- Singapore

- /

- Construction

- /

- SGX:BRD

The three-year decline in earnings might be taking its toll on Sapphire (SGX:BRD) shareholders as stock falls 14% over the past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Sapphire Corporation Limited (SGX:BRD) shareholders have had that experience, with the share price dropping 36% in three years, versus a market return of about 25%. Shareholders have had an even rougher run lately, with the share price down 21% in the last 90 days.

After losing 14% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

We've discovered 4 warning signs about Sapphire. View them for free.To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

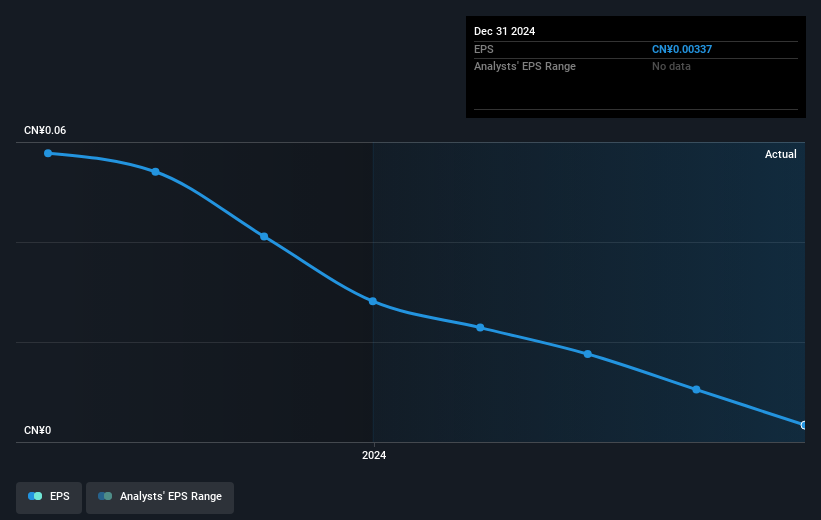

During the three years that the share price fell, Sapphire's earnings per share (EPS) dropped by 64% each year. This fall in the EPS is worse than the 14% compound annual share price fall. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term. This positive sentiment is also reflected in the generous P/E ratio of 63.02.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Sapphire's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Sapphire's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Sapphire shareholders, and that cash payout contributed to why its TSR of 8.6%, over the last 3 years, is better than the share price return.

A Different Perspective

Sapphire provided a TSR of 2.7% over the last twelve months. But that return falls short of the market. On the bright side, the longer term returns (running at about 3% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Sapphire better, we need to consider many other factors. For example, we've discovered 4 warning signs for Sapphire that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BRD

Sapphire

An investment management and holding company, engages in engineering, procurement, and construction business related to the land transport infrastructure and water conservancy and environmental projects in Singapore and China.

Adequate balance sheet slight.

Market Insights

Community Narratives