- Sweden

- /

- Food and Staples Retail

- /

- OM:AXFO

Swedish Dividend Stocks To Watch In September 2024

Reviewed by Simply Wall St

As European inflation nears the central bank’s target, the Swedish stock market has shown resilience, supported by a stable economic environment and positive investor sentiment. With this backdrop, September 2024 presents an opportune moment to consider dividend stocks in Sweden. When evaluating dividend stocks, it's crucial to focus on companies with strong financial health and consistent payout histories, especially in stable economic conditions like those currently seen in Sweden.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.42% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.67% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.58% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.75% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.43% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.10% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.99% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.37% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.75% | ★★★★★☆ |

| Bahnhof (OM:BAHN B) | 3.70% | ★★★★☆☆ |

Click here to see the full list of 18 stocks from our Top Swedish Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Axfood (OM:AXFO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Axfood AB (publ) operates in the food retail and wholesale sectors primarily in Sweden, with a market cap of approximately SEK59.22 billion.

Operations: Axfood AB (publ) generates revenue from several segments: Dagab (SEK75.09 billion), Willys (SEK44.82 billion), Snabbgross (SEK5.38 billion), Joint-Group (SEK1.45 billion), and Home Purchase (SEK7.67 billion).

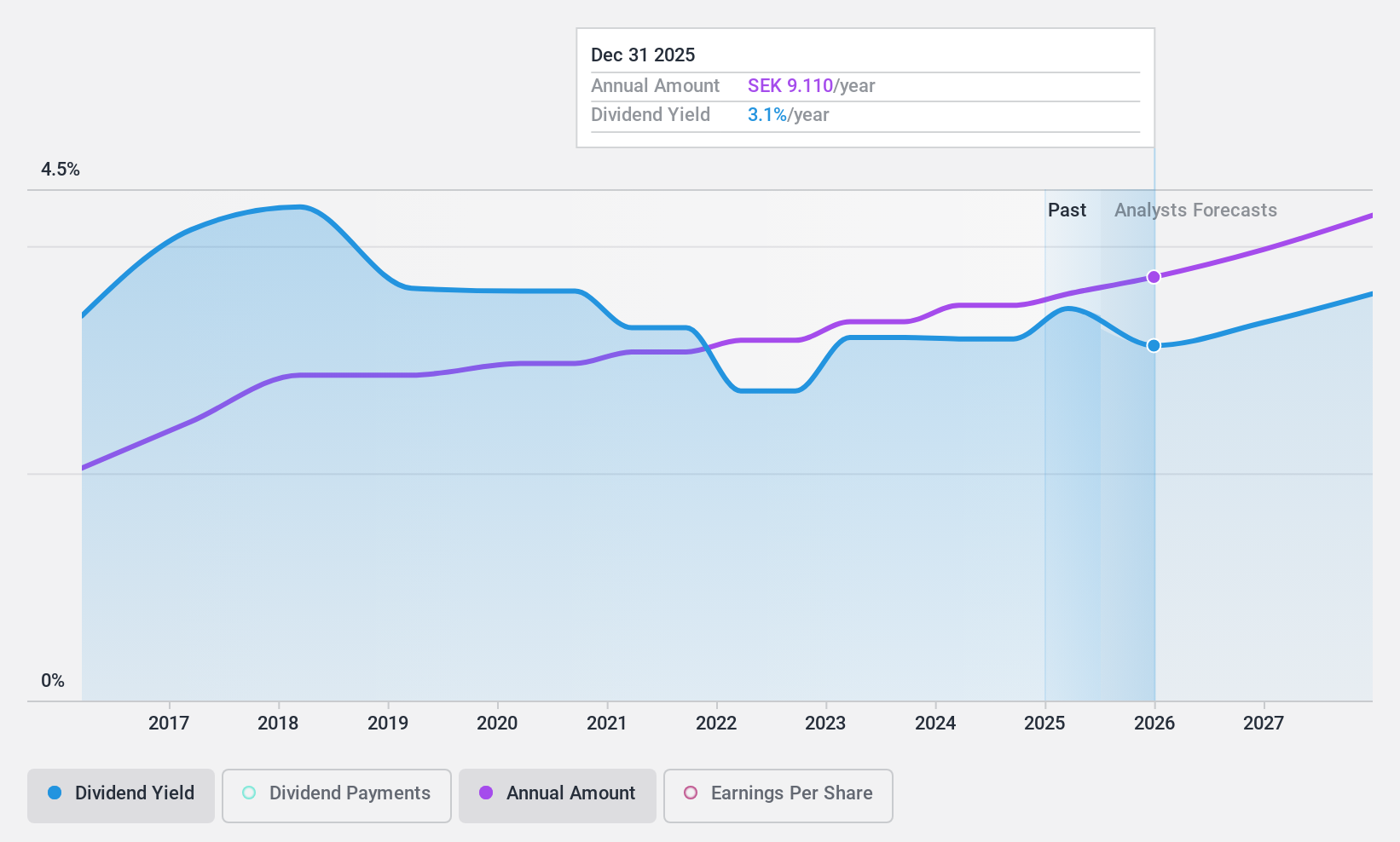

Dividend Yield: 3.1%

Axfood's dividend payments are well-covered by earnings (76.8% payout ratio) and cash flows (39.3% cash payout ratio), ensuring sustainability. The company has a reliable 3.1% dividend yield, although lower than the top 25% of Swedish dividend payers. Recent executive changes include Simone Margulies as CEO, and the closure of Middagsfrid due to market challenges, aligning with their strategic focus on profitability amidst high inflation impacts on consumer behavior.

- Delve into the full analysis dividend report here for a deeper understanding of Axfood.

- Upon reviewing our latest valuation report, Axfood's share price might be too optimistic.

Bahnhof (OM:BAHN B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market cap of SEK 5.82 billion.

Operations: Bahnhof AB (publ) generates revenue from its Internet and telecommunications services across Sweden and Europe.

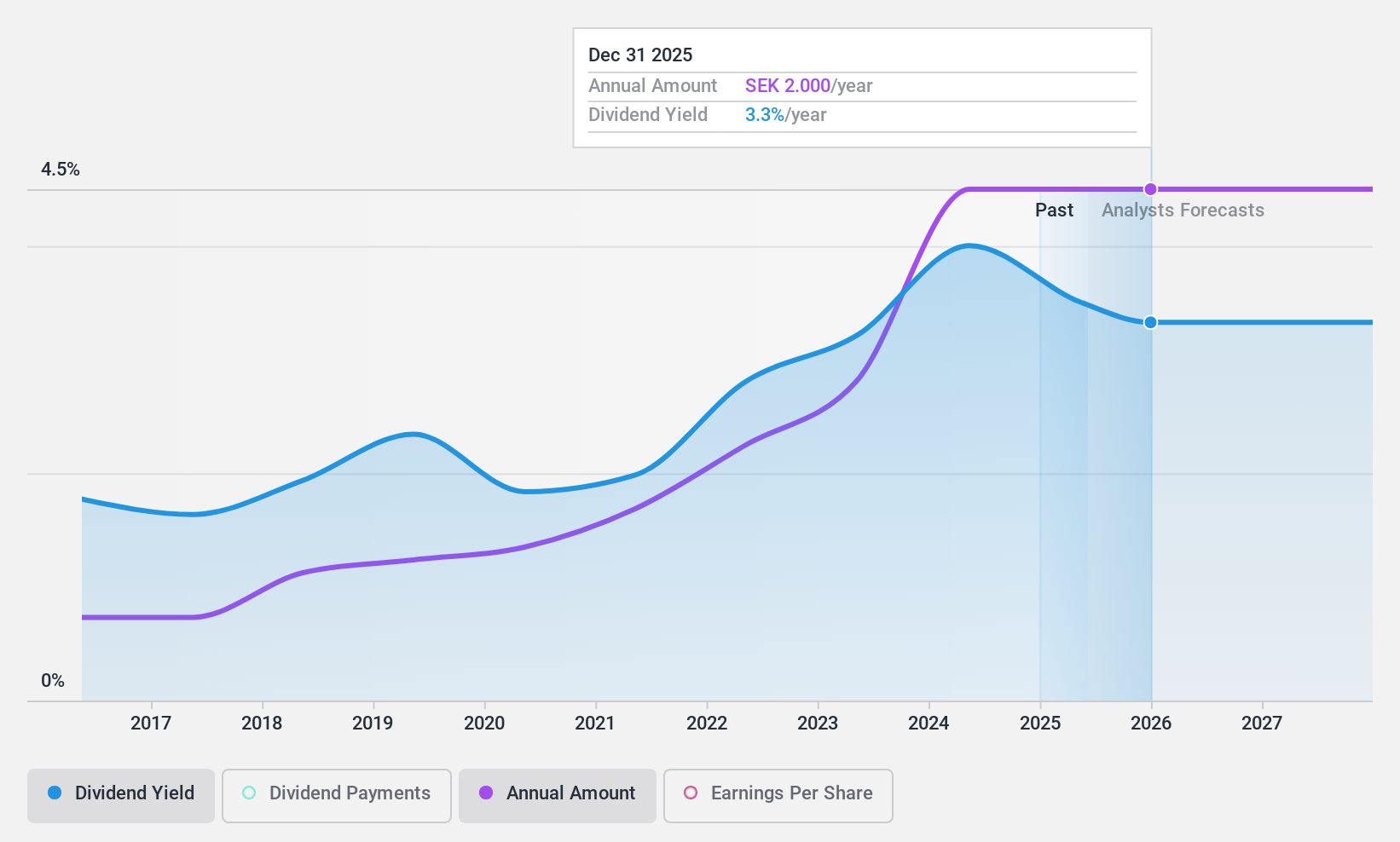

Dividend Yield: 3.7%

Bahnhof AB's dividend payments have been stable and growing over the past 10 years, though its current yield of 3.7% is below the top quartile of Swedish dividend payers. The company reported strong earnings growth, with net income rising to SEK 53.71 million in Q2 2024 from SEK 46.44 million a year ago. However, its high payout ratio (94.4%) indicates dividends are not well covered by earnings, raising concerns about sustainability despite adequate cash flow coverage (85.3%).

- Get an in-depth perspective on Bahnhof's performance by reading our dividend report here.

- The analysis detailed in our Bahnhof valuation report hints at an inflated share price compared to its estimated value.

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag (OM:SFAB) offers non-life insurance services to private and business customers across several countries including Sweden, Denmark, Norway, Finland, Germany, Switzerland and internationally with a market cap of SEK1.54 billion.

Operations: Solid Försäkringsaktiebolag (OM:SFAB) generates revenue from three main segments: Product (SEK320.51 million), Assistance (SEK351.63 million), and Personal Safety (SEK435.09 million).

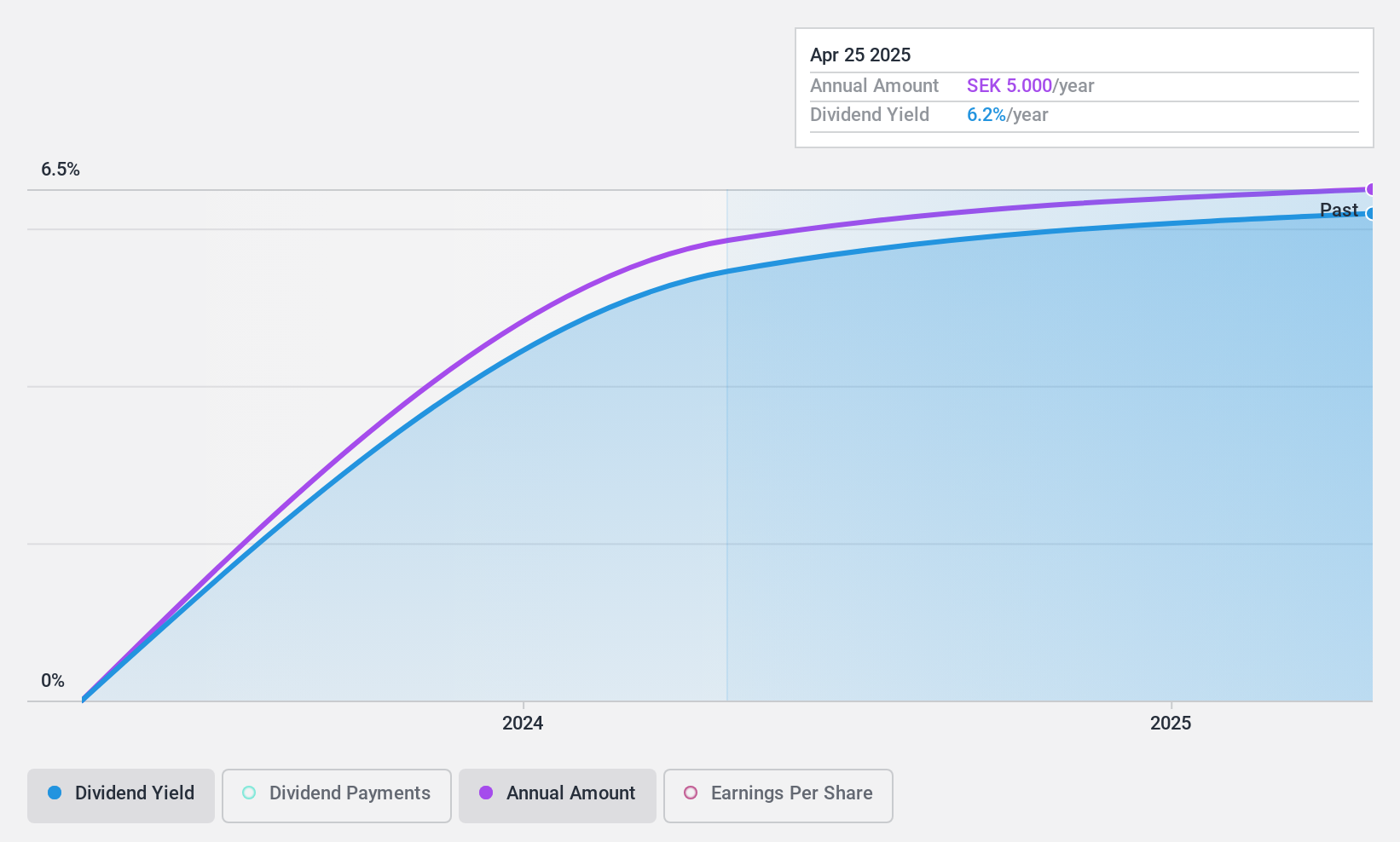

Dividend Yield: 5.4%

Solid Försäkringsaktiebolag's dividend yield of 5.36% places it in the top quartile of Swedish dividend payers. The company's dividend payments are well covered by earnings with a payout ratio of 49.1%, and cash flows with a cash payout ratio of 73.7%. Recent buybacks, including SEK 10.19 million in July, aim to improve capital structure and shareholder value. However, it's too early to assess the reliability and stability of its dividends as they have only recently started paying out.

- Click here to discover the nuances of Solid Försäkringsaktiebolag with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Solid Försäkringsaktiebolag is priced lower than what may be justified by its financials.

Where To Now?

- Unlock more gems! Our Top Swedish Dividend Stocks screener has unearthed 15 more companies for you to explore.Click here to unveil our expertly curated list of 18 Top Swedish Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AXFO

Axfood

Engages in the food retail and wholesale businesses primarily in Sweden.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives