As global markets navigate through a period of broad-based gains, with U.S. indexes approaching record highs and positive sentiment bolstered by strong labor market data, investors are increasingly looking to dividend stocks as a stable income source amidst geopolitical uncertainties and economic shifts. In this dynamic environment, selecting dividend stocks that offer consistent payouts and potential for growth can be an effective strategy for those seeking to balance risk while capitalizing on the current market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.25% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.35% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.77% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Tai Sin Electric (SGX:500)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tai Sin Electric Limited, with a market cap of SGD179.50 million, manufactures and deals in cable and wire products across Singapore, Malaysia, Brunei, Vietnam, Indonesia, Myanmar, Cambodia, Thailand and internationally.

Operations: Tai Sin Electric Limited generates revenue from several segments, including Cable & Wire (SGD272.15 million), Electrical Material Distribution (SGD95.10 million), Test & Inspection (SGD29.72 million), and Switchboard (SGD4.55 million).

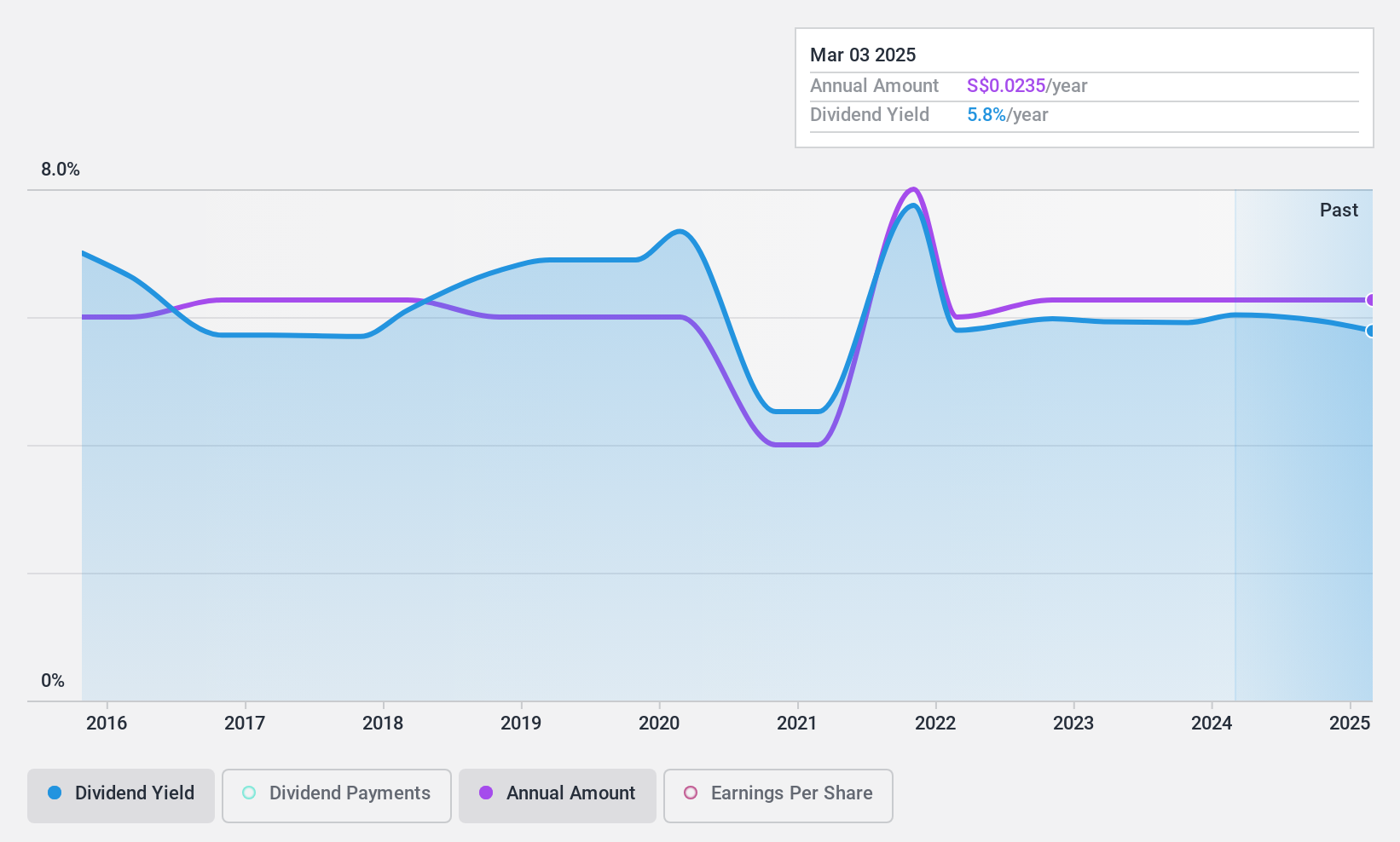

Dividend Yield: 5.9%

Tai Sin Electric's dividend payments have shown growth over the past decade but remain volatile, with a 5.95% yield placing them in the top 25% of Singaporean dividend payers. However, dividends are not covered by free cash flow, raising sustainability concerns despite a reasonable payout ratio of 74.1%. Recent board changes aim to refresh leadership and governance structures as part of compliance with tenure rules, potentially impacting future strategic direction and financial management.

- Dive into the specifics of Tai Sin Electric here with our thorough dividend report.

- Our valuation report here indicates Tai Sin Electric may be undervalued.

Bank of Nanjing (SHSE:601009)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Nanjing Co., Ltd. offers a range of financial products and services in China, with a market cap of CN¥112.03 billion.

Operations: Bank of Nanjing Co., Ltd. generates revenue through diverse financial products and services within China.

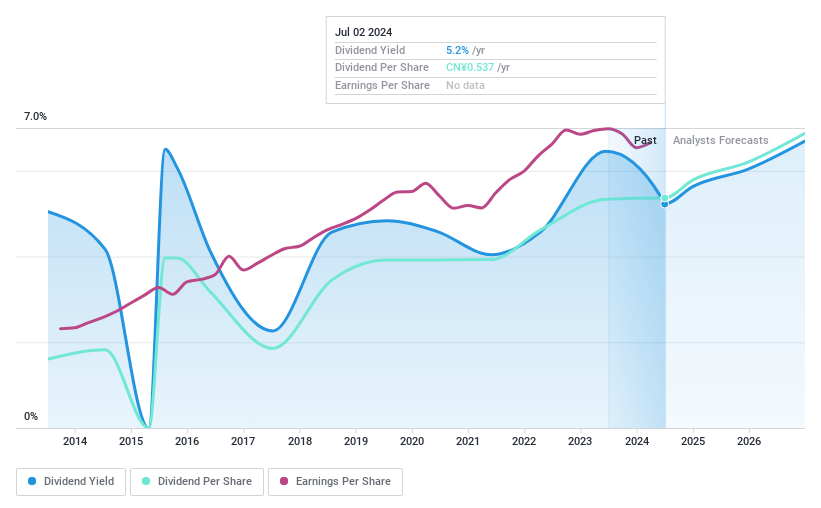

Dividend Yield: 6.5%

Bank of Nanjing's dividend yield of 6.53% ranks in the top 25% among Chinese payers, supported by a low payout ratio of 48.7%, ensuring coverage by earnings. Despite this, dividends have been volatile over the past decade, with an unstable track record. Recent earnings show growth with Q3 net income rising to CNY 5.07 billion from CNY 4.60 billion last year, indicating potential for future dividend stability if trends continue positively.

- Navigate through the intricacies of Bank of Nanjing with our comprehensive dividend report here.

- Our expertly prepared valuation report Bank of Nanjing implies its share price may be too high.

104 (TWSE:3130)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: 104 Corporation operates in the information technology, general advertising, employment, and human resource consultancy sectors in Taiwan and internationally, with a market cap of NT$7.27 billion.

Operations: 104 Corporation generates revenue through its operations in information technology, general advertising, employment services, and human resource consultancy both domestically in Taiwan and internationally.

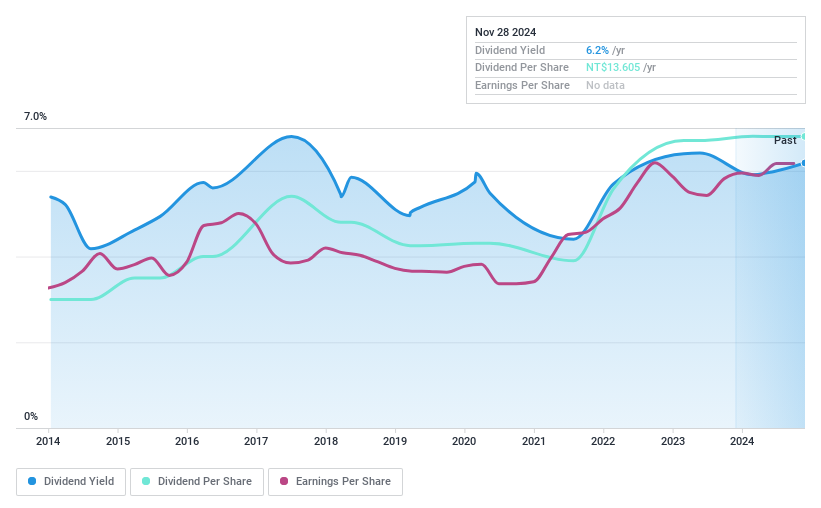

Dividend Yield: 6.1%

104 Corporation's dividend yield of 6.1% is among the top 25% in Taiwan, with stable and growing payouts over the past decade. However, a high payout ratio of 96.5% indicates dividends are not well covered by earnings, though cash flows provide some support with a reasonable cash payout ratio of 70%. Recent Q3 results show steady sales growth to TWD 665.05 million and consistent net income, suggesting ongoing operational stability despite dividend coverage concerns.

- Get an in-depth perspective on 104's performance by reading our dividend report here.

- According our valuation report, there's an indication that 104's share price might be on the cheaper side.

Turning Ideas Into Actions

- Discover the full array of 1957 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nanjing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601009

Bank of Nanjing

Provides various financial products and services in China.

Flawless balance sheet established dividend payer.