Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that BH Global Corporation Limited (SGX:BQN) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for BH Global

What Is BH Global's Net Debt?

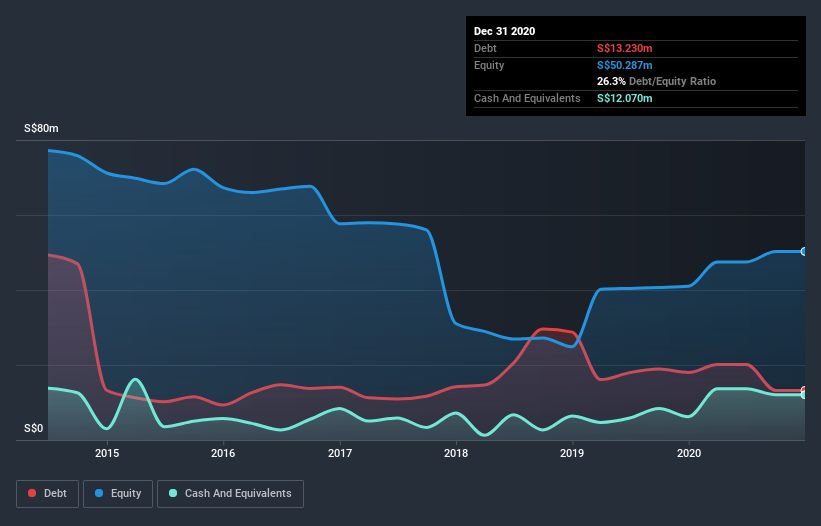

As you can see below, BH Global had S$13.2m of debt at December 2020, down from S$18.0m a year prior. However, because it has a cash reserve of S$12.1m, its net debt is less, at about S$1.16m.

How Healthy Is BH Global's Balance Sheet?

According to the last reported balance sheet, BH Global had liabilities of S$23.9m due within 12 months, and liabilities of S$12.4m due beyond 12 months. On the other hand, it had cash of S$12.1m and S$12.6m worth of receivables due within a year. So its liabilities total S$11.6m more than the combination of its cash and short-term receivables.

Since publicly traded BH Global shares are worth a total of S$78.0m, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. But either way, BH Global has virtually no net debt, so it's fair to say it does not have a heavy debt load!

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

BH Global has very little debt (net of cash), and boasts a debt to EBITDA ratio of 0.095 and EBIT of 16.2 times the interest expense. So relative to past earnings, the debt load seems trivial. Even more impressive was the fact that BH Global grew its EBIT by 422% over twelve months. That boost will make it even easier to pay down debt going forward. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since BH Global will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, BH Global actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Happily, BH Global's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! We think BH Global is no more beholden to its lenders, than the birds are to birdwatchers. To our minds it has a healthy happy balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for BH Global (1 can't be ignored) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading BH Global or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BH Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BQN

BH Global

An investment holding company, provides a suite of solutions in marine and offshore, green LED, integrated technology, cyber security, and infrared and thermal sensing technology fields in Singapore, Japan, China, the United Arab Emirates, the United States of America, Indonesia, Vietnam, Malaysia, the United Kingdom, the Netherlands, and internationally.

Excellent balance sheet slight.

Market Insights

Community Narratives