- Singapore

- /

- Construction

- /

- SGX:MR7

Top 3 SGX Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

The Singapore market has shown resilience amid global economic uncertainties, with indices reflecting a stable yet cautious optimism. In this environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for investors looking to boost their portfolios.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.99% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.72% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.27% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.43% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.17% | ★★★★★☆ |

| QAF (SGX:Q01) | 6.13% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.13% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.69% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.89% | ★★★★☆☆ |

| Nordic Group (SGX:MR7) | 4.48% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

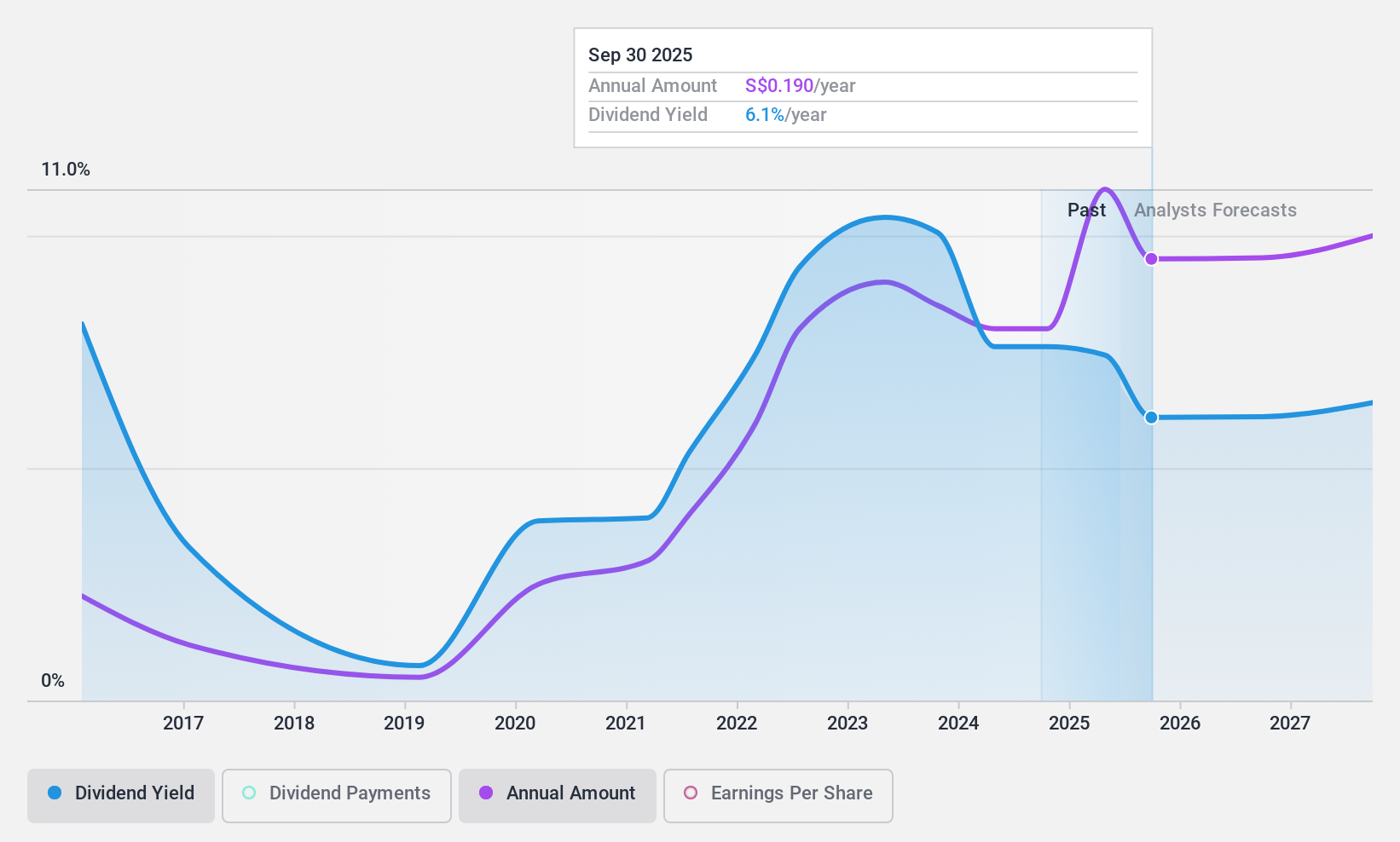

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited, with a market cap of SGD628.26 million, specializes in the prefabrication of steel reinforcement for concrete across various regions including Singapore, Australia, and several other countries internationally.

Operations: BRC Asia Limited generates revenue primarily from two segments: Trading, which accounts for SGD319.71 million, and Fabrication and Manufacturing, contributing SGD1.35 billion.

Dividend Yield: 7.0%

BRC Asia Limited trades at 60% below its estimated fair value and offers a dividend yield of 6.99%, placing it in the top 25% of dividend payers in Singapore. With a payout ratio of 35.9%, dividends are well covered by earnings, though cash flow coverage is tighter at an 85.3% payout ratio. Despite a history of volatile dividends, recent news indicates an interim tax-exempt dividend payment on November 15, 2024, reinforcing its commitment to returning capital to shareholders.

- Click here to discover the nuances of BRC Asia with our detailed analytical dividend report.

- Our valuation report unveils the possibility BRC Asia's shares may be trading at a discount.

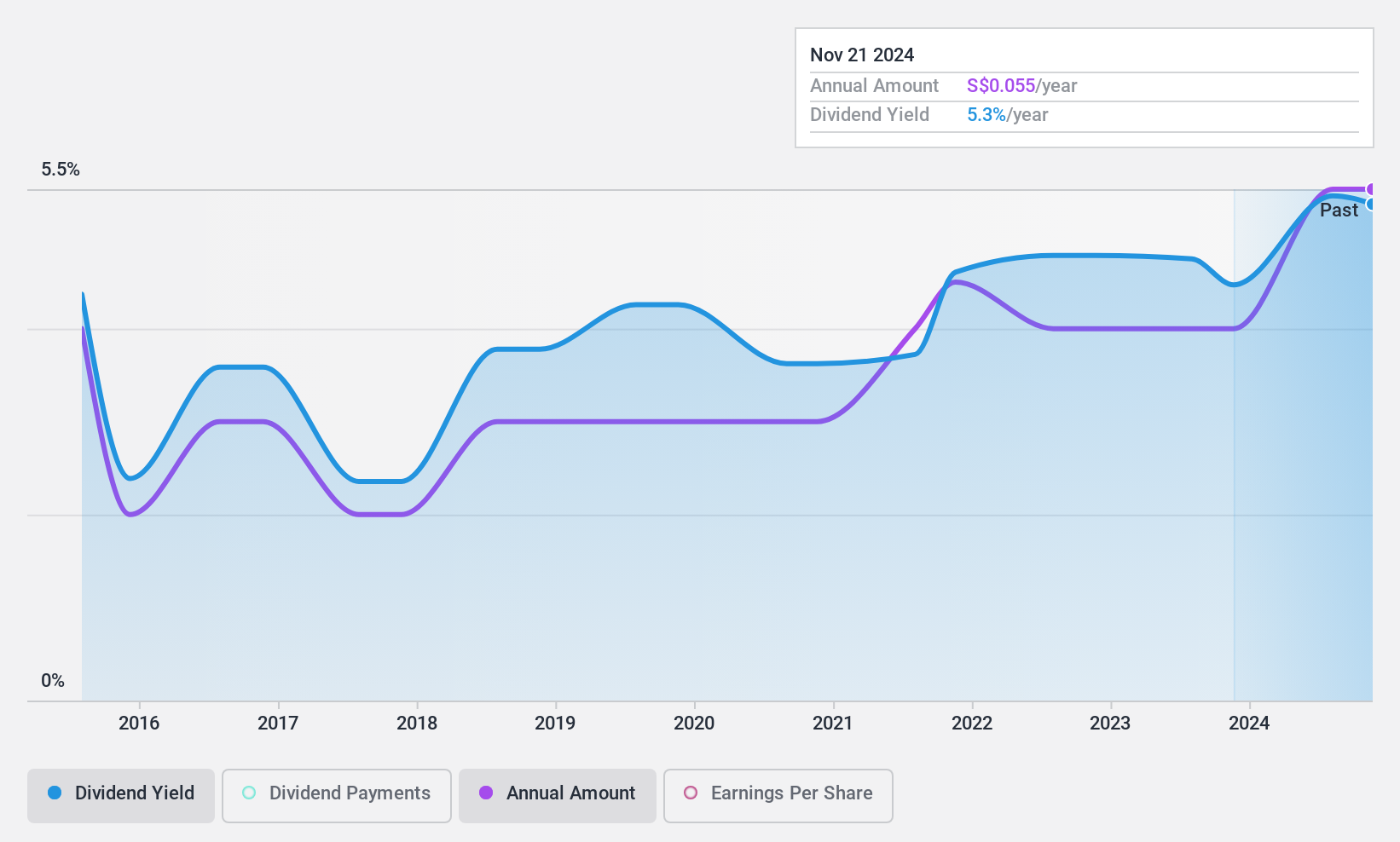

Boustead Singapore (SGX:F9D)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boustead Singapore Limited, with a market cap of SGD487.02 million, operates as an investment holding company providing energy engineering, real estate, geospatial, and healthcare technology solutions across various regions including Singapore, Australia, Malaysia, the United States, Europe, Asia Pacific, the Americas, the Middle East and Africa.

Operations: Boustead Singapore Limited generates revenue from several segments including Geospatial (SGD212.67 million), Healthcare (SGD10.58 million), Energy Engineering (SGD174.41 million), and Real Estate Solutions (SGD369.46 million).

Dividend Yield: 5.4%

Boustead Singapore has proposed a final tax-exempt dividend of S$0.04 per share, contingent on shareholder approval at the upcoming AGM. Despite a 41.6% earnings growth over the past year and a low payout ratio of 40.9%, its dividend history has been volatile with significant drops in some years. However, dividends are well covered by both earnings and cash flows, indicating sustainability despite past inconsistencies in payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Boustead Singapore.

- Our valuation report unveils the possibility Boustead Singapore's shares may be trading at a premium.

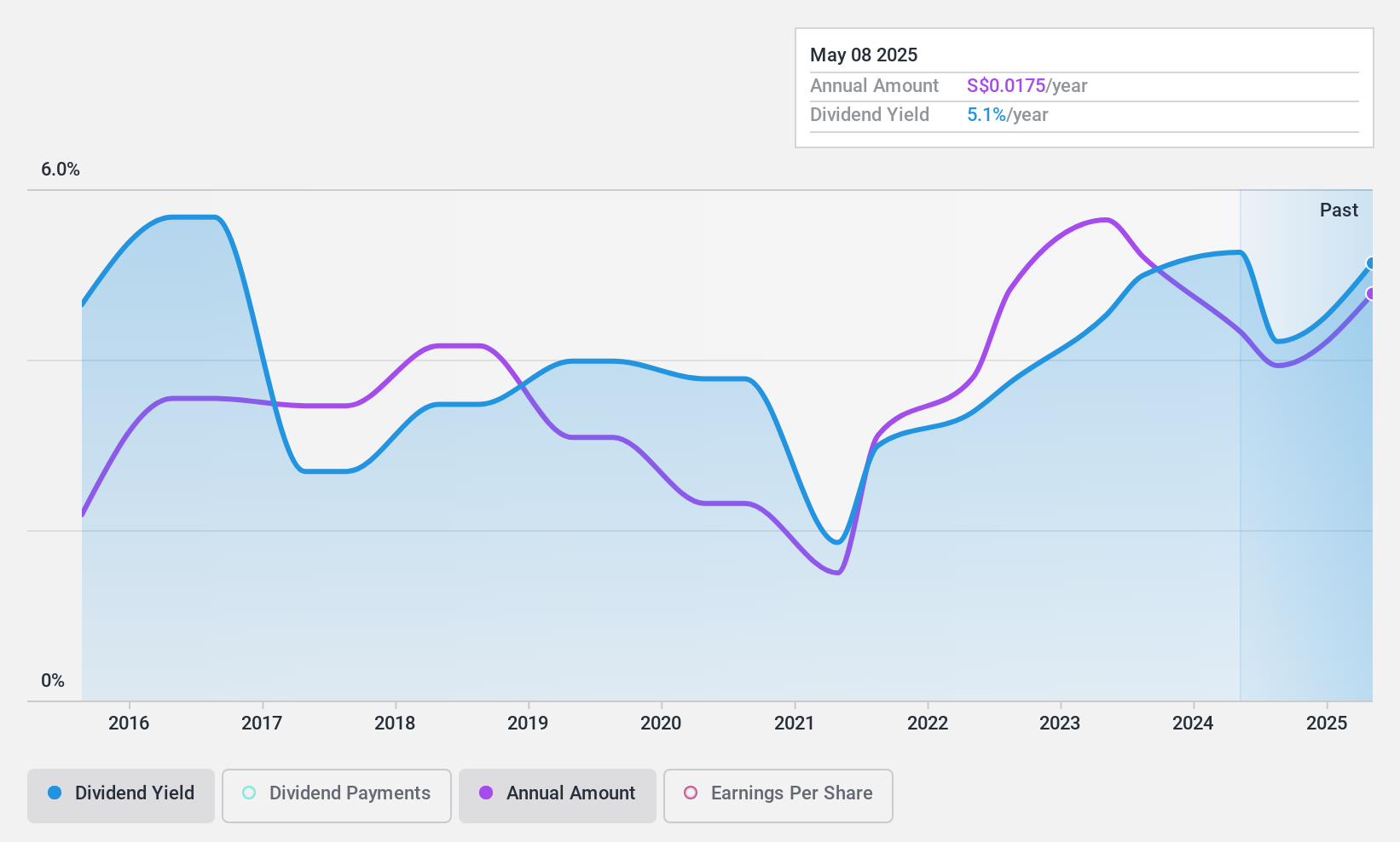

Nordic Group (SGX:MR7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Group Limited (SGX:MR7) is an investment holding company providing system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering services globally with a market cap of SGD141.68 million.

Operations: Nordic Group Limited generates revenue from Project Services (SGD69.93 million) and Maintenance Services (SGD83.13 million).

Dividend Yield: 4.5%

Nordic Group's dividend payments have been inconsistent over the past decade, with notable volatility. Despite this, the current payout ratio of 40% and cash payout ratio of 32.7% indicate that dividends are well covered by earnings and cash flows. Recently, Nordic announced a decreased interim tax-exempt dividend of S$0.008526 per share, reflecting a cautious approach amidst declining sales and net income for H1 2024 compared to the previous year.

- Click to explore a detailed breakdown of our findings in Nordic Group's dividend report.

- Our comprehensive valuation report raises the possibility that Nordic Group is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Access the full spectrum of 19 Top SGX Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:MR7

Nordic Group

An investment holding company, offers solutions in the areas of system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering, cleanroom, air, and water engineering worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives