- Hong Kong

- /

- Entertainment

- /

- SEHK:8368

Uncovering Opportunities: Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets grapple with cautious Federal Reserve commentary and political uncertainties, investors are navigating a landscape marked by fluctuating indices and tempered expectations for future rate cuts. Amidst this backdrop, the search for promising investment opportunities continues, with penny stocks drawing attention for their potential to offer growth at accessible price points. Despite being an outdated term, penny stocks represent smaller or newer companies that can provide surprising value when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.555 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,831 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Creative China Holdings (SEHK:8368)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Creative China Holdings Limited is an investment holding company that focuses on the creation, adaptation, production, and licensing of film and television scripts in China, Hong Kong, and Southeast Asia with a market cap of HK$317.79 million.

Operations: The company's revenue is primarily derived from its Artist Management segment (CN¥1.76 million), Concert and Event Organisation (CN¥2.92 million), Mobile Application Development and Operation (CN¥1.91 million), and Serial Program/Film Production, Film Distribution, and Income Rights (CN¥180.04 million).

Market Cap: HK$317.79M

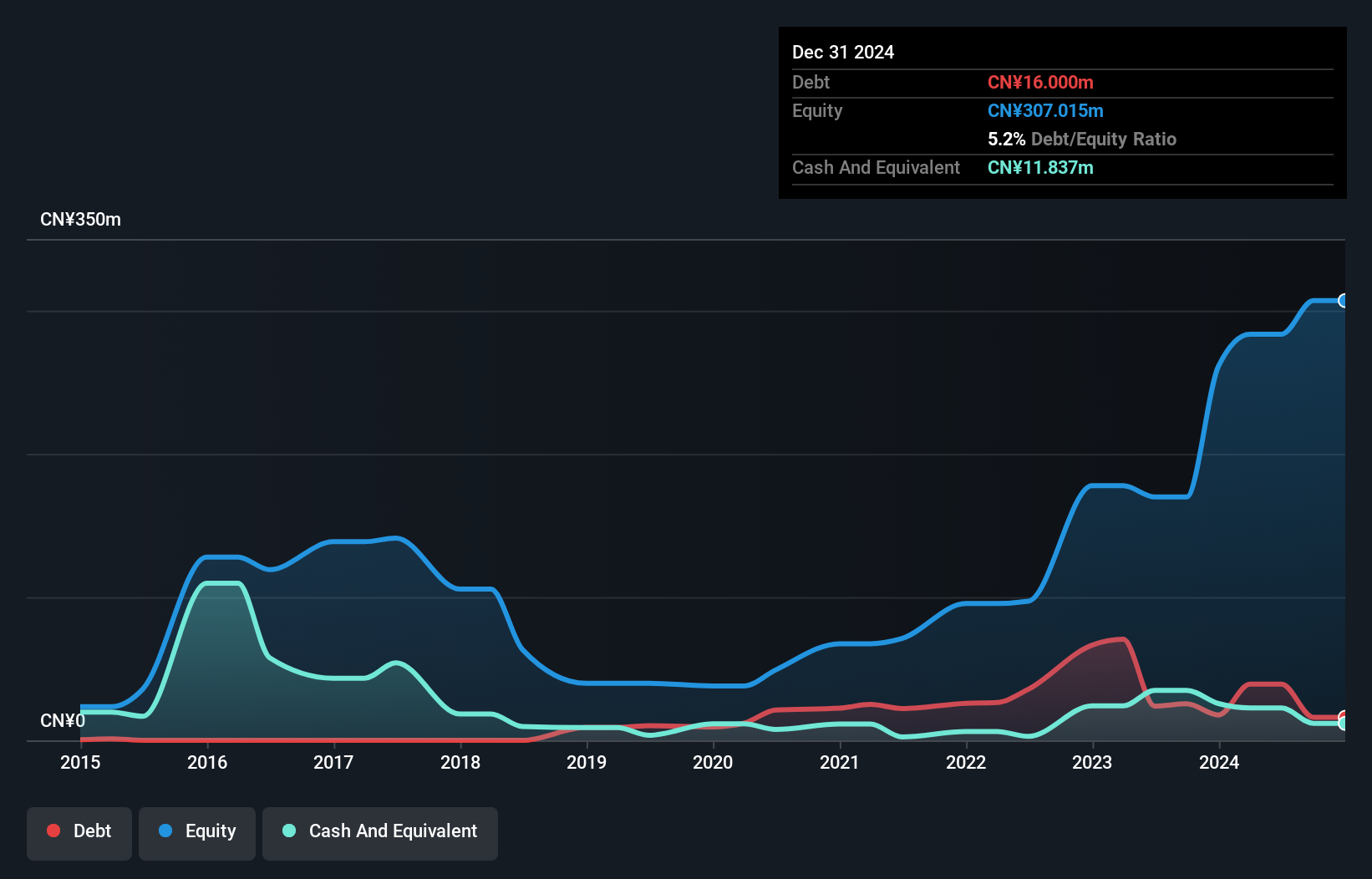

Creative China Holdings, with a market cap of HK$317.79 million, has shown significant earnings growth over the past five years, averaging 47.4% annually. Despite this strong historical performance, its recent earnings growth of 10.1% did not surpass the entertainment industry average and is below its own five-year average. The company's price-to-earnings ratio of 6.1x suggests it may be undervalued compared to the broader Hong Kong market at 9.9x. While it maintains a satisfactory net debt to equity ratio of 5.9%, shareholder dilution occurred last year with shares outstanding increasing by 9.4%.

- Take a closer look at Creative China Holdings' potential here in our financial health report.

- Explore historical data to track Creative China Holdings' performance over time in our past results report.

PSG Corporation (SET:PSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PSG Corporation Public Company Limited, along with its subsidiary PSGC (Lao) Sole Company Limited, operates in turnkey engineering, procurement, and construction (EPC) and large-scale construction projects in Thailand and the Lao People's Democratic Republic, with a market cap of THB30.55 billion.

Operations: The company's revenue primarily comes from the Plant and Building Construction segment, generating THB4.62 billion.

Market Cap: THB30.55B

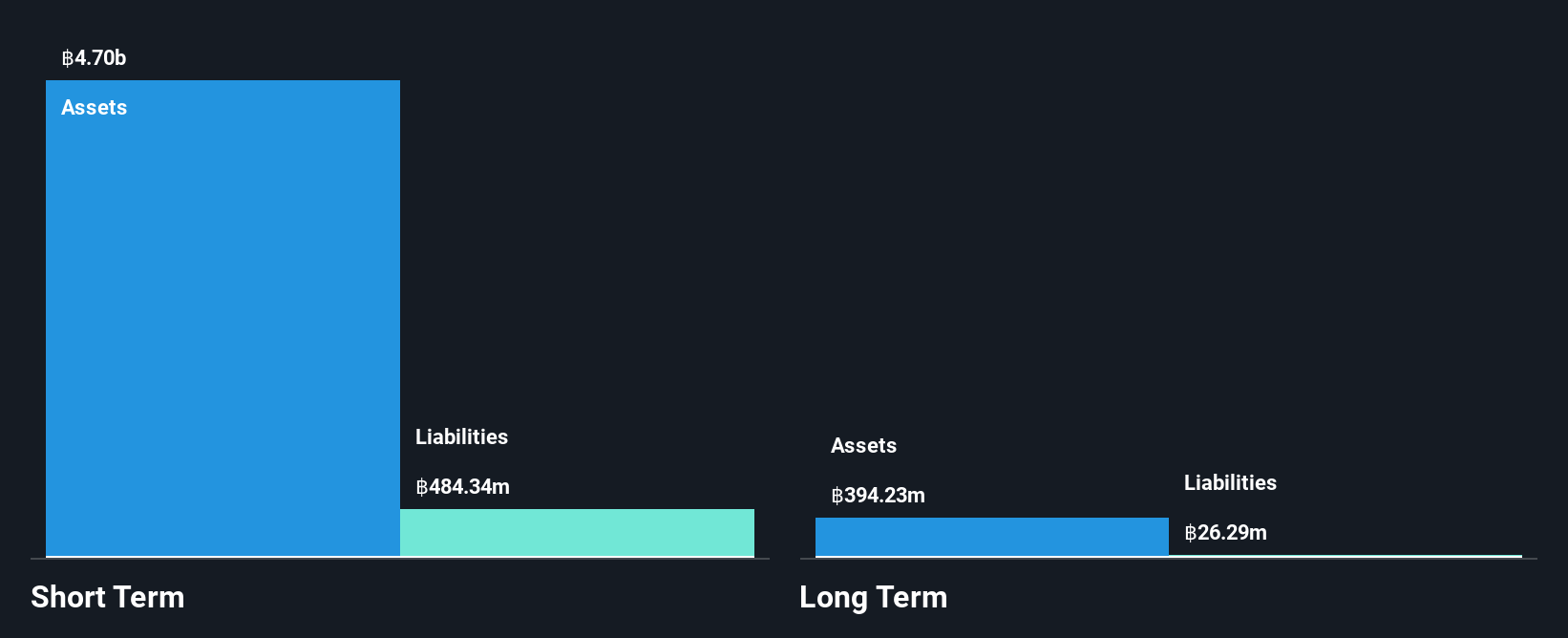

PSG Corporation, with a market cap of THB30.55 billion, has demonstrated robust earnings growth of 217.9% over the past year, significantly outperforming the construction industry's decline. The company reported third-quarter revenue of THB730.37 million, up from THB294.36 million a year ago, though net income decreased to THB12.79 million from THB116.72 million last year due to lower profit margins at 42% compared to 48.7%. PSG's financial stability is underscored by its debt-free status and strong asset position, with short-term assets covering both short- and long-term liabilities comfortably while maintaining an outstanding return on equity at 45.9%.

- Click here and access our complete financial health analysis report to understand the dynamics of PSG Corporation.

- Assess PSG Corporation's previous results with our detailed historical performance reports.

BRC Asia (SGX:BEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BRC Asia Limited, with a market cap of SGD680.39 million, specializes in the prefabrication of steel reinforcement for concrete across Singapore and various international markets including Australia and Hong Kong.

Operations: The company generates revenue primarily from two segments: Trading, contributing SGD217.69 million, and Fabrication and Manufacturing, which accounts for SGD1.26 billion.

Market Cap: SGD680.39M

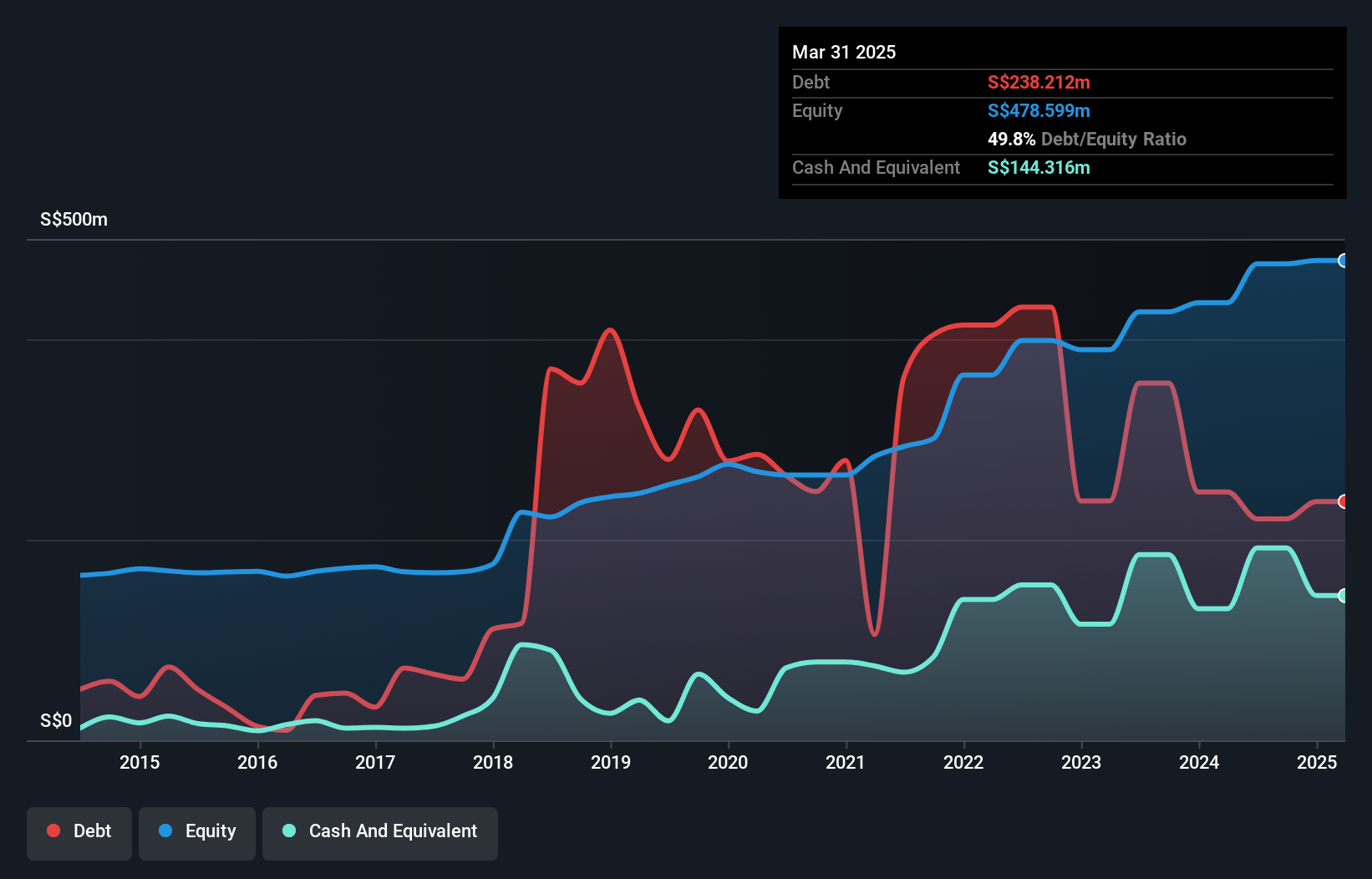

BRC Asia Limited, with a market cap of SGD680.39 million, has shown solid financial performance despite challenges. Recent earnings reported sales of SGD1.48 billion and net income of SGD93.54 million, reflecting improved profit margins from the previous year. The company's debt management is commendable, with a reduced debt to equity ratio and interest payments well-covered by EBIT at 13.4 times coverage. While earnings growth has decelerated slightly compared to its five-year average, BRC Asia remains undervalued relative to industry peers and exhibits stable weekly volatility alongside high-quality past earnings and an experienced management team.

- Get an in-depth perspective on BRC Asia's performance by reading our balance sheet health report here.

- Understand BRC Asia's earnings outlook by examining our growth report.

Next Steps

- Navigate through the entire inventory of 5,831 Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8368

Creative China Holdings

An investment holding company, engages in serial program/film production and film rights investment activities in the People’s Republic of China, Hong Kong, and Southeast Asia.

Excellent balance sheet slight.

Market Insights

Community Narratives