Discovering Opportunities: Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets adjust to the evolving policies of the Trump 2.0 administration, investors are navigating a landscape marked by sector volatility and shifting interest rate expectations. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing area for exploration due to their affordability and potential for growth. Despite being considered a somewhat outdated term, these stocks can still offer significant opportunities when backed by strong financials, making them worthy of attention in today's market climate.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR134.24M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.40 | MYR2.36B | ★★★★★☆ |

| Seafco (SET:SEAFCO) | THB1.99 | THB1.6B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR288.79M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.225 | £838.3M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.67 | £365M | ★★★★☆☆ |

Click here to see the full list of 5,805 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

China Lilang (SEHK:1234)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Lilang Limited, along with its subsidiaries, manufactures and sells branded menswear and related accessories in the People’s Republic of China, with a market cap of HK$4.60 billion.

Operations: The company generates revenue of CN¥3.65 billion from its menswear and accessories manufacturing and sales segment.

Market Cap: HK$4.6B

China Lilang, with a market cap of HK$4.60 billion, shows potential in the penny stock space due to its strong financial metrics and stable operations. The company generates CN¥3.65 billion in revenue from menswear and accessories, indicating solid business activity rather than being pre-revenue. Its earnings are forecast to grow by 11.81% annually, supported by improved profit margins and a satisfactory net debt to equity ratio of 0.7%. Despite an unstable dividend track record, China Lilang's seasoned board and management team provide stability, while analysts agree on potential stock price appreciation of 27.5%.

- Click here and access our complete financial health analysis report to understand the dynamics of China Lilang.

- Gain insights into China Lilang's future direction by reviewing our growth report.

Yeebo (International Holdings) (SEHK:259)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yeebo (International Holdings) Limited is an investment holding company involved in the manufacture and sale of liquid crystal display (LCD) and liquid crystal display module (LCM) products, with a market cap of approximately HK$2.10 billion.

Operations: The company's revenue from Displays amounts to HK$936.61 million.

Market Cap: HK$2.1B

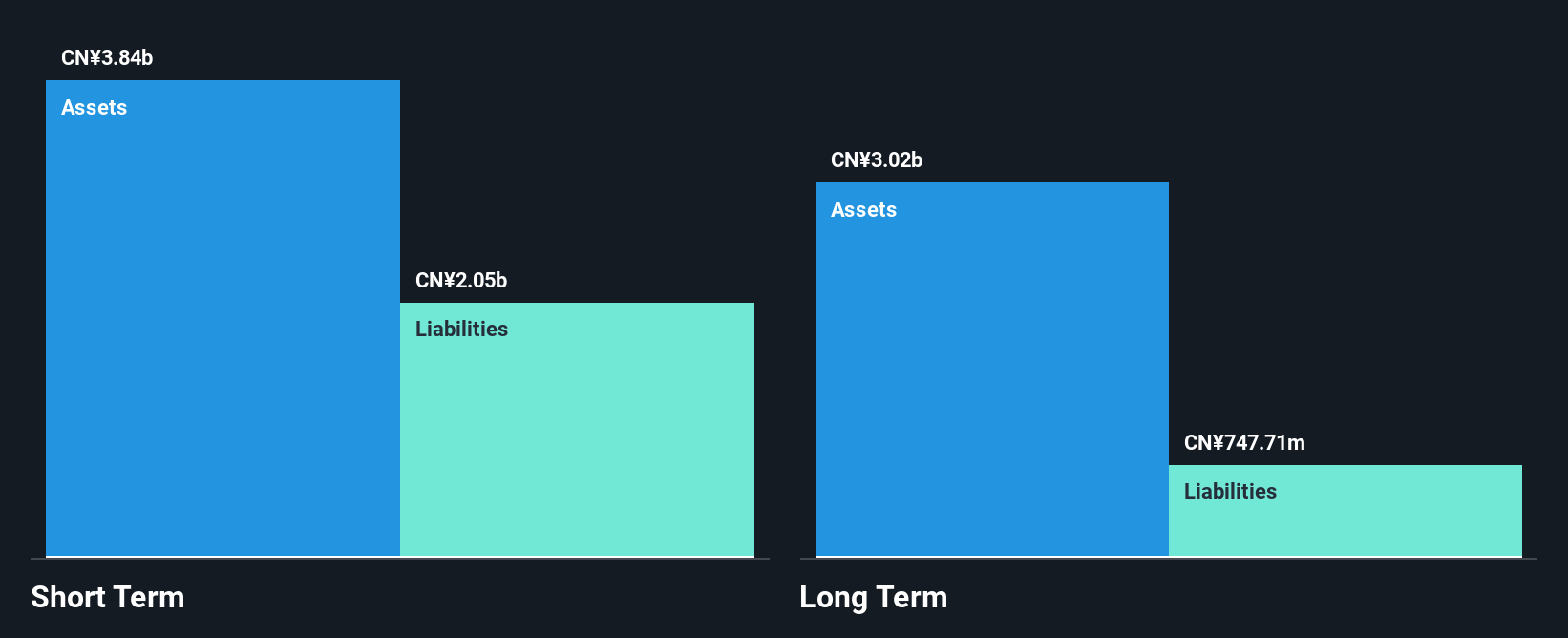

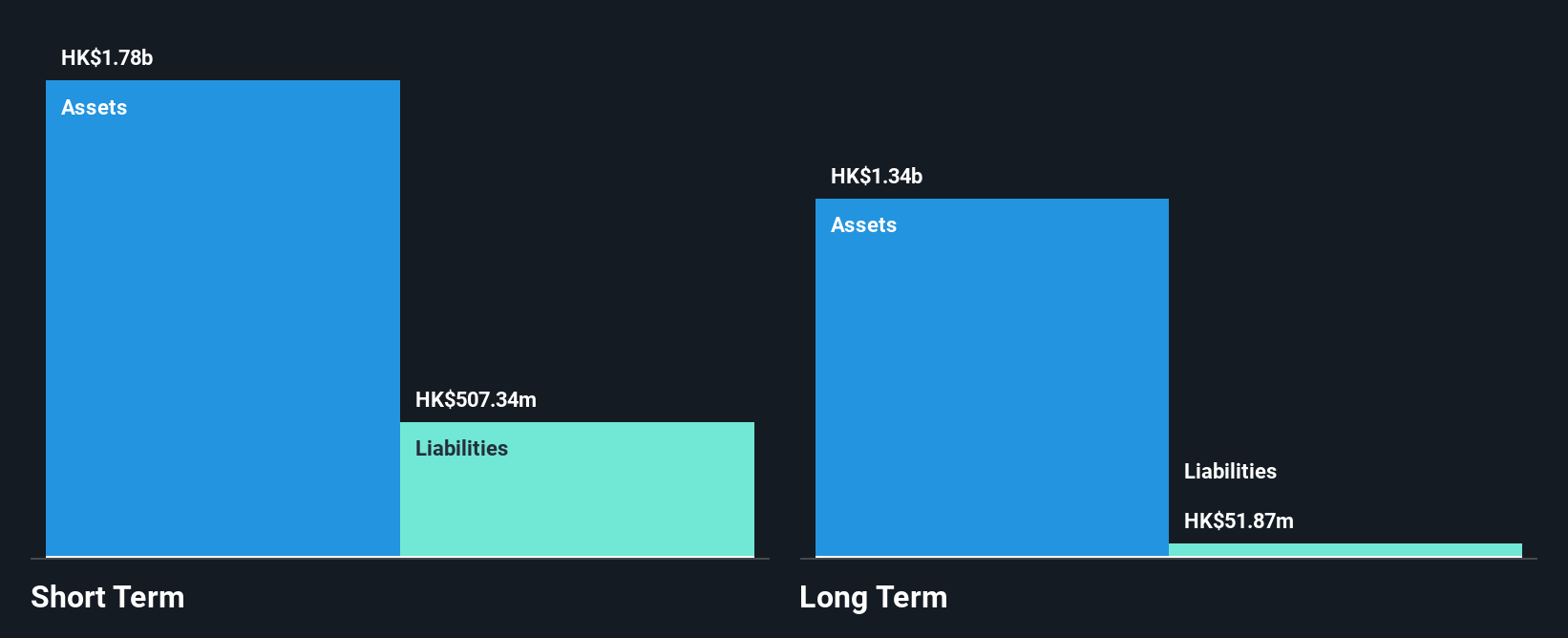

Yeebo (International Holdings) Limited, with a market cap of HK$2.10 billion, demonstrates certain strengths and challenges in the penny stock category. The company has substantial revenue from its LCD and LCM products, amounting to HK$936.61 million, indicating it is not pre-revenue. Despite experiencing a significant drop in profit margins from 46.4% to 18.9%, Yeebo maintains strong financial health with short-term assets covering both short- and long-term liabilities comfortably. Recent share repurchase activities aim to enhance net asset value per share, reflecting management's focus on shareholder value amidst negative earnings growth over the past year.

- Click to explore a detailed breakdown of our findings in Yeebo (International Holdings)'s financial health report.

- Gain insights into Yeebo (International Holdings)'s historical outcomes by reviewing our past performance report.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China, Canada, Japan, Italy, Greece, other European countries, and internationally with a market cap of SGD9.96 billion.

Operations: The company's revenue is primarily derived from its shipbuilding segment, which accounts for CN¥24.53 billion, followed by its shipping segment at CN¥1.09 billion.

Market Cap: SGD9.96B

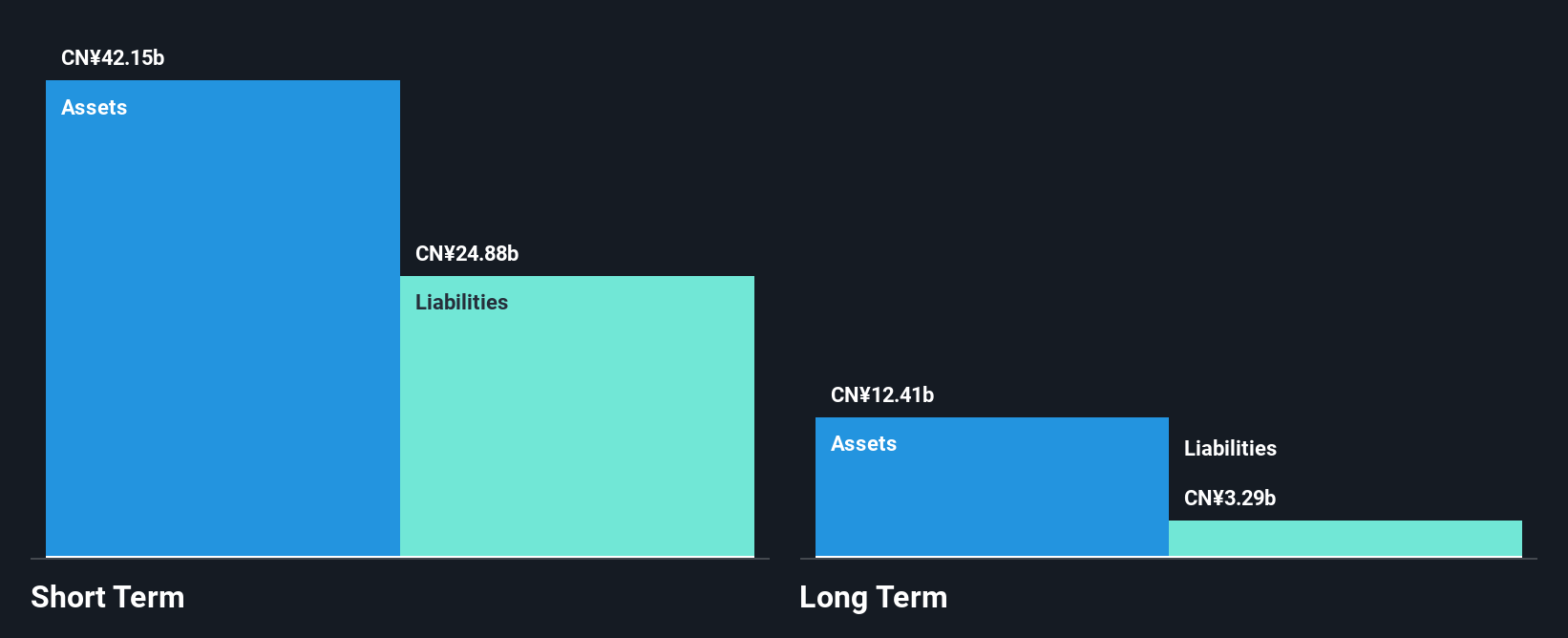

Yangzijiang Shipbuilding (Holdings) Ltd., with a market cap of SGD9.96 billion, presents a mixed picture for investors in the penny stock arena. The company boasts robust revenue streams, primarily from its shipbuilding segment at CN¥24.53 billion, and demonstrates strong financial health with more cash than total debt and short-term assets exceeding liabilities. Earnings growth has been impressive at 71.5% over the past year, outpacing industry averages and supported by high-quality earnings and improved profit margins. However, challenges include an inexperienced board with an average tenure of 2.3 years, which could impact strategic direction.

- Jump into the full analysis health report here for a deeper understanding of Yangzijiang Shipbuilding (Holdings).

- Explore Yangzijiang Shipbuilding (Holdings)'s analyst forecasts in our growth report.

Seize The Opportunity

- Take a closer look at our Penny Stocks list of 5,805 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:259

Yeebo (International Holdings)

An investment holding company, engages in the manufacture and sale of liquid crystal display (LCD) and liquid crystal display module (LCM) products.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives