As global markets navigate a complex landscape marked by government shutdowns and shifting economic indicators, the Russell 2000 Index of small-cap stocks has shown resilience, outperforming broader indices amid expectations of lower interest rates. In this environment, identifying promising small-cap stocks in Asia requires careful consideration of factors such as growth potential and adaptability to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MSC | 29.29% | 6.15% | 15.10% | ★★★★★★ |

| Korea Ratings | NA | 0.99% | 3.62% | ★★★★★★ |

| Namuga | 14.63% | -4.73% | 24.37% | ★★★★★★ |

| Myung In Pharmaceutical | NA | 9.70% | 9.38% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 34.33% | 7.40% | 2.05% | ★★★★★☆ |

| Messe eSangLtd | 0.21% | 35.18% | 96.55% | ★★★★★☆ |

| MNtech | 66.79% | 12.39% | -12.13% | ★★★★★☆ |

| BIOBIJOULtd | 0.07% | 45.63% | 49.17% | ★★★★★☆ |

| Kyungbangco.Ltd | 26.56% | 3.71% | -24.98% | ★★★★☆☆ |

| TSTE | 38.15% | 4.63% | -6.91% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Wealthink AI-Innovation Capital (SEHK:1140)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wealthink AI-Innovation Capital (SEHK:1140) functions as an investment holding company based in Hong Kong with a market capitalization of approximately HK$2.47 billion.

Operations: The company generates revenue primarily from its investment holding activities, reporting HK$275.63 million in this segment.

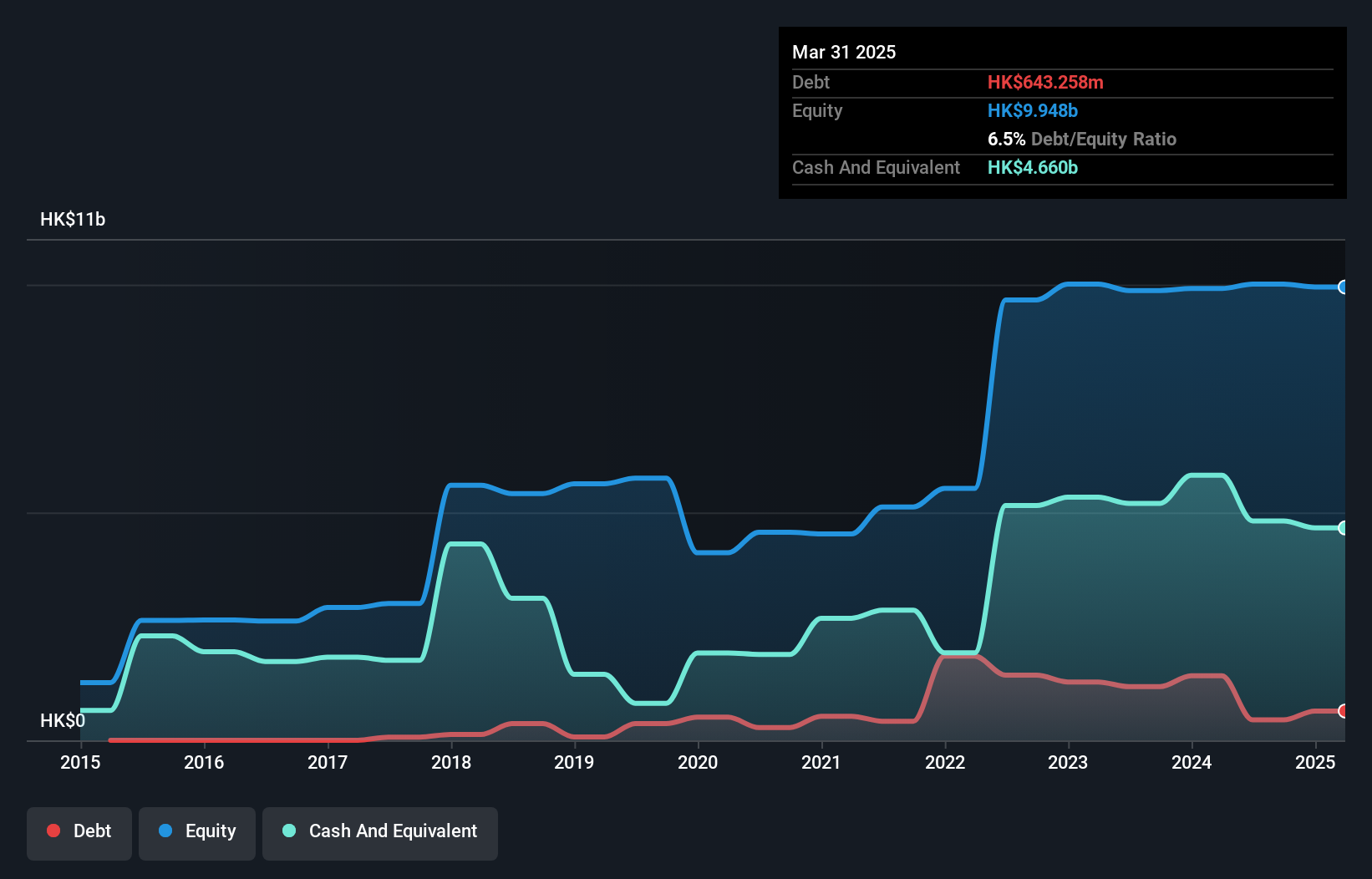

Wealthink AI-Innovation Capital, a relatively small player in the industry, recently experienced a significant one-off loss of HK$169.6M affecting its annual results up to March 2025. Despite this setback, the company has more cash than total debt and maintains strong interest coverage with EBIT covering interest payments 5.1 times over. Over the past year, earnings grew by 19.6%, outpacing the Capital Markets industry's growth of 18.1%. The debt-to-equity ratio improved from 12.3% to 6.5% over five years, although free cash flow remains negative amidst volatile share price movements recently observed.

- Get an in-depth perspective on Wealthink AI-Innovation Capital's performance by reading our health report here.

Understand Wealthink AI-Innovation Capital's track record by examining our Past report.

Boustead Singapore (SGX:F9D)

Simply Wall St Value Rating: ★★★★★★

Overview: Boustead Singapore Limited is an investment holding company that offers energy engineering, real estate, geospatial, and healthcare technology solutions across various regions globally, with a market capitalization of approximately SGD969.07 million.

Operations: Boustead Singapore generates revenue primarily from its Geospatial (SGD221.35 million) and Energy Engineering (SGD158.89 million) segments, supplemented by Real Estate Solutions (SGD134.35 million) and Healthcare (SGD12.14 million). The company’s net profit margin is a key financial metric to consider when evaluating its profitability across these diverse revenue streams.

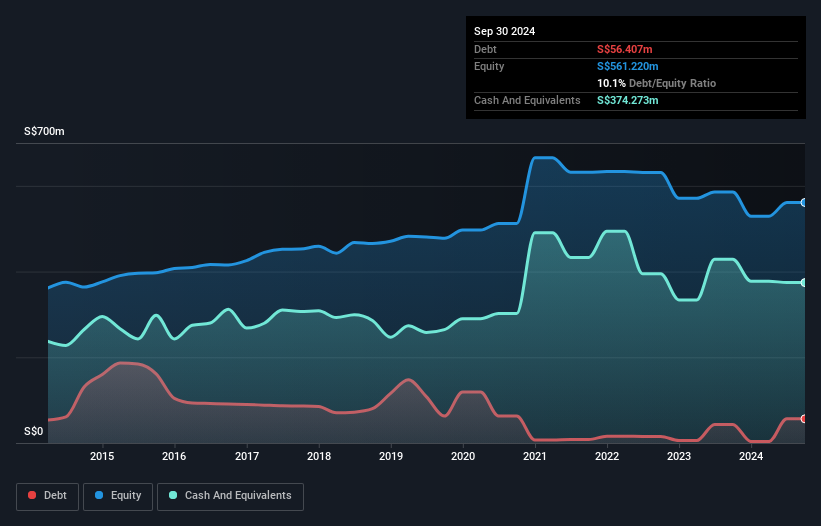

Boustead Singapore, a nimble player in the construction sector, has been making waves with its impressive 48.1% earnings growth over the past year, outpacing the industry's 13.7%. The company’s debt-to-equity ratio has significantly improved from 24% to just 1.3% over five years, showcasing sound financial management. Despite a one-off gain of S$31 million affecting recent results, Boustead remains financially robust with more cash than total debt and positive free cash flow of S$69 million as of March 2025. Recent inclusion in the S&P Global BMI Index further highlights its growing market prominence and potential appeal to investors seeking value opportunities in Asia.

Tsuburaya Fields Holdings (TSE:2767)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsuburaya Fields Holdings Inc. operates in the content-related businesses in Japan and has a market capitalization of ¥148.15 billion.

Operations: The company generates revenue primarily from its Amusement Equipment Business, which accounts for ¥152.51 billion, and the Content & Digital Business, contributing ¥16.35 billion. The Amusement Equipment segment is the largest revenue stream by a significant margin compared to other segments.

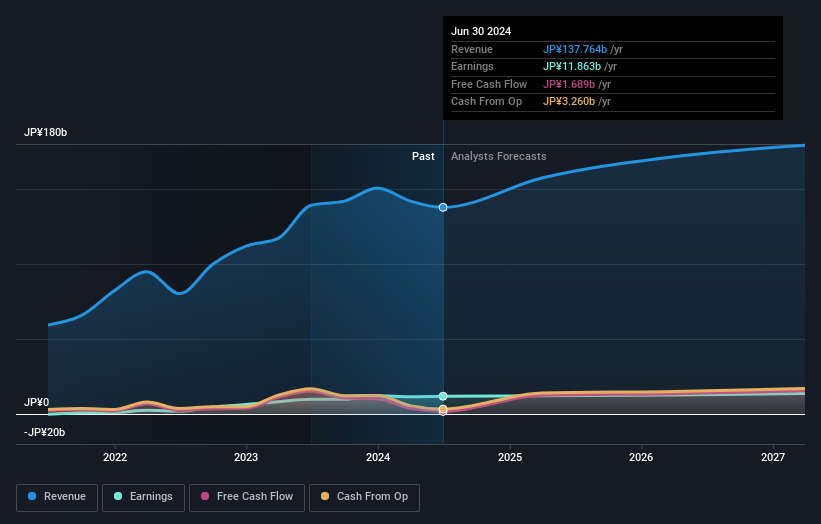

Tsuburaya Fields Holdings, a relatively small player in the Asian market, has shown impressive financial resilience. The company’s earnings surged by 26.8% over the past year, outpacing the broader leisure industry which saw a decline of 14.6%. Trading at a significant discount of 64.5% below its estimated fair value, it offers an attractive proposition for investors seeking undervalued opportunities. Notably, Tsuburaya's debt to equity ratio improved from 38.4% to 18.3% over five years, indicating prudent financial management and reduced leverage risk. Looking ahead, projected net sales are JPY 150 billion with operating profits expected at JPY 16 billion for fiscal year ending March 2025.

Key Takeaways

- Gain an insight into the universe of 2373 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsuburaya Fields Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2767

Tsuburaya Fields Holdings

Engages in the content-related businesses in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives