In the last week, the Singapore market has stayed flat, with notable gains of 4.3% in the Energy sector. Over the past 12 months, the market has risen by 8.7%, and earnings are forecast to grow by 10% annually. In this context, identifying dividend stocks that offer stable returns can be a prudent strategy for investors looking to benefit from both income and potential growth in a steady market environment.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.78% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.40% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.06% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.43% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.15% | ★★★★★☆ |

| QAF (SGX:Q01) | 6.02% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 9.62% | ★★★★☆☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.01% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.83% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.36% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Oversea-Chinese Banking (SGX:O39)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited (SGX:O39) and its subsidiaries provide financial services across Singapore, Malaysia, Indonesia, Greater China, the rest of the Asia Pacific, and internationally with a market cap of approximately SGD67.96 billion.

Operations: Oversea-Chinese Banking Corporation Limited generates revenue primarily from Global Wholesale Banking (SGD5.23 billion), Global Consumer/Private Banking (SGD5.19 billion), Insurance (SGD1.27 billion), and Global Markets (SGD512 million).

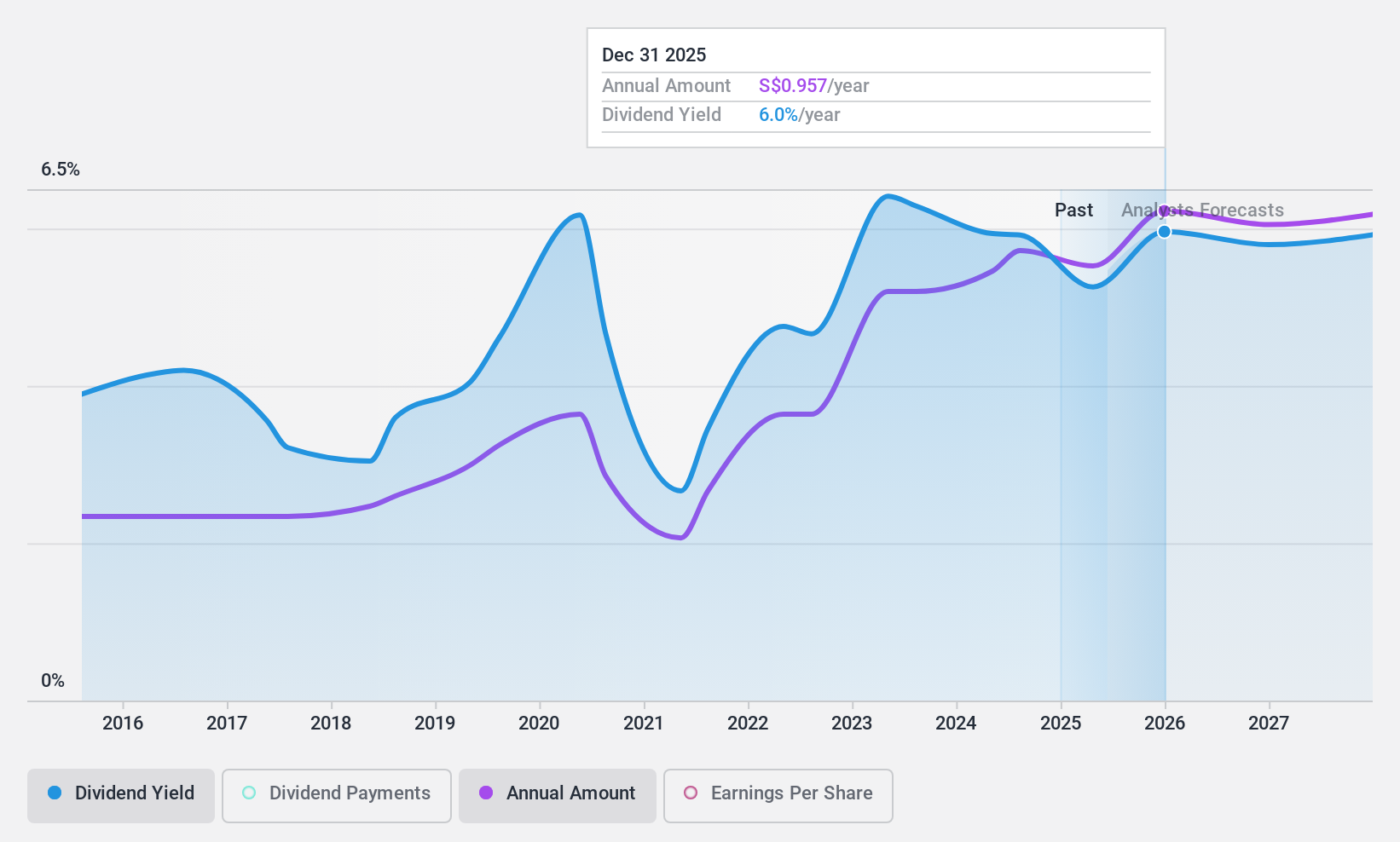

Dividend Yield: 5.8%

Oversea-Chinese Banking Corporation Limited (OCBC) offers a reasonable dividend yield, with recent increases reflecting strong earnings growth. Despite a payout ratio of 52.8%, dividends are well-covered by earnings and expected to remain sustainable. However, the retirement of Group COO Lim Khiang Tong may impact operational stability. OCBC's dividend track record has been volatile over the past decade, but recent trends show improvement in reliability and growth.

- Take a closer look at Oversea-Chinese Banking's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Oversea-Chinese Banking is trading behind its estimated value.

QAF (SGX:Q01)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: QAF Limited is an investment holding company involved in the manufacture and distribution of bread, bakery, and confectionery products across Singapore, Australia, the Philippines, Malaysia, and internationally with a market cap of SGD477.47 million.

Operations: QAF Limited generates revenue primarily from its Bakery segment, which accounts for SGD460.50 million, and its Distribution & Warehousing segment, contributing SGD164.22 million.

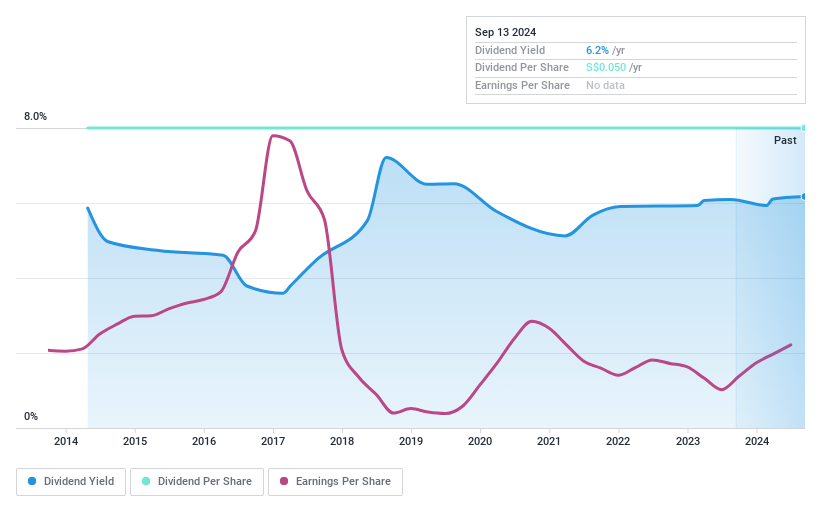

Dividend Yield: 6%

QAF Limited has announced an interim tax-exempt dividend of S$0.01 per share for FY2024, with a payment date of 26 September 2024. The company reported half-year earnings of S$12.48 million, up from S$4.91 million the previous year, and stable dividends over the past decade. Despite a high payout ratio (82%) and cash payout ratio (82.9%), dividends are covered by earnings and cash flows, making them sustainable but not growing over time.

- Dive into the specifics of QAF here with our thorough dividend report.

- According our valuation report, there's an indication that QAF's share price might be on the expensive side.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company offering stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services across Singapore, Hong Kong, Thailand, Malaysia and internationally with a market cap of SGD1.43 billion.

Operations: UOB-Kay Hian Holdings Limited generates SGD581.07 million in revenue from securities and futures broking and other related services.

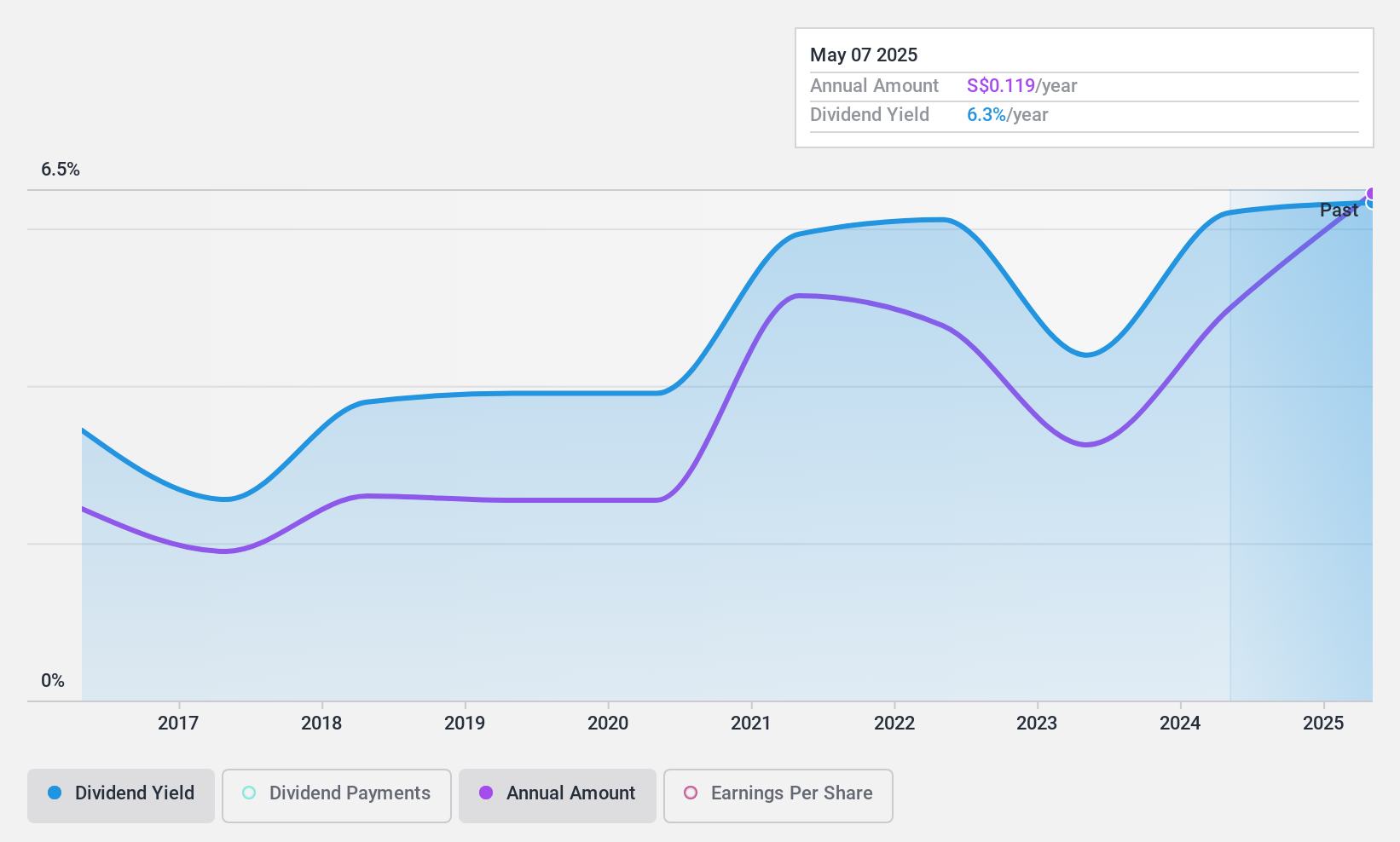

Dividend Yield: 6%

UOB-Kay Hian Holdings reported half-year earnings of S$113.91 million, up from S$69.32 million the previous year, with basic EPS increasing to S$0.1264. While its dividend yield of 6.01% is among the top 25% in Singapore, dividends have been volatile and not well covered by cash flows despite a low payout ratio (38.6%). Recent changes include new company secretaries appointed on 20 September 2024.

- Click here to discover the nuances of UOB-Kay Hian Holdings with our detailed analytical dividend report.

- The valuation report we've compiled suggests that UOB-Kay Hian Holdings' current price could be quite moderate.

Seize The Opportunity

- Reveal the 21 hidden gems among our Top SGX Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:O39

Oversea-Chinese Banking

Engages in the provision of financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

Flawless balance sheet with solid track record and pays a dividend.