- Sweden

- /

- Telecom Services and Carriers

- /

- OM:OVZON

Ovzon AB (publ)'s (STO:OVZON) Stock Retreats 27% But Revenues Haven't Escaped The Attention Of Investors

To the annoyance of some shareholders, Ovzon AB (publ) (STO:OVZON) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Still, a bad month hasn't completely ruined the past year with the stock gaining 30%, which is great even in a bull market.

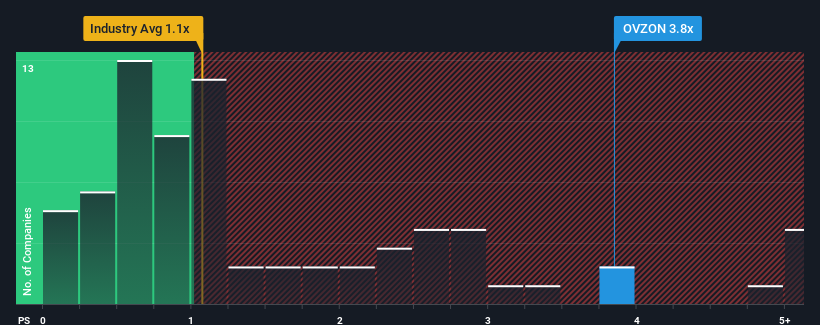

Even after such a large drop in price, when almost half of the companies in Sweden's Telecom industry have price-to-sales ratios (or "P/S") below 1.4x, you may still consider Ovzon as a stock not worth researching with its 3.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Ovzon

What Does Ovzon's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Ovzon's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Ovzon's future stacks up against the industry? In that case, our free report is a great place to start.How Is Ovzon's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Ovzon's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 3.4% decrease to the company's top line. Still, the latest three year period has seen an excellent 101% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 47% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 1.9%, which is noticeably less attractive.

With this information, we can see why Ovzon is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Ovzon's P/S Mean For Investors?

A significant share price dive has done very little to deflate Ovzon's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Ovzon maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Telecom industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Ovzon you should be aware of, and 1 of them is potentially serious.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OVZON

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.