- Thailand

- /

- Oil and Gas

- /

- SET:PTTEP

PTT Exploration and Production And 2 Other Reliable Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence waning and European stocks showing modest gains, investors are increasingly seeking stable income sources amidst uncertainty. Dividend stocks can offer such stability, providing consistent returns even when market volatility is high, making them an attractive option for those looking to balance growth with reliability in their investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.85% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

PTT Exploration and Production (SET:PTTEP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTT Exploration and Production Public Company Limited, along with its subsidiaries, is involved in the exploration and production of petroleum both in Thailand and globally, with a market cap of THB472.43 billion.

Operations: PTT Exploration and Production generates revenue from its operations in Southeast Asia - Thailand ($5.45 billion), other Southeast Asian regions ($2.25 billion), the Middle East ($1.12 billion), Africa ($353 million), and other exploration and production activities ($61 million).

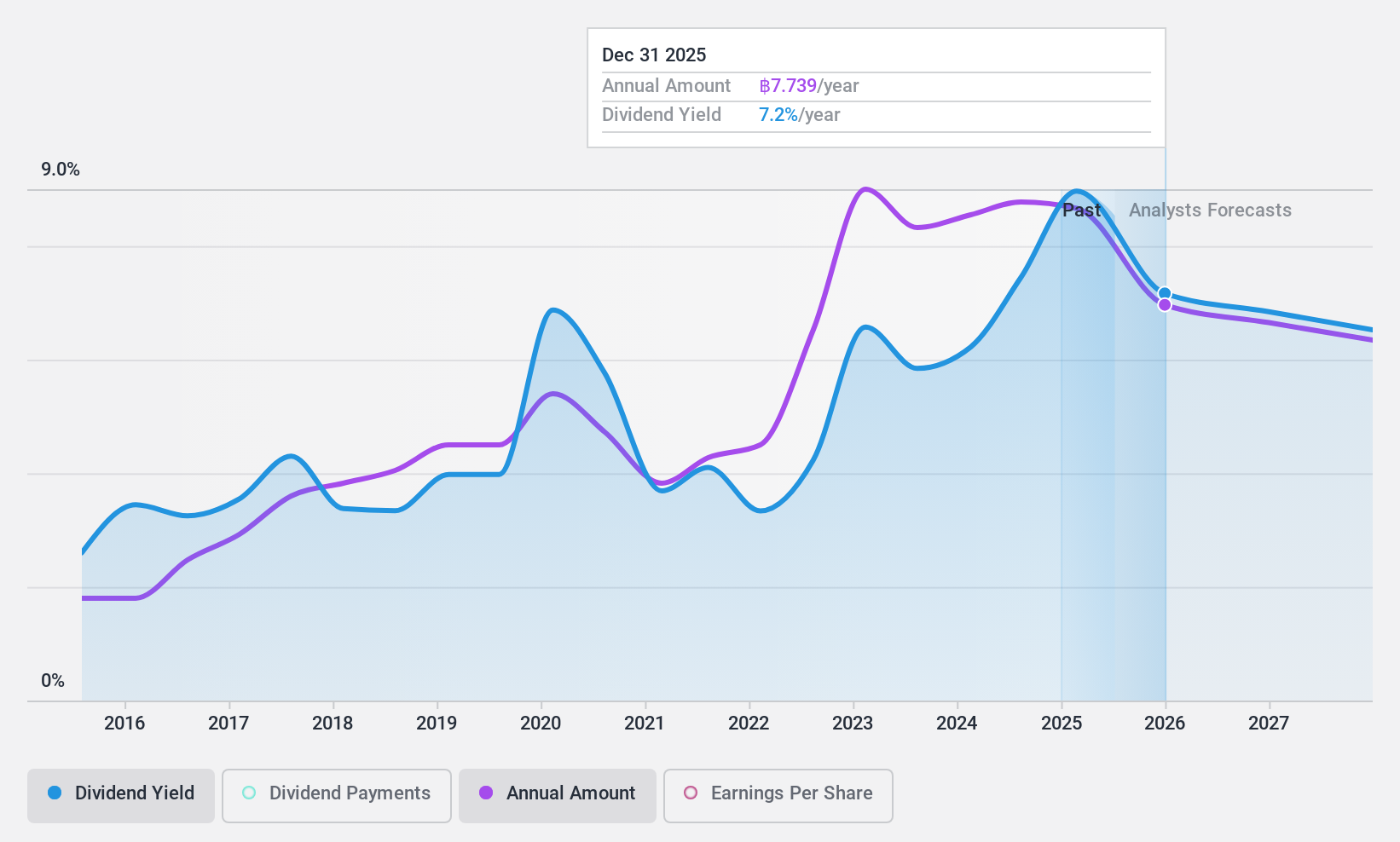

Dividend Yield: 7.5%

PTT Exploration and Production's dividend payments have been volatile over the past decade, despite recent growth. The company's dividends are well-covered by both earnings (payout ratio: 53.9%) and cash flows (cash payout ratio: 39.8%). With a dividend yield of 7.46%, PTTEP ranks in the top quarter of Thai market payers, although its track record remains unstable. Recent earnings reports show modest growth, with net income reaching US$1.69 billion for the first nine months of 2024.

- Get an in-depth perspective on PTT Exploration and Production's performance by reading our dividend report here.

- Our valuation report unveils the possibility PTT Exploration and Production's shares may be trading at a discount.

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited, with a market cap of SGD685.88 million, is involved in the prefabrication of steel reinforcement for concrete across Singapore and several international markets including Australia and Hong Kong.

Operations: BRC Asia Limited generates revenue primarily from two segments: Trading, which accounts for SGD217.69 million, and Fabrication and Manufacturing, contributing SGD1.26 billion.

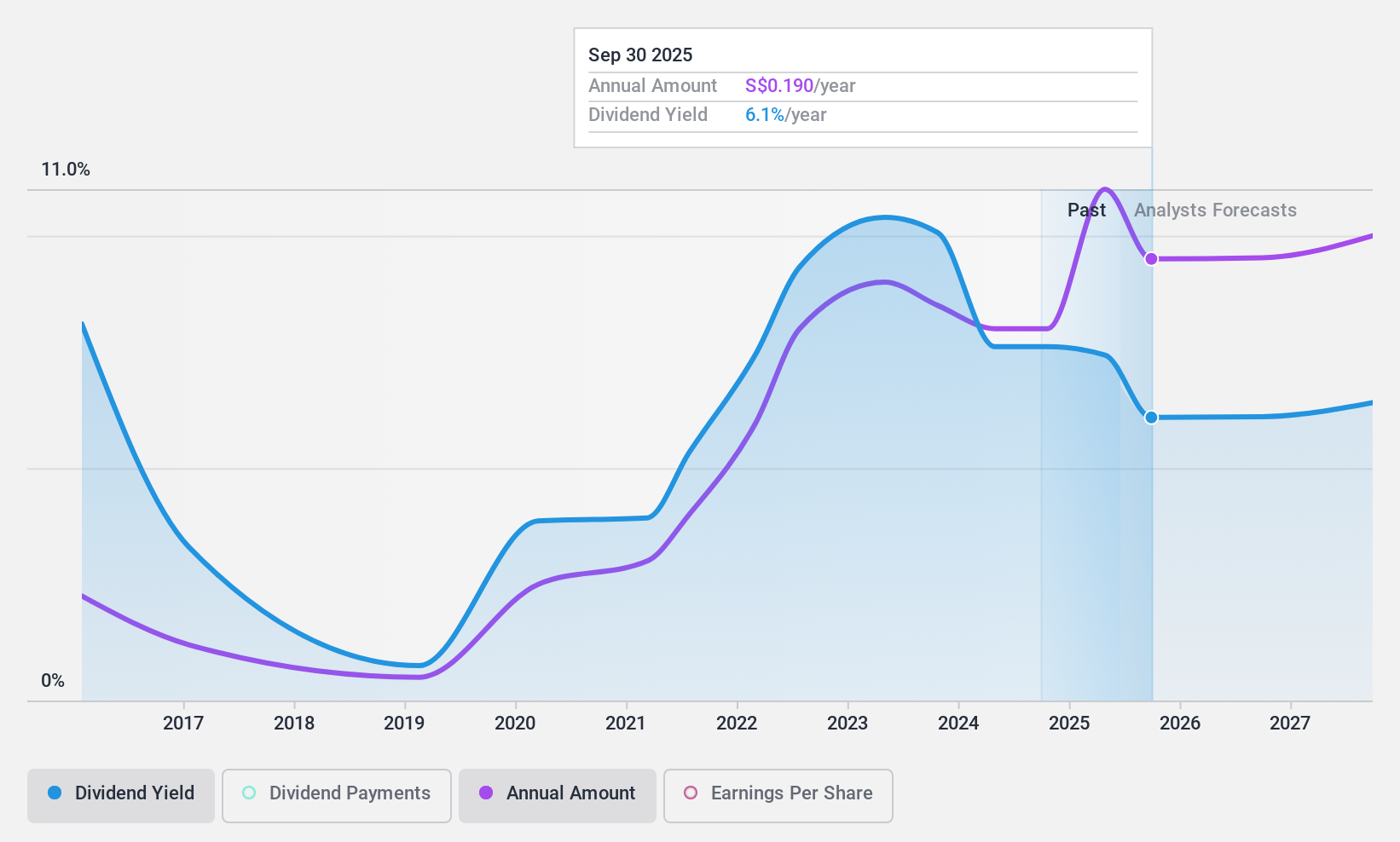

Dividend Yield: 8.6%

BRC Asia offers a high dividend yield of 8.63%, placing it in the top 25% of Singaporean payers, with dividends well-supported by earnings (payout ratio: 41.1%) and cash flows (cash payout ratio: 32%). Despite a history of volatility, dividends have grown over the past decade. Recent earnings showed net income growth to S$93.54 million for the year ending September 2024, despite a drop in sales from S$1.63 billion to S$1.48 billion.

- Dive into the specifics of BRC Asia here with our thorough dividend report.

- Our expertly prepared valuation report BRC Asia implies its share price may be lower than expected.

Good Will Instrument (TWSE:2423)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Good Will Instrument Co., Ltd. manufactures and markets electrical test and measurement instruments for educational and industrial manufacturing markets, with a market cap of NT$5.95 billion.

Operations: The company's revenue is primarily derived from its Electronic Test & Measurement Instruments segment, totaling NT$2.85 billion.

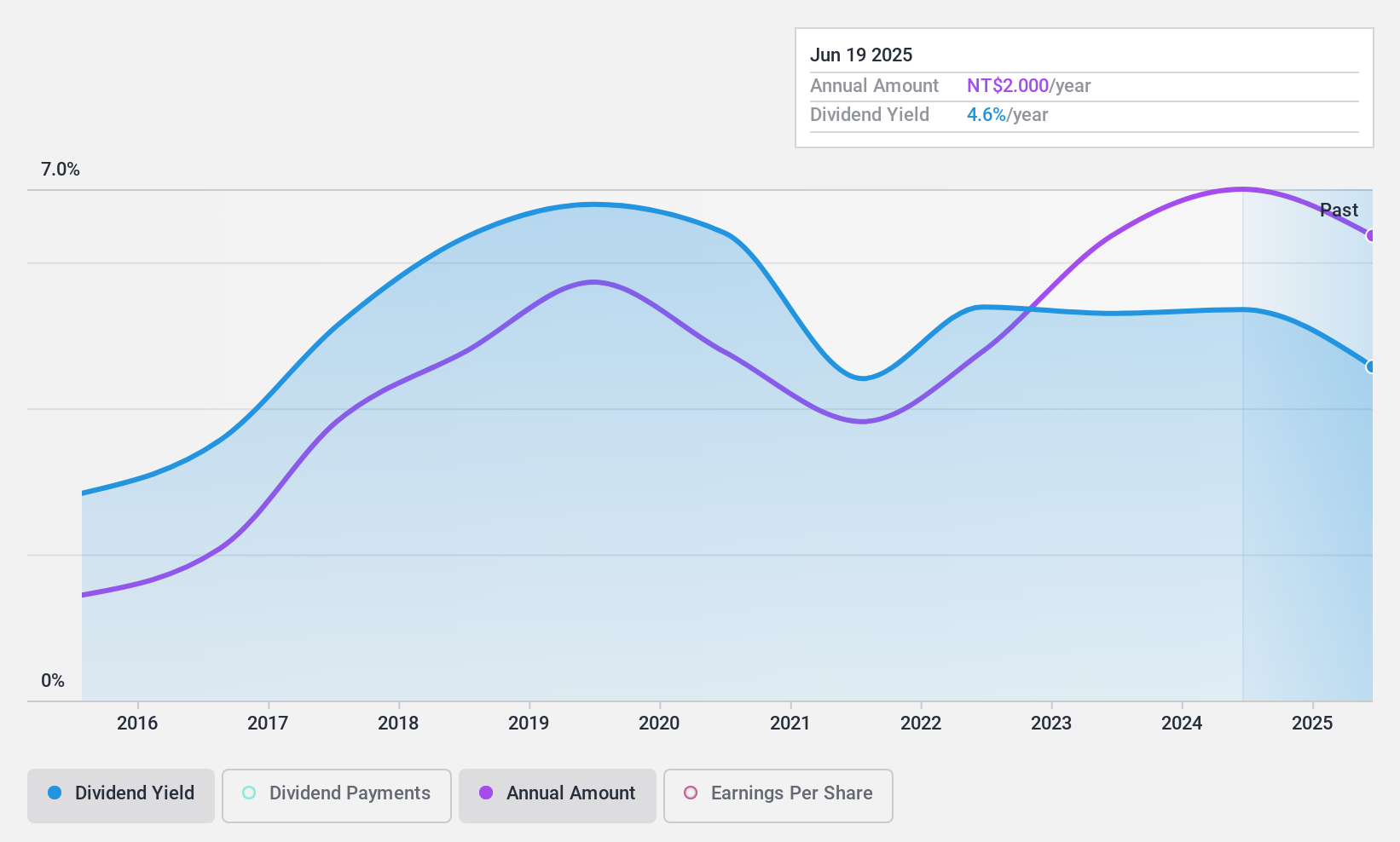

Dividend Yield: 5.3%

Good Will Instrument's dividend yield of 5.26% ranks in the top 25% of Taiwan's market, supported by an earnings payout ratio of 85% and a cash payout ratio of 54.4%. Although recent earnings showed declines, with Q3 net income at TWD 83.28 million compared to TWD 112.19 million last year, dividends have remained stable and growing over the past decade, indicating reliability despite fluctuating sales figures.

- Take a closer look at Good Will Instrument's potential here in our dividend report.

- Our valuation report here indicates Good Will Instrument may be undervalued.

Summing It All Up

- Embark on your investment journey to our 1958 Top Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PTTEP

PTT Exploration and Production

Engages in the exploration and production of petroleum in Thailand and internationally.

Established dividend payer with proven track record.