- Singapore

- /

- Trade Distributors

- /

- SGX:BDU

Federal International (2000) Ltd's (SGX:BDU) Earnings Haven't Escaped The Attention Of Investors

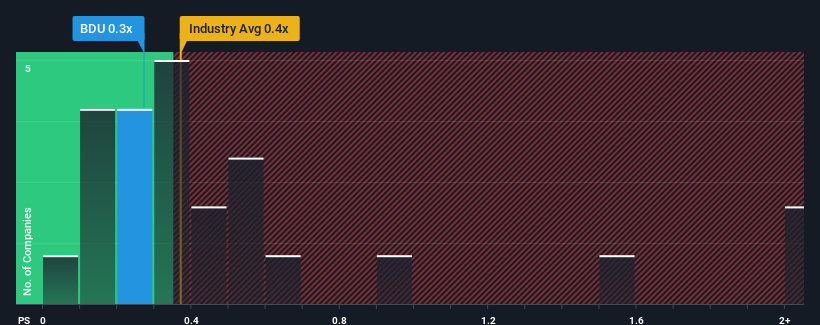

It's not a stretch to say that Federal International (2000) Ltd's (SGX:BDU) price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" for companies in the Trade Distributors industry in Singapore, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Federal International (2000)

How Has Federal International (2000) Performed Recently?

As an illustration, revenue has deteriorated at Federal International (2000) over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Federal International (2000), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Federal International (2000)'s Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Federal International (2000)'s is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 1.5% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we can see why Federal International (2000) is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears to us that Federal International (2000) maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for Federal International (2000) you should be aware of, and 1 of them is significant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Federal International (2000), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BDU

Federal International (2000)

An investment holding company, operates as an integrated service provider and procurement specialist in the oil and gas, and energy industries in Indonesia, Japan, the People’s Republic of China, Singapore, Thailand, the United Kingdom, Vietnam, and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives