How United Overseas Bank's Q3 2025 Earnings Insights Will Impact Investors (SGX:U11)

Reviewed by Sasha Jovanovic

- United Overseas Bank Limited held its Q3 2025 earnings call on November 6, providing updates on financial performance and outlook for the quarter.

- This quarterly disclosure drew significant attention from analysts and investors, who rely on these events to evaluate growth prospects and operational strategy shifts.

- We will now examine how insights from the recent Q3 2025 earnings call may impact United Overseas Bank’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

United Overseas Bank Investment Narrative Recap

To be a United Overseas Bank shareholder, I believe you must have confidence in the long-term growth story of ASEAN banking and UOB’s ability to drive digital transformation, manage risk, and grow its fee income. The recent Q3 2025 earnings call did not materially alter the most important short-term catalyst, accelerated digital banking adoption, nor did it shift the biggest immediate risk: ongoing net interest margin compression in a lower-rate environment.

Of the recent announcements, the appointment of Jocelyn Tan as Head of Group Product Management and Digitalisation stands out. This leadership addition is highly relevant given ongoing digital initiatives remain a core driver of near-term growth, especially when cost-to-income pressures and fee competition are top of mind for investors.

In contrast, one risk investors should be aware of is how sustained margin pressure could offset technology-led revenue gains if...

Read the full narrative on United Overseas Bank (it's free!)

United Overseas Bank's narrative projects SGD16.0 billion revenue and SGD6.7 billion earnings by 2028. This requires 6.2% yearly revenue growth and a SGD0.8 billion earnings increase from the current earnings of SGD5.9 billion.

Uncover how United Overseas Bank's forecasts yield a SGD35.73 fair value, a 5% upside to its current price.

Exploring Other Perspectives

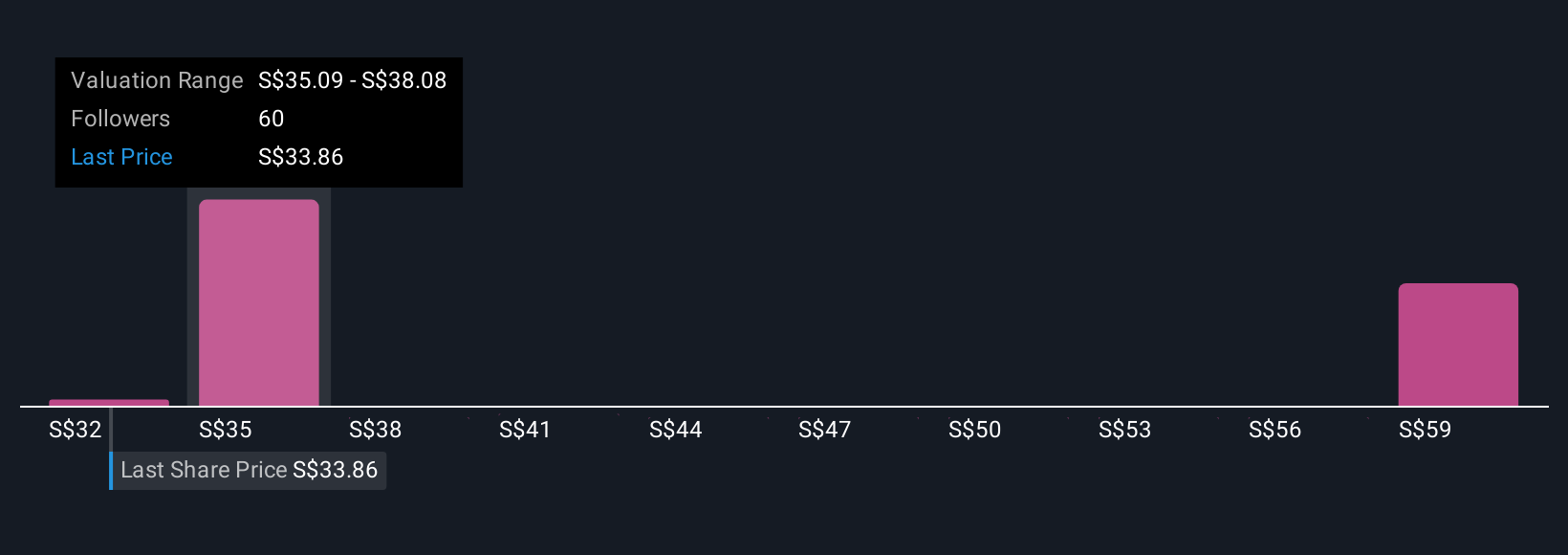

Ten private investors in the Simply Wall St Community estimate UOB’s fair value between S$32.09 and S$59.99, reflecting a wide span of expectations. While digital transformation remains the key catalyst for the bank, your own outlook may shift as the earnings and margin story evolves, explore these differing viewpoints to inform your next steps.

Explore 10 other fair value estimates on United Overseas Bank - why the stock might be worth as much as 76% more than the current price!

Build Your Own United Overseas Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Overseas Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United Overseas Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Overseas Bank's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U11

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives