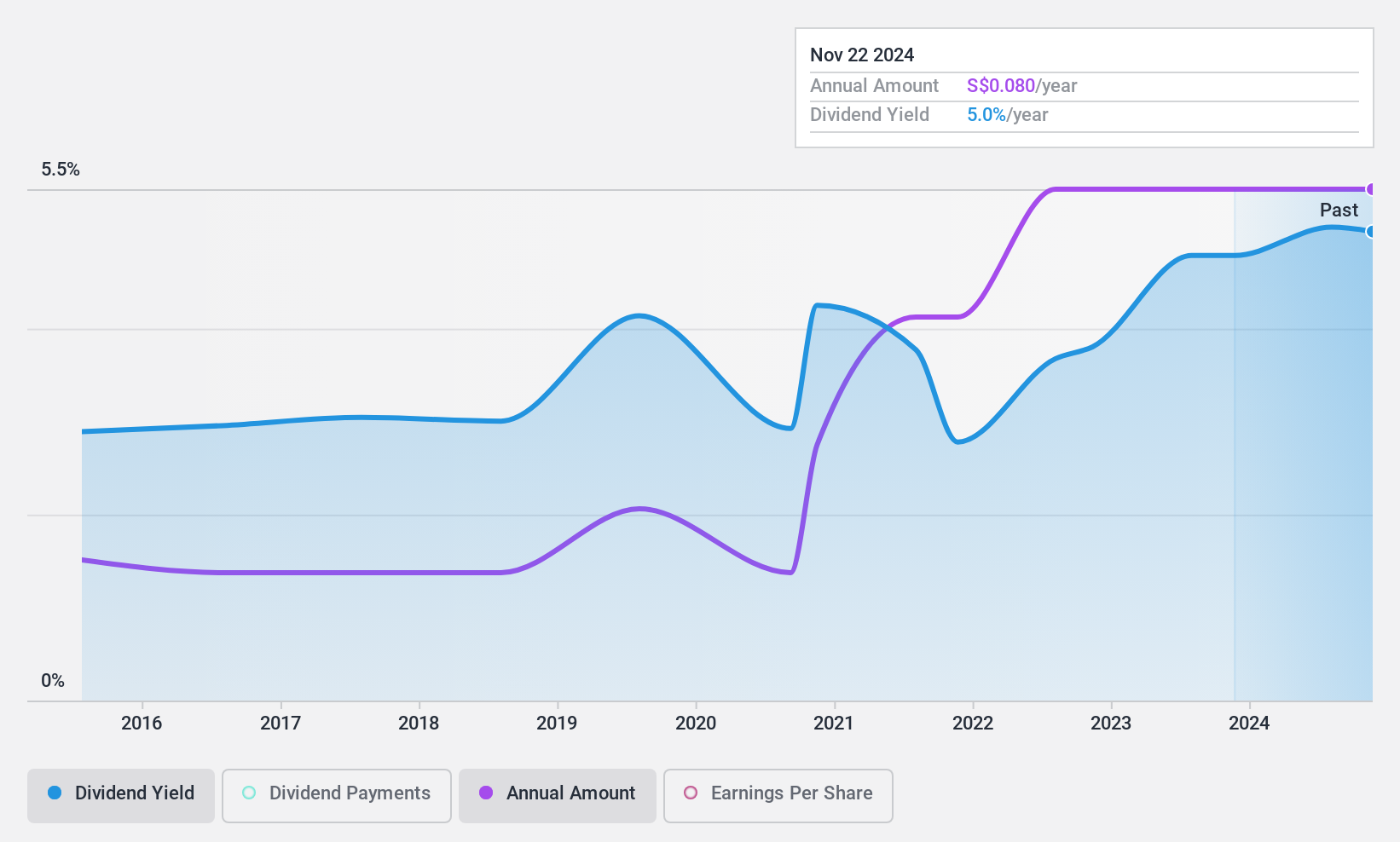

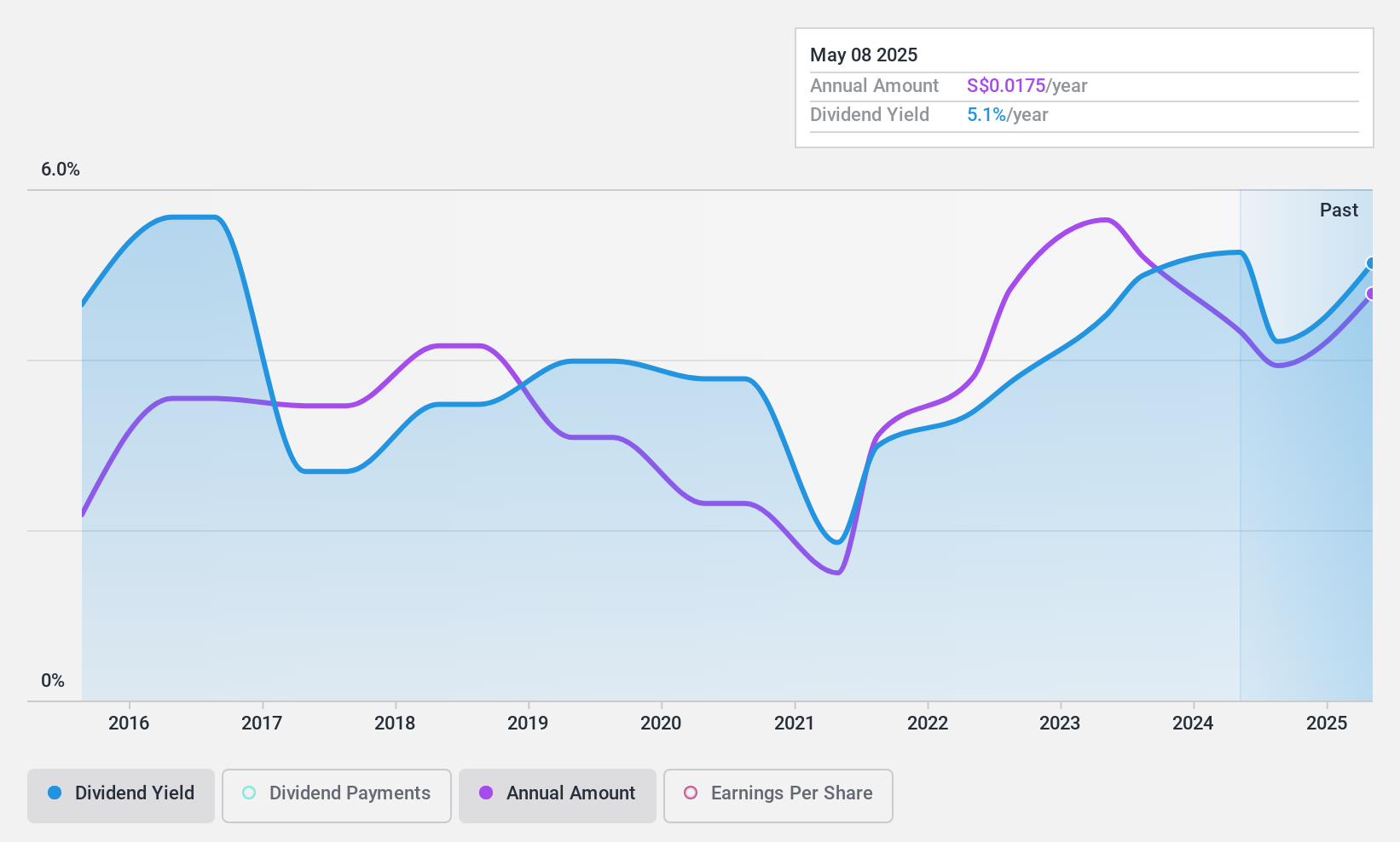

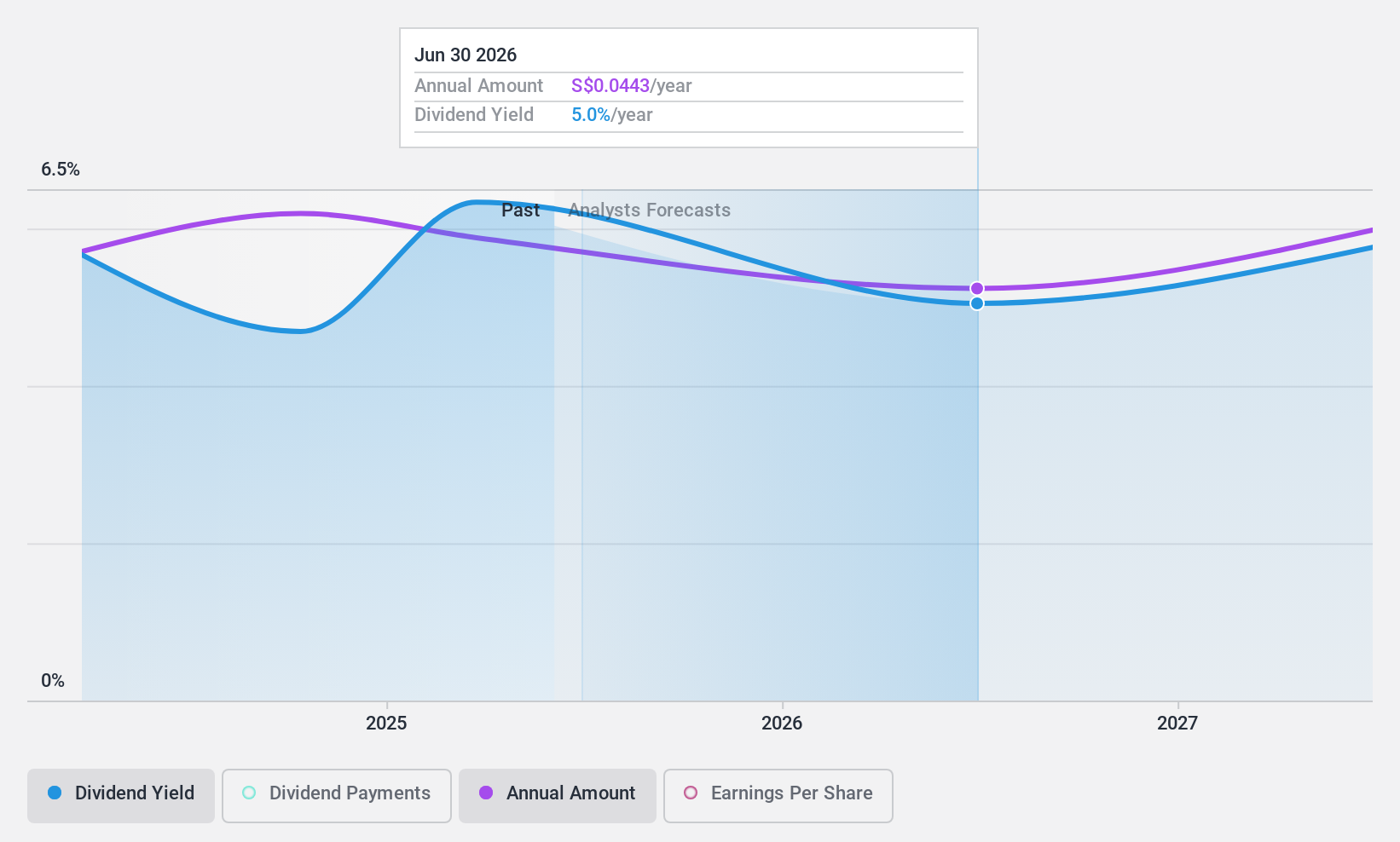

Nordic Group (SGX:MR7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Group Limited (SGX:MR7) is an investment holding company providing global solutions in system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering, cleanroom technology, air and water engineering with a market cap of SGD137.69 million.

Operations: Nordic Group Limited generates revenue primarily from Project Services (SGD69.93 million) and Maintenance Services (SGD83.13 million).

Dividend Yield: 4.6%

Nordic Group's dividend payments have been volatile over the past decade, with a recent decrease to S$0.008526 per share for August 2024. Despite this, dividends are well-covered by earnings (payout ratio: 40%) and cash flows (cash payout ratio: 32.7%). The company trades at a significant discount to its estimated fair value. Recent earnings showed a decline in sales and net income compared to the previous year, potentially impacting future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Nordic Group.

- Our valuation report here indicates Nordic Group may be undervalued.

Civmec (SGX:P9D)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited (SGX:P9D) is an investment holding company that offers construction and engineering services across the energy, resources, infrastructure, marine, and defense sectors in Australia with a market cap of SGD466.98 million.

Operations: Civmec Limited's revenue segments, in millions of A$, are as follows: Energy: 46.02, Resources: 752.82, and Infrastructure, Marine & Defence: 105.52.

Dividend Yield: 5.3%

Civmec, now Civmec Singapore Limited, offers a stable dividend yield of 5.29%, supported by a low payout ratio of 45.4% and cash payout ratio of 27%. Over the past decade, dividends have grown reliably with minimal volatility. The company trades at a significant discount to its estimated fair value. Recent strategic moves include a joint venture with Austal Limited and new contracts worth A$174 million, which could bolster future earnings and dividend sustainability.

- Click here to discover the nuances of Civmec with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Civmec's share price might be too pessimistic.

Next Steps

- Delve into our full catalog of 20 Top SGX Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nordic Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nordic Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:MR7

Nordic Group

An investment holding company, offers solutions in the areas of system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering, cleanroom, air, and water engineering worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives