- Singapore

- /

- Electrical

- /

- SGX:I07

Is ISDN Holdings Limited's (SGX:I07) Latest Stock Performance A Reflection Of Its Financial Health?

ISDN Holdings' (SGX:I07) stock is up by a considerable 9.2% over the past month. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. Specifically, we decided to study ISDN Holdings' ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for ISDN Holdings

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for ISDN Holdings is:

10% = S$22m ÷ S$213m (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. That means that for every SGD1 worth of shareholders' equity, the company generated SGD0.10 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

ISDN Holdings' Earnings Growth And 10% ROE

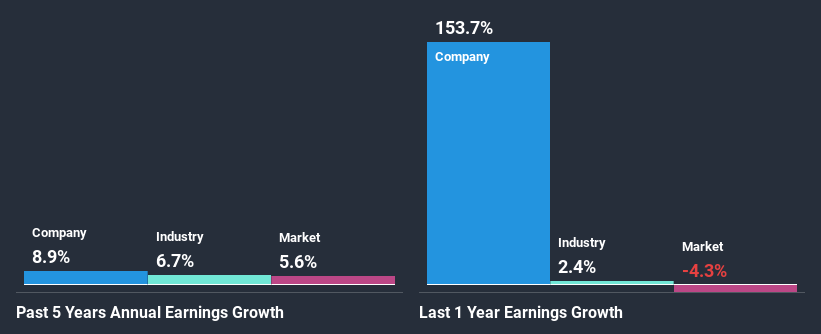

To start with, ISDN Holdings' ROE looks acceptable. Especially when compared to the industry average of 7.7% the company's ROE looks pretty impressive. Probably as a result of this, ISDN Holdings was able to see a decent growth of 8.9% over the last five years.

We then compared ISDN Holdings' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 1.2% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about ISDN Holdings''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is ISDN Holdings Efficiently Re-investing Its Profits?

ISDN Holdings has a low three-year median payout ratio of 23%, meaning that the company retains the remaining 77% of its profits. This suggests that the management is reinvesting most of the profits to grow the business.

Additionally, ISDN Holdings has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 25%. As a result, ISDN Holdings' ROE is not expected to change by much either, which we inferred from the analyst estimate of 12% for future ROE.

Conclusion

Overall, we are quite pleased with ISDN Holdings' performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you’re looking to trade ISDN Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:I07

ISDN Holdings

Provides motion control, industrial computing, and other specialized engineering solutions in Singapore, China, Hong Kong, Malaysia, Indonesia, Vietnam, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives