- Switzerland

- /

- Pharma

- /

- SWX:COPN

Undiscovered Gems In Europe Three Promising Stocks For May 2025

Reviewed by Simply Wall St

As European markets experience a resurgence, with the pan-European STOXX Europe 600 Index climbing 3.44% due to easing tariff concerns and improved economic growth in the eurozone, investors are keenly searching for opportunities within this optimistic landscape. In such an environment, identifying promising stocks involves looking for companies that can capitalize on favorable economic conditions and exhibit potential for growth amidst shifting market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Green Tech International (BVB:GREEN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Green Tech International S.A. focuses on the production and sale of geothermal energy, with a market capitalization of RON1.12 billion.

Operations: Green Tech generates revenue primarily from the sale of geothermal energy. The company has a market capitalization of RON1.12 billion.

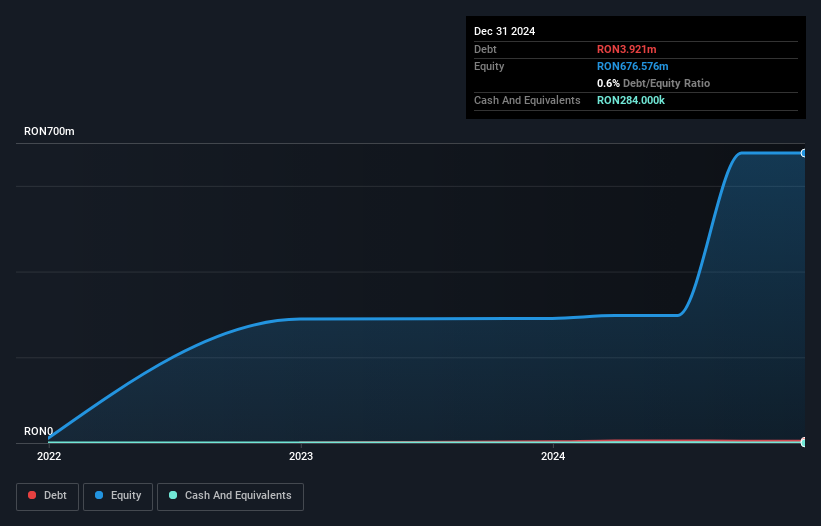

Green Tech International, a small yet promising player in the market, has shown remarkable earnings growth of 743% over the past year, significantly outpacing its industry peers. Despite high volatility in its share price recently, the company trades at nearly 79% below estimated fair value. With a net debt to equity ratio of just 0.5%, their financial structure appears robust and interest payments are well covered by EBIT at an impressive 32 times coverage. While revenue remains modest at RON12M, Green Tech's high-quality earnings and positive free cash flow suggest potential for future growth.

Bahnhof (OM:BAHN B)

Simply Wall St Value Rating: ★★★★★★

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market capitalization of SEK6.21 billion.

Operations: Bahnhof AB (publ) generates revenue primarily from its Retail Market, contributing SEK1.38 billion, and the Corporate Market, excluding Typhoon, which adds SEK634.16 million.

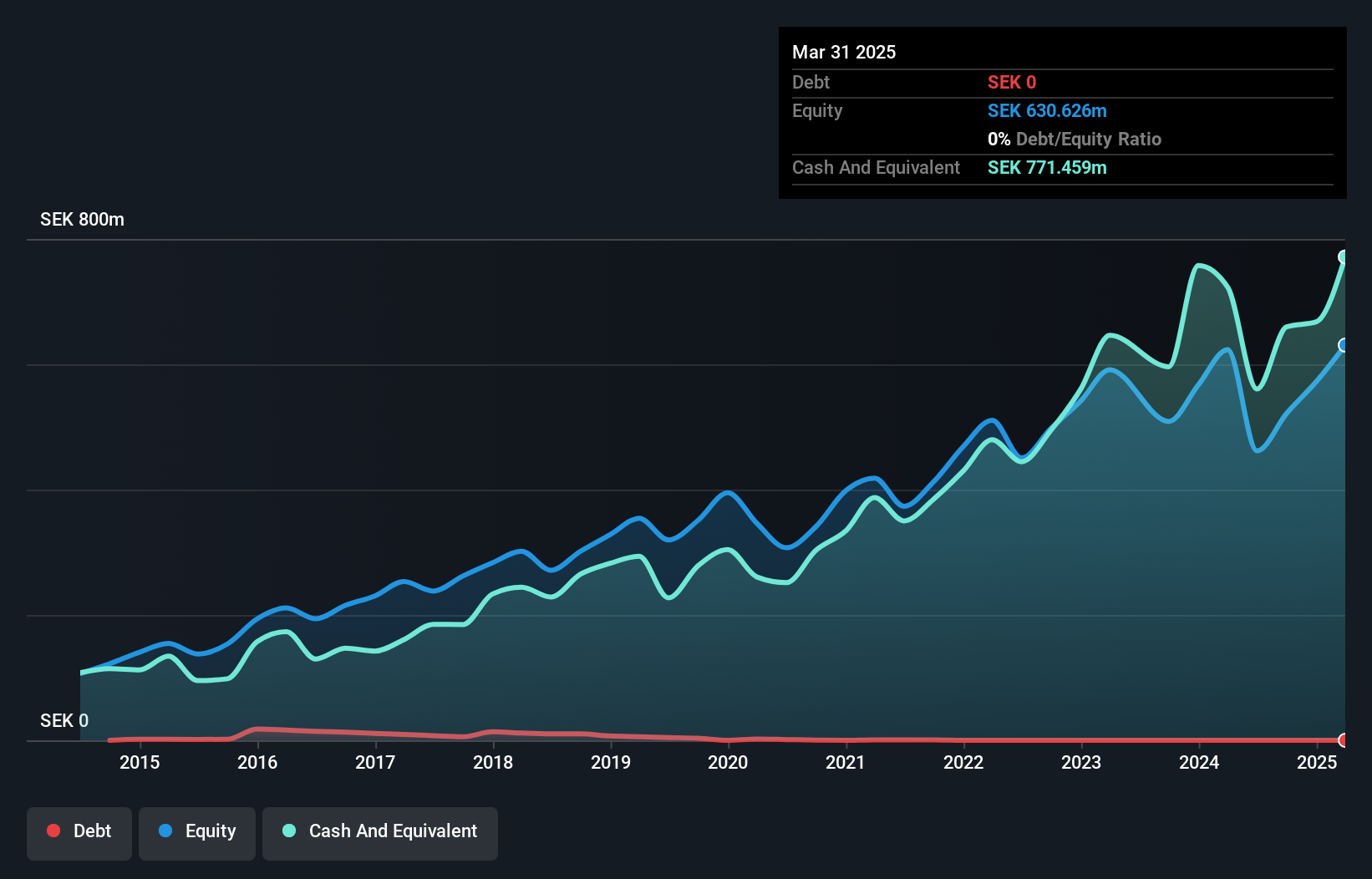

Bahnhof, a nimble player in the telecom sector, has seen its earnings grow at 14% annually over the past five years. Despite being debt-free, it trades at a significant discount of 40% below estimated fair value. The company reported Q1 2025 sales of SEK 536.18 million and net income of SEK 57.75 million, reflecting stable performance with basic earnings per share rising to SEK 0.54 from SEK 0.52 last year. With high-quality earnings and positive free cash flow, Bahnhof's financial health seems robust even as its growth pace lags behind the industry average of 10%.

- Dive into the specifics of Bahnhof here with our thorough health report.

Understand Bahnhof's track record by examining our Past report.

Cosmo Pharmaceuticals (SWX:COPN)

Simply Wall St Value Rating: ★★★★★★

Overview: Cosmo Pharmaceuticals N.V. specializes in developing and commercializing products for gastroenterology, dermatology, and healthtech on a global scale, with a market capitalization of CHF774.33 million.

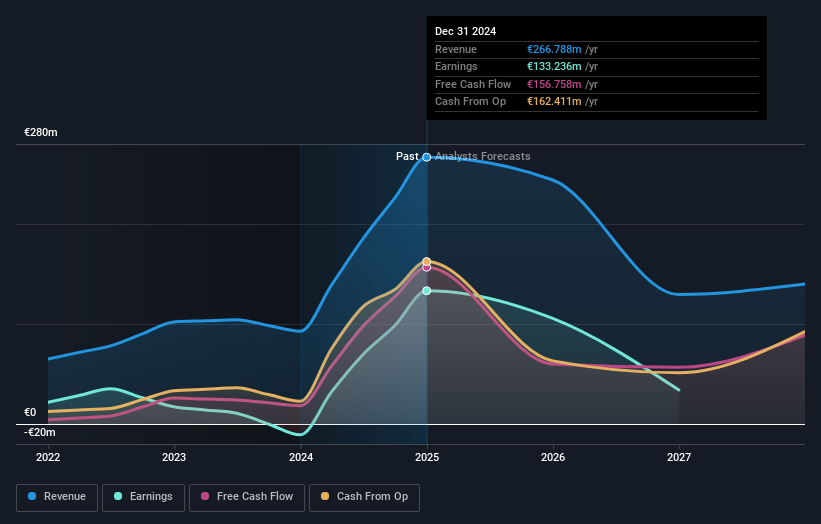

Operations: Cosmo Pharmaceuticals generates revenue primarily from its pharmaceuticals segment, amounting to €266.79 million. The company's market capitalization stands at CHF774.33 million.

Cosmo Pharmaceuticals, a nimble player in the pharma arena, has recently reported impressive financial results with net income soaring to €133.24 million from a previous loss of €10.78 million, and sales jumping to €266.79 million from €92.78 million last year. The company is leveraging AI as a strategic growth driver, appointing Andrea Cherubini as Chief AI Officer to spearhead innovation across its portfolio. Cosmo's debt-to-equity ratio has impressively shrunk from 40% to nearly zero over five years, indicating robust financial health and positioning it well for future expansions like Winlevi's UK approval with Glenmark Pharmaceuticals.

Taking Advantage

- Click through to start exploring the rest of the 329 European Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Cosmo Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:COPN

Cosmo Pharmaceuticals

Focuses on the development and commercialization products for gastroenterology, dermatology, and healthtech worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives