Return Trends At Hong Leong Asia (SGX:H22) Aren't Appealing

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after briefly looking over the numbers, we don't think Hong Leong Asia (SGX:H22) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Hong Leong Asia is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.055 = S$163m ÷ (S$5.9b - S$2.9b) (Based on the trailing twelve months to December 2020).

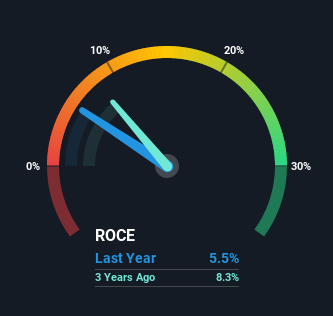

Thus, Hong Leong Asia has an ROCE of 5.5%. Even though it's in line with the industry average of 6.2%, it's still a low return by itself.

See our latest analysis for Hong Leong Asia

In the above chart we have measured Hong Leong Asia's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Hong Leong Asia here for free.

What The Trend Of ROCE Can Tell Us

In terms of Hong Leong Asia's historical ROCE trend, it doesn't exactly demand attention. Over the past five years, ROCE has remained relatively flat at around 5.5% and the business has deployed 20% more capital into its operations. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

On a separate but related note, it's important to know that Hong Leong Asia has a current liabilities to total assets ratio of 50%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

The Bottom Line On Hong Leong Asia's ROCE

Long story short, while Hong Leong Asia has been reinvesting its capital, the returns that it's generating haven't increased. And with the stock having returned a mere 39% in the last five years to shareholders, you could argue that they're aware of these lackluster trends. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

Hong Leong Asia does have some risks though, and we've spotted 1 warning sign for Hong Leong Asia that you might be interested in.

While Hong Leong Asia may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade Hong Leong Asia, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hong Leong Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:H22

Hong Leong Asia

An investment holding company, manufactures and distributes powertrain solutions and related products, building materials, and rigid packaging products in the People’s Republic of China, Singapore, Malaysia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success