- Singapore

- /

- Capital Markets

- /

- SGX:U10

Top 3 Asian Penny Stocks With Market Caps Over US$1B To Watch

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by mixed performances and economic uncertainties, investors are increasingly looking for opportunities in less conventional areas. Penny stocks, despite their vintage moniker, continue to offer intriguing prospects for those interested in smaller or newer companies. When these stocks are supported by strong financial health and sound fundamentals, they can present unique growth opportunities that defy traditional expectations.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.80 | THB3.75B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.99 | HK$2.43B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.71 | HK$2.25B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.33 | SGD539.03M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.78 | THB2.87B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.38 | SGD13.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.16 | HK$3.35B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.80 | THB9.7B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 957 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Viva Goods (SEHK:933)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Viva Goods Company Limited is an investment holding company that supplies apparel and footwear across various regions including the UK, Ireland, the US, China, Asia, Europe, the Middle East, and Africa with a market cap of HK$6.07 billion.

Operations: The company's revenue is primarily derived from its Multi-Brand Apparel and Footwear segment, generating HK$9.58 billion, followed by the Sports Experience segment with HK$558.53 million.

Market Cap: HK$6.07B

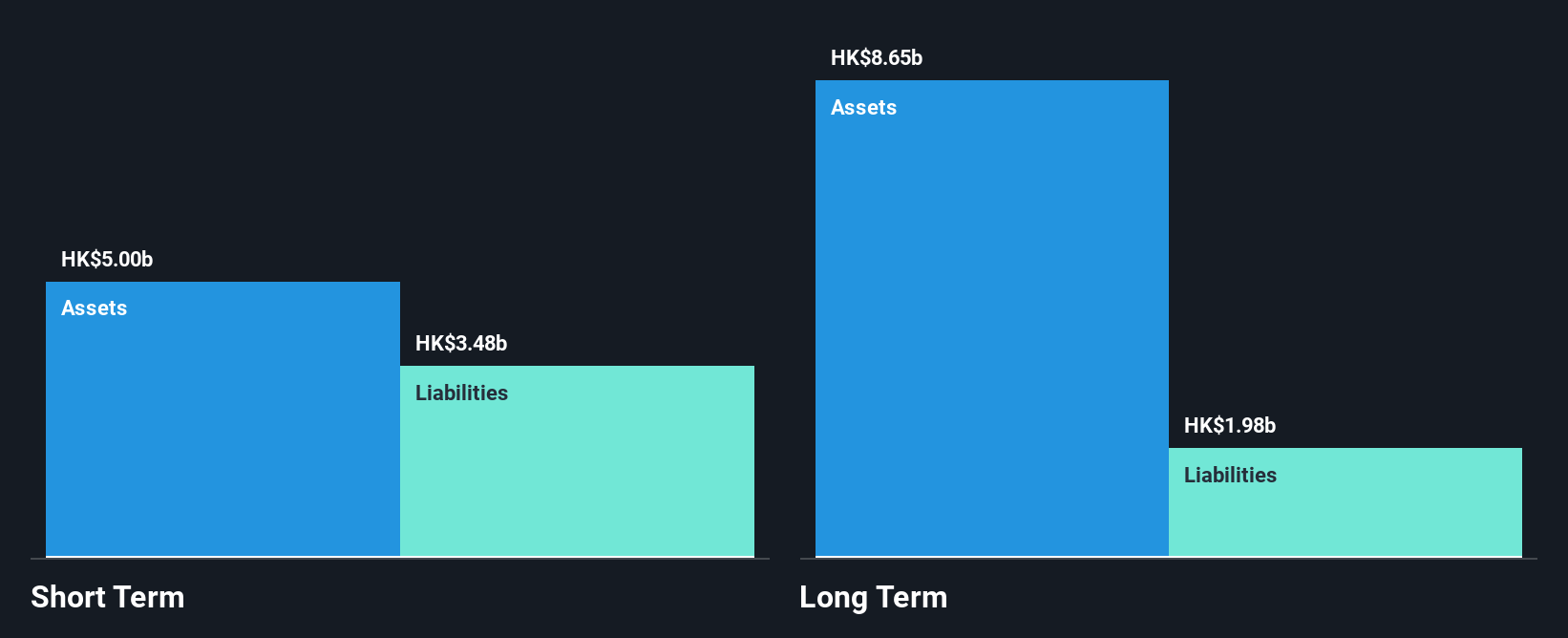

Viva Goods Company Limited, with a market cap of HK$6.07 billion, primarily generates revenue from its Multi-Brand Apparel and Footwear segment. Despite being unprofitable with increasing losses over the past five years, recent earnings showed net income growth to HK$181.5 million for the half-year ended June 2025 due to enhanced cost control measures. The company's short-term assets exceed both its short and long-term liabilities, indicating good liquidity management. However, it was recently dropped from the S&P Global BMI Index and has completed a modest share buyback program worth HK$3.71 million in mid-2025.

- Take a closer look at Viva Goods' potential here in our financial health report.

- Evaluate Viva Goods' historical performance by accessing our past performance report.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and several international markets, with a market cap of SGD13.30 billion.

Operations: The company generates revenue primarily from its Shipbuilding segment, which accounts for CN¥25.07 billion, followed by the Shipping segment contributing CN¥1.15 billion.

Market Cap: SGD13.3B

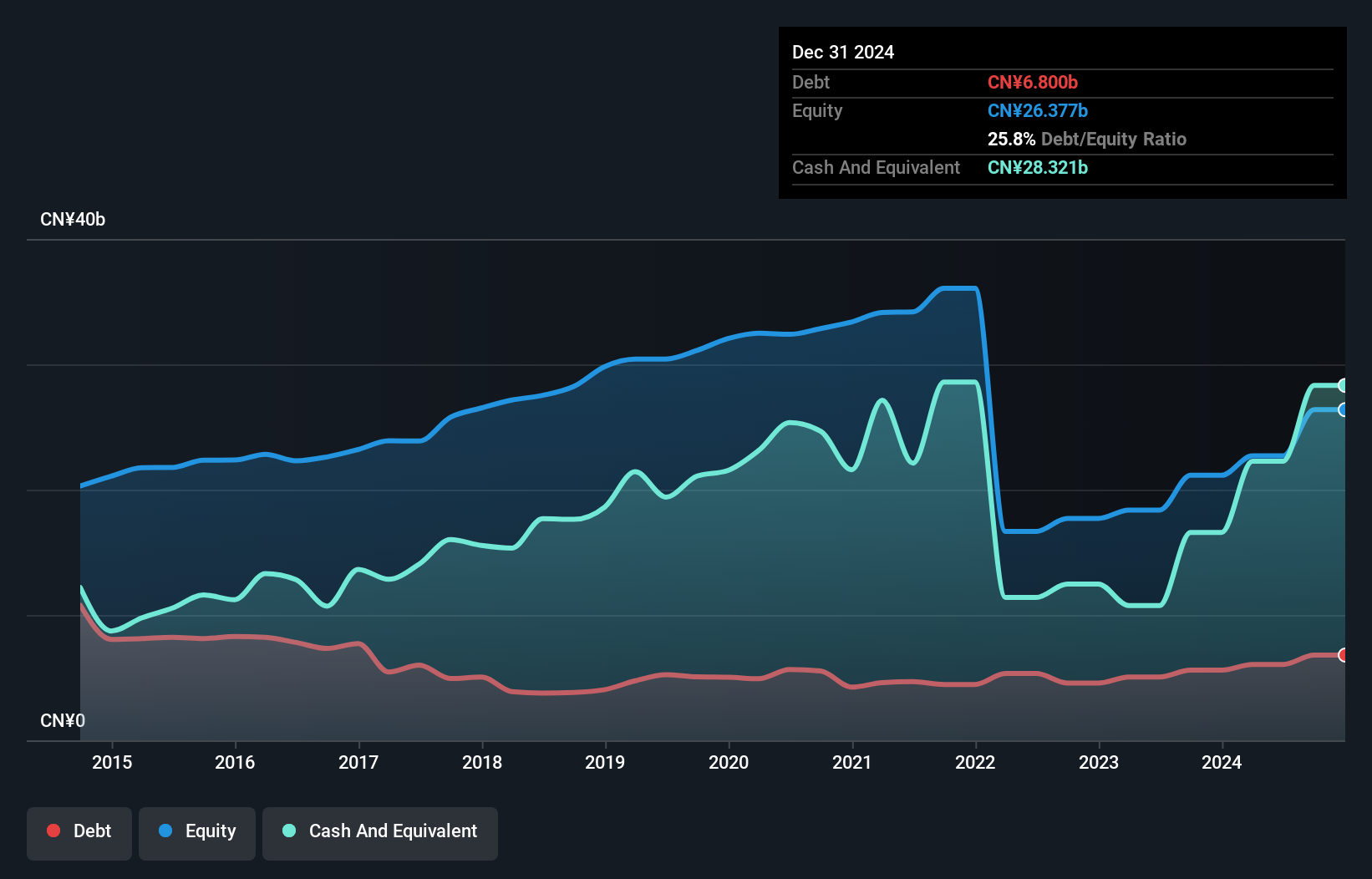

Yangzijiang Shipbuilding (Holdings) Ltd. has demonstrated solid financial health with short-term assets of CN¥40.2 billion exceeding both its short and long-term liabilities, indicating robust liquidity. The company has secured shipbuilding contracts valued at US$1.90 billion year-to-date, enhancing its order book without impacting 2025 earnings significantly due to delivery timelines extending to 2029. Despite a rise in debt to equity from 17.4% to 21.7% over five years, the firm maintains more cash than total debt and covers interest payments comfortably with operating cash flow covering debt well at 111.3%. Earnings growth of 42.7% last year underscores strong performance against industry benchmarks, supported by a high return on equity of 27.8%.

- Click here and access our complete financial health analysis report to understand the dynamics of Yangzijiang Shipbuilding (Holdings).

- Learn about Yangzijiang Shipbuilding (Holdings)'s future growth trajectory here.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company that offers services such as stockbroking, futures broking, structured lending, investment trading, margin financing, and research services, with a market cap of SGD2.37 billion.

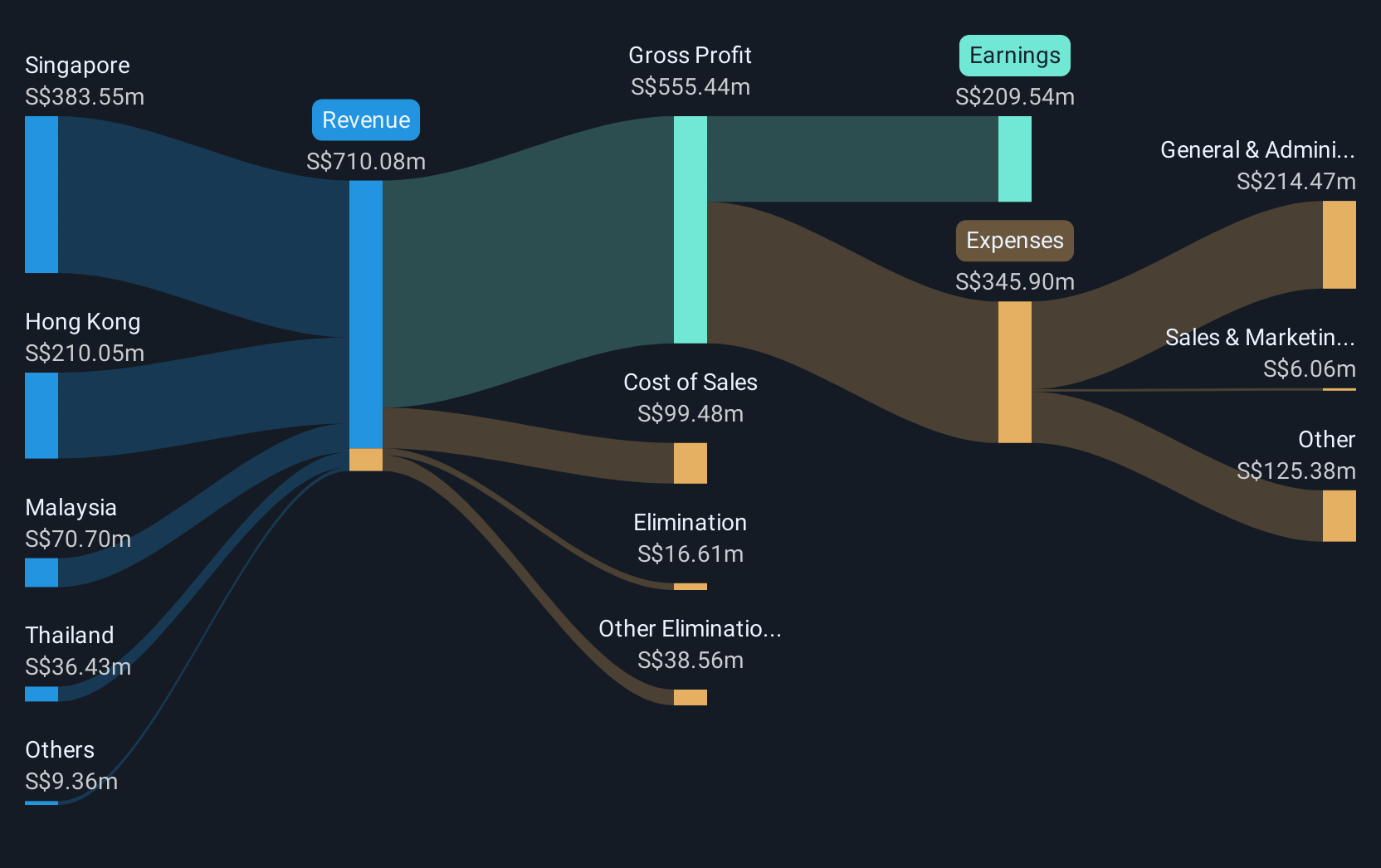

Operations: The company generates revenue of SGD654.91 million from its securities and futures broking and other related services segment.

Market Cap: SGD2.37B

UOB-Kay Hian Holdings Limited, with a market cap of S$2.37 billion, has shown financial stability despite recent challenges. The company reported a net income of S$99.23 million for the half year ending June 2025, down from S$113.91 million the previous year, while maintaining high-quality earnings and a stable weekly volatility of 5%. Its debt to equity ratio has improved over five years from 95.8% to 74.2%, and it holds more cash than total debt, although operating cash flow does not adequately cover its debt obligations. Recent board changes reflect ongoing corporate governance improvements amidst planned renewal processes.

- Navigate through the intricacies of UOB-Kay Hian Holdings with our comprehensive balance sheet health report here.

- Explore historical data to track UOB-Kay Hian Holdings' performance over time in our past results report.

Summing It All Up

- Access the full spectrum of 957 Asian Penny Stocks by clicking on this link.

- Ready For A Different Approach? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U10

UOB-Kay Hian Holdings

An investment holding company, provides stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives