Sino Biopharmaceutical And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate a landscape of evolving economic indicators and central bank policies, the recent rate cuts by the European Central Bank and the Bank of England have fueled expectations for further easing measures. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing area for investors seeking growth opportunities at lower price points. Despite being considered a somewhat outdated term, penny stocks can still highlight companies with robust financials and potential for significant returns, making them worthy of attention.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.595 | MYR2.96B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.805 | MYR139.44M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$495.14M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.055 | £796.84M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.92 | MYR305.39M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.23 | CN¥2.08B | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.57 | MYR2.59B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.245 | £433.13M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,790 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Sino Biopharmaceutical (SEHK:1177)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sino Biopharmaceutical Limited is an investment holding company that operates as a research and development pharmaceutical conglomerate in the People’s Republic of China, with a market cap of HK$68.82 billion.

Operations: The company generates revenue primarily from its Modernised Chinese Medicines and Chemical Medicines segment, amounting to CN¥27.45 billion.

Market Cap: HK$68.82B

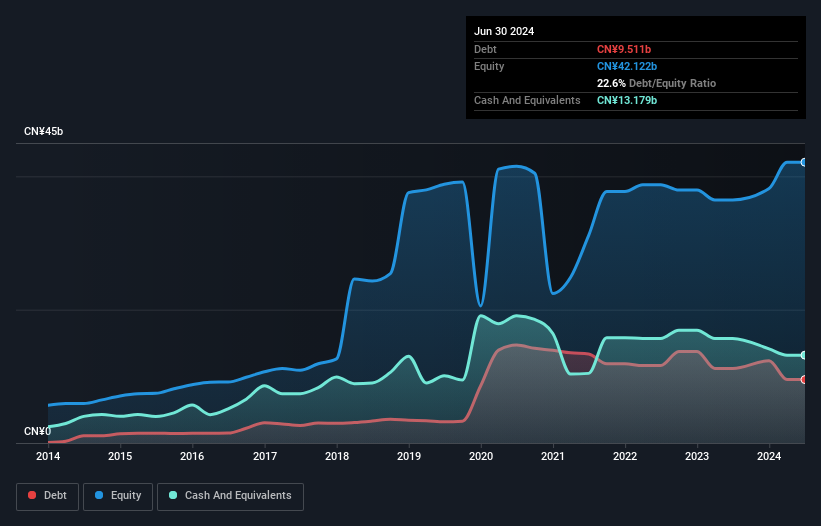

Sino Biopharmaceutical Limited, with a market cap of HK$68.82 billion, has demonstrated robust financial performance and strategic advancements in its pharmaceutical pipeline. The company's revenue primarily stems from Modernised Chinese Medicines and Chemical Medicines, totaling CN¥27.45 billion. Recent clinical trials have shown promising results for innovative drugs like Culmerciclib and Anlotinib Hydrochloride Capsules, which could enhance treatment options for various cancers. Financially stable with more cash than debt and no significant shareholder dilution recently, Sino Biopharmaceutical's earnings growth outpaced the industry average over the past year despite a low return on equity of 12%.

- Click to explore a detailed breakdown of our findings in Sino Biopharmaceutical's financial health report.

- Learn about Sino Biopharmaceutical's future growth trajectory here.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China, Canada, Japan, Italy, Greece, other European countries, and internationally with a market cap of SGD10.19 billion.

Operations: The company's revenue is primarily derived from its shipbuilding segment, which generated CN¥24.53 billion, followed by the shipping segment with CN¥1.09 billion.

Market Cap: SGD10.19B

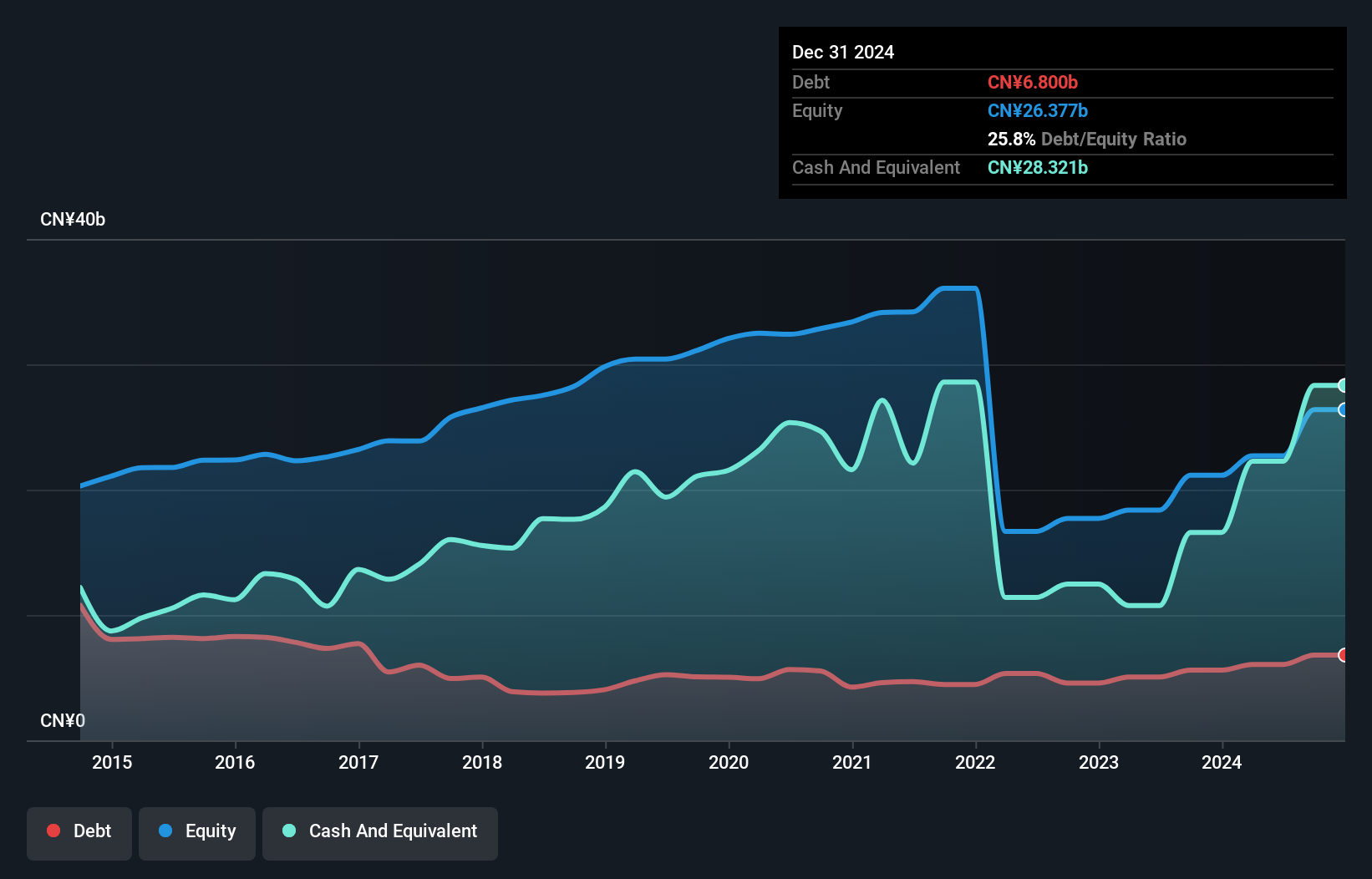

Yangzijiang Shipbuilding (Holdings) Ltd. has shown strong financial performance with CN¥24.53 billion in revenue from its shipbuilding segment. The company boasts a high return on equity of 23.8% and a price-to-earnings ratio of 10.2x, indicating good value compared to the SG market average. Recent earnings growth is impressive, with net income rising significantly over the past year, supported by robust operating cash flow that comfortably covers debt obligations. Despite an inexperienced board and increased debt-to-equity ratio over five years, short-term assets exceed liabilities substantially, underscoring financial stability and potential for continued growth.

- Click here and access our complete financial health analysis report to understand the dynamics of Yangzijiang Shipbuilding (Holdings).

- Evaluate Yangzijiang Shipbuilding (Holdings)'s prospects by accessing our earnings growth report.

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and cloud data sectors both in China and internationally, with a market capitalization of CN¥30.30 billion.

Operations: The company generates revenue of CN¥7.71 billion from China and CN¥8.80 billion from exports.

Market Cap: CN¥30.3B

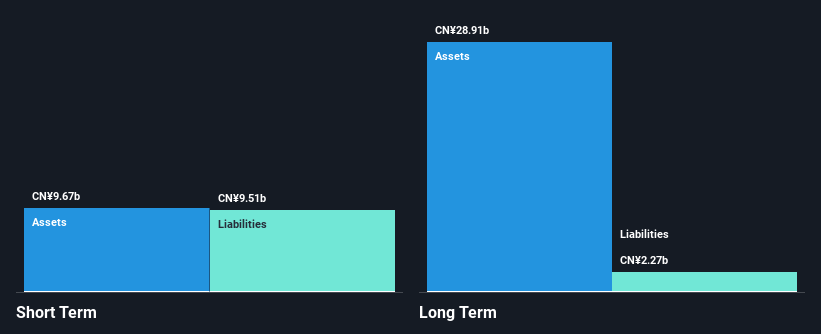

Zhejiang Century Huatong Group Co., Ltd has recently become profitable, marking a significant turnaround despite a historical decline in earnings. The company demonstrates financial stability with short-term assets exceeding both short and long-term liabilities, and its debt is well-covered by operating cash flow. Although the return on equity is low at 3.4%, the interest on debt remains well covered with EBIT at 6.5 times interest payments. Recent buyback activity indicates shareholder value focus, while half-year earnings showed substantial revenue growth to CN¥9.28 billion from CN¥6.05 billion year-on-year, reflecting improved operational performance.

- Navigate through the intricacies of Zhejiang Century Huatong GroupLtd with our comprehensive balance sheet health report here.

- Gain insights into Zhejiang Century Huatong GroupLtd's future direction by reviewing our growth report.

Seize The Opportunity

- Embark on your investment journey to our 5,790 Penny Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Yangzijiang Shipbuilding (Holdings), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BS6

Yangzijiang Shipbuilding (Holdings)

An investment holding company, engages in the shipbuilding activities in the Greater China, Canada, Japan, Italy, Greece, other European countries, and internationally.

Outstanding track record, undervalued and pays a dividend.