OCBC (SGX:O39) Valuation: Assessing the Bank After Steady Earnings and Leadership Shift Toward Digital Growth

Reviewed by Simply Wall St

Oversea-Chinese Banking (SGX:O39) just posted its third quarter results, showing net income holding steady even as net interest income slipped. Investors are also watching a boardroom change aimed at accelerating OCBC's strategic growth and digital transformation.

See our latest analysis for Oversea-Chinese Banking.

OCBC's share price has gathered steam in recent weeks, adding 10% over the last month alone, as investors respond to its sturdy earnings and evolving digital strategy. This momentum builds on a robust track record; the stock has delivered a total shareholder return of nearly 20% over the past year and a striking 142% over five years.

If the bank’s transformation story has you looking for what’s next, now is an ideal moment to explore opportunities with fast growing stocks with high insider ownership.

But after such a strong run, is OCBC still undervalued or are investors already pricing in the bank’s future digital and growth ambitions? Is there still a buying opportunity, or has the market anticipated what comes next?

Most Popular Narrative: 5% Overvalued

Compared to Oversea-Chinese Banking’s last close price of SGD 18.52, the most widely followed narrative sets fair value at SGD 17.58, just below where the stock currently trades. That tight gap points to a market struggling to price in OCBC’s shifting growth outlook as it leans further into digital, insurance, and cross-border strategies.

OCBC's strengthened synergy and integration with Great Eastern (now a 93.7% stake), coupled with rising demand for insurance and bancassurance products from urbanizing, younger regional populations, expand recurring non-interest income sources and support higher overall group earnings.

Curious what transforms rising non-interest income into a premium price target? The narrative is built around a bullish mix of long-term regional growth, digital disruption, and a future profit multiple that defies banking sector norms. Want to see how ambitious forecasts of profit expansion and recurring income drive this hard-to-justify valuation? Unlock the specifics that make this narrative tick.

Result: Fair Value of $17.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in interest rates or heightened global trade uncertainty could quickly undermine the optimistic outlook surrounding OCBC’s growth initiatives and valuations.

Find out about the key risks to this Oversea-Chinese Banking narrative.

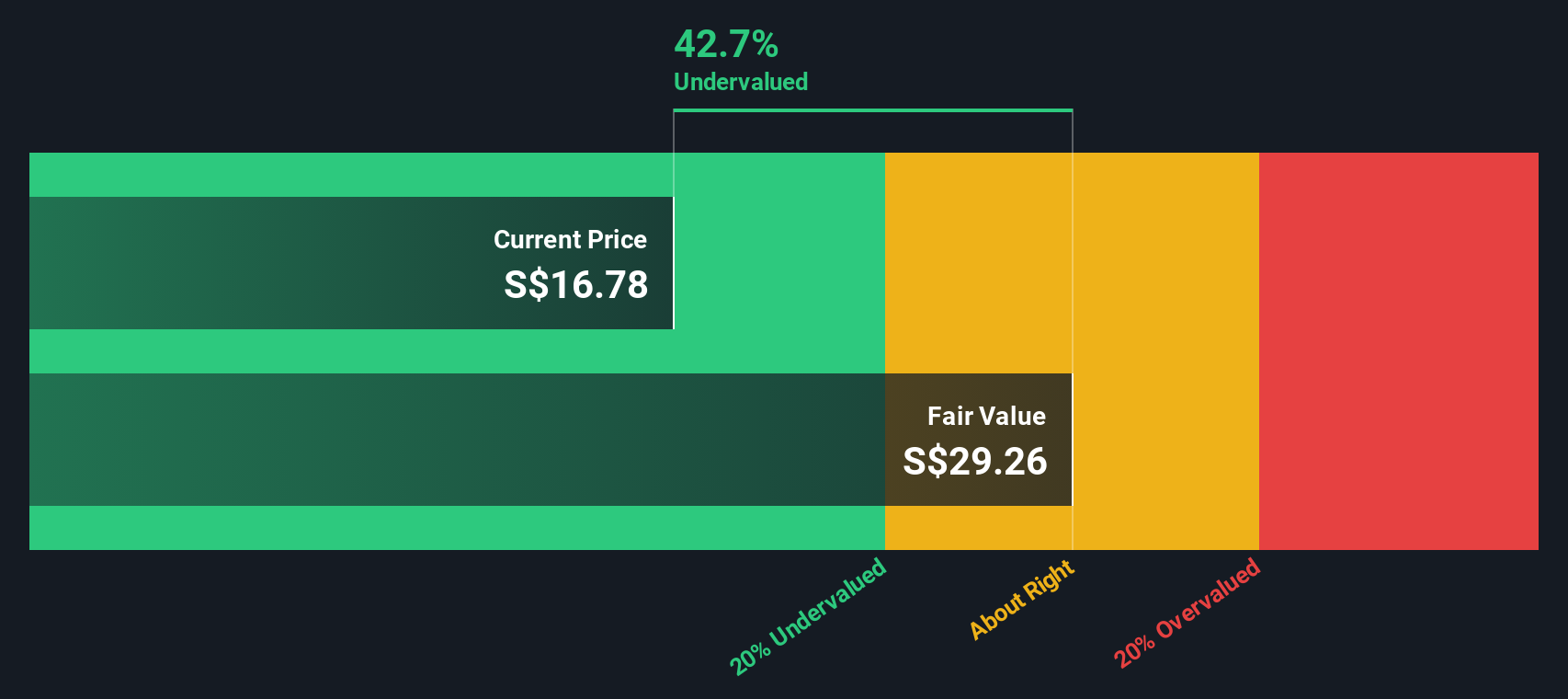

Another View: Discounted Cash Flow Paints a Different Picture

While the market and analysts see OCBC as slightly overvalued, our SWS DCF model offers a strikingly different perspective. According to this method, OCBC shares are trading more than 39% below their estimated fair value. This suggests substantial long-term upside for patient investors. Could this be a rare value opportunity, or is the market wary for good reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Oversea-Chinese Banking for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Oversea-Chinese Banking Narrative

If you have a different take or want to dig deeper into the numbers yourself, you can craft your own OCBC narrative in just minutes, your way with Do it your way.

A great starting point for your Oversea-Chinese Banking research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity slip past you. Take advantage of Simply Wall Street’s smart screeners to find stocks that could shape your portfolio’s next big move.

- Boost your passive income by targeting reliable payers through these 16 dividend stocks with yields > 3%, and uncover stocks offering yields above 3% in today’s market.

- Catch the momentum of emerging tech by exploring these 25 AI penny stocks, where pioneers in artificial intelligence are setting new industry standards.

- Tap into significant upside potential by analyzing these 877 undervalued stocks based on cash flows, which features companies trading at a discount to their cash flow-based fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:O39

Oversea-Chinese Banking

Provides financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives