- Sweden

- /

- Telecom Services and Carriers

- /

- OM:TELIA

Telia Company (STO:TELIA) Is Increasing Its Dividend To kr1.00

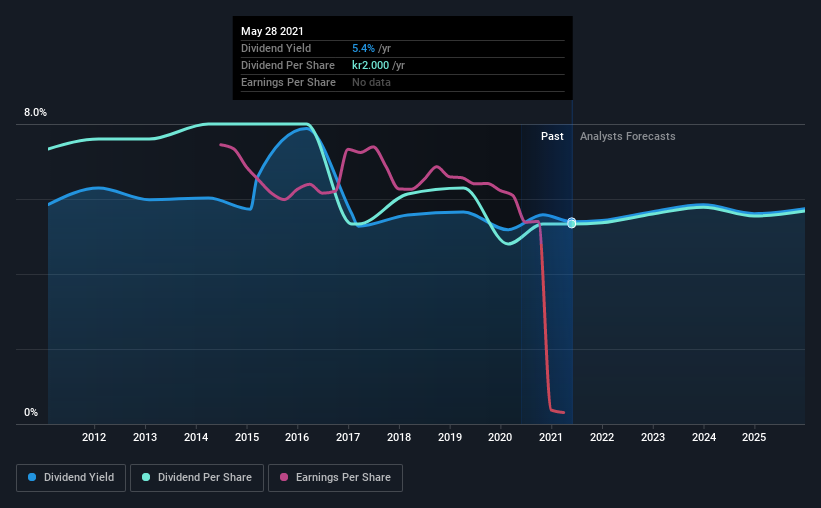

The board of Telia Company AB (publ) (STO:TELIA) has announced that it will be increasing its dividend on the 2nd of November to kr1.00. This will take the dividend yield from 5.4% to 7.1%, providing a nice boost to shareholder returns.

View our latest analysis for Telia Company

Telia Company's Distributions May Be Difficult To Sustain

A big dividend yield for a few years doesn't mean much if it can't be sustained. Even though Telia Company isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Recent, EPS has fallen by 39.7%, so this could continue over the next year. This means that the company won't turn a profit over the next year, but with healthy cash flows at the moment the dividend could still be okay to continue.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2011, the first annual payment was kr2.75, compared to the most recent full-year payment of kr2.00. Doing the maths, this is a decline of about 3.1% per year. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Telia Company's EPS has fallen by approximately 40% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

Telia Company's Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Telia Company's payments are rock solid. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for Telia Company that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

When trading Telia Company or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Telia Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:TELIA

Telia Company

Provides communication services to businesses, individuals, families, and communities in Sweden, Finland, Norway, Denmark, Lithuania, Estonia, and Latvia.

Reasonable growth potential second-rate dividend payer.