- France

- /

- Consumer Durables

- /

- ENXTPA:RBO

Aedas Homes And 2 More Top Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate cuts in Europe and rising inflation expectations in the U.S., investors are keenly observing how these macroeconomic shifts influence equity performance. While major indices like the Nasdaq Composite continue to reach new heights, sectors such as communication services and consumer discretionary have shown resilience amidst broader market declines. In this context, dividend stocks can offer a compelling option for those seeking steady income streams, especially when market volatility is high and economic indicators suggest potential shifts in monetary policy.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1858 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Aedas Homes (BME:AEDAS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aedas Homes, S.A. is involved in the development of residential properties in Spain and has a market cap of approximately €1.10 billion.

Operations: Aedas Homes, S.A. generates revenue primarily from its property development segment, which accounted for €1.22 billion.

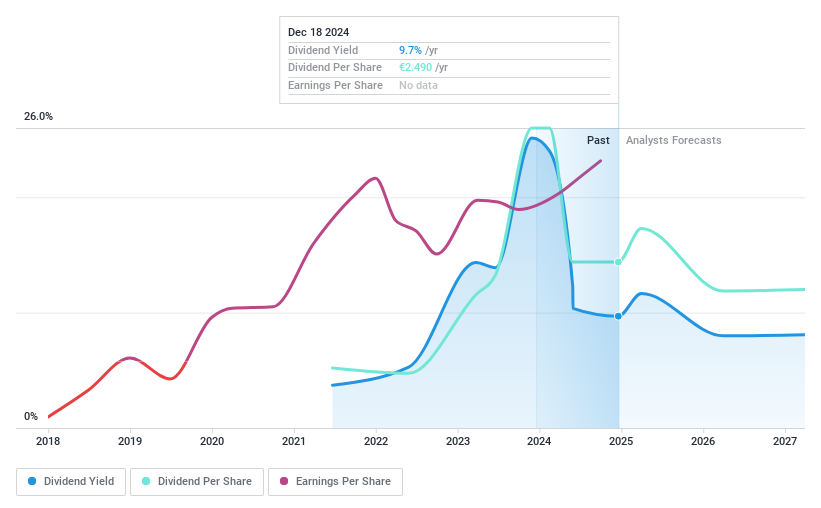

Dividend Yield: 9.7%

Aedas Homes reported a significant increase in net income to €24.66 million for the half year ended September 30, 2024, with earnings per share rising to €0.56. Despite an unstable dividend track record over three years and forecasts of declining earnings, Aedas's dividends are well-covered by both earnings (8% payout ratio) and cash flows (37.2% cash payout ratio). The company offers a high dividend yield of 9.69%, placing it among the top payers in Spain.

- Click here to discover the nuances of Aedas Homes with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Aedas Homes shares in the market.

Roche Bobois (ENXTPA:RBO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Roche Bobois S.A. is involved in the design and distribution of furniture on a global scale, with a market capitalization of €369.21 million.

Operations: Roche Bobois S.A.'s revenue is primarily derived from its segments, with Roche Bobois USA/Canada contributing €141.89 million, Roche Bobois France generating €115.24 million, Roche Bobois Europe (excluding France) at €102.35 million, Cuir Center bringing in €41.90 million, and the Corporate segment accounting for €3.82 million.

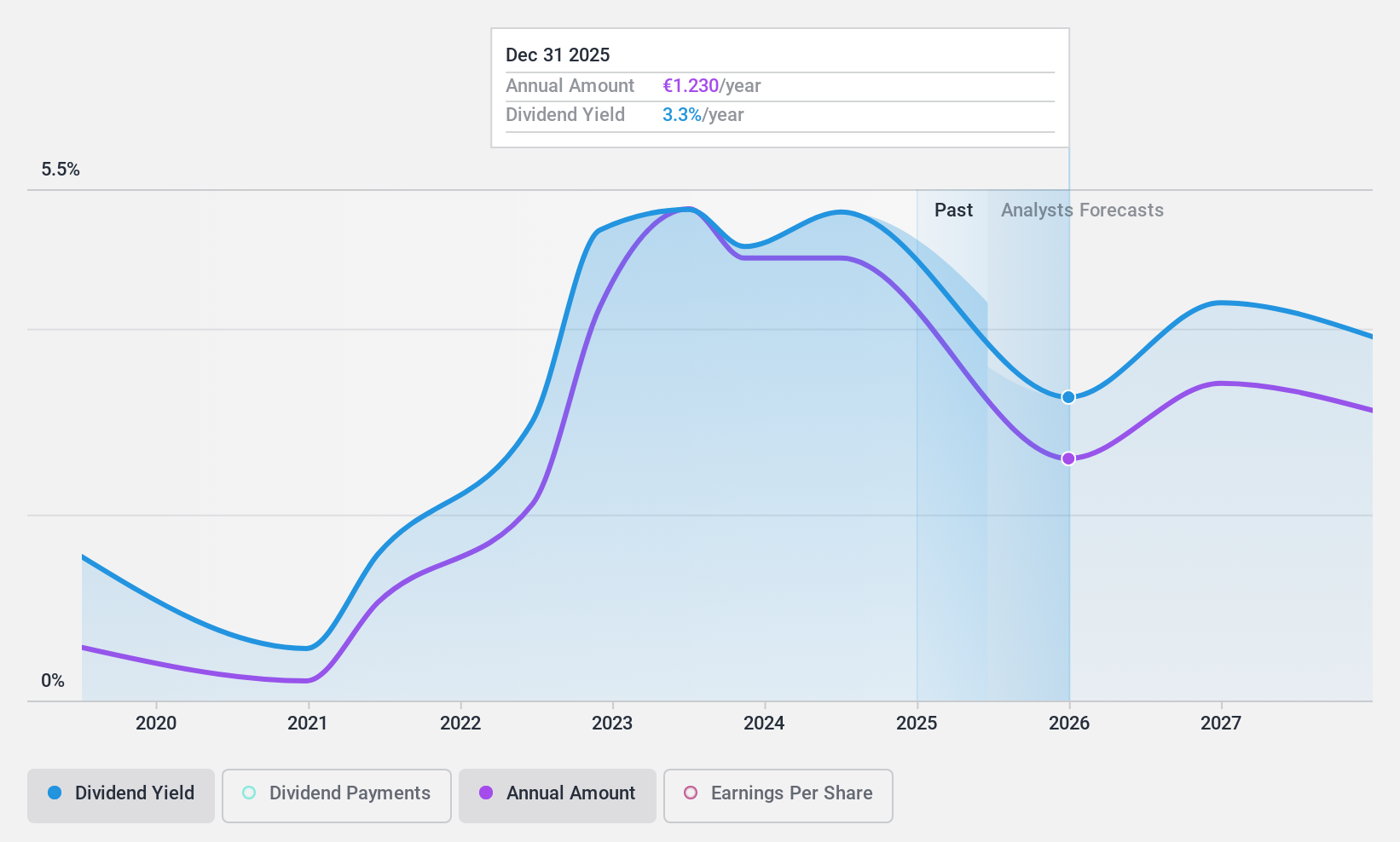

Dividend Yield: 6%

Roche Bobois offers a dividend yield of 6.05%, ranking it in the top 25% of French dividend payers. The dividends are reasonably covered by earnings and cash flows, with payout ratios around 63%. However, its six-year dividend history is marked by volatility and unreliability. Despite this instability, the stock trades at a significant discount to its estimated fair value and analysts expect a price increase of 23.7%.

- Get an in-depth perspective on Roche Bobois' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Roche Bobois' current price could be quite moderate.

Bahnhof (OM:BAHN B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market capitalization of SEK5.49 billion.

Operations: Bahnhof AB (publ) generates revenue from its operations in the Internet and telecommunications industry within Sweden and other parts of Europe.

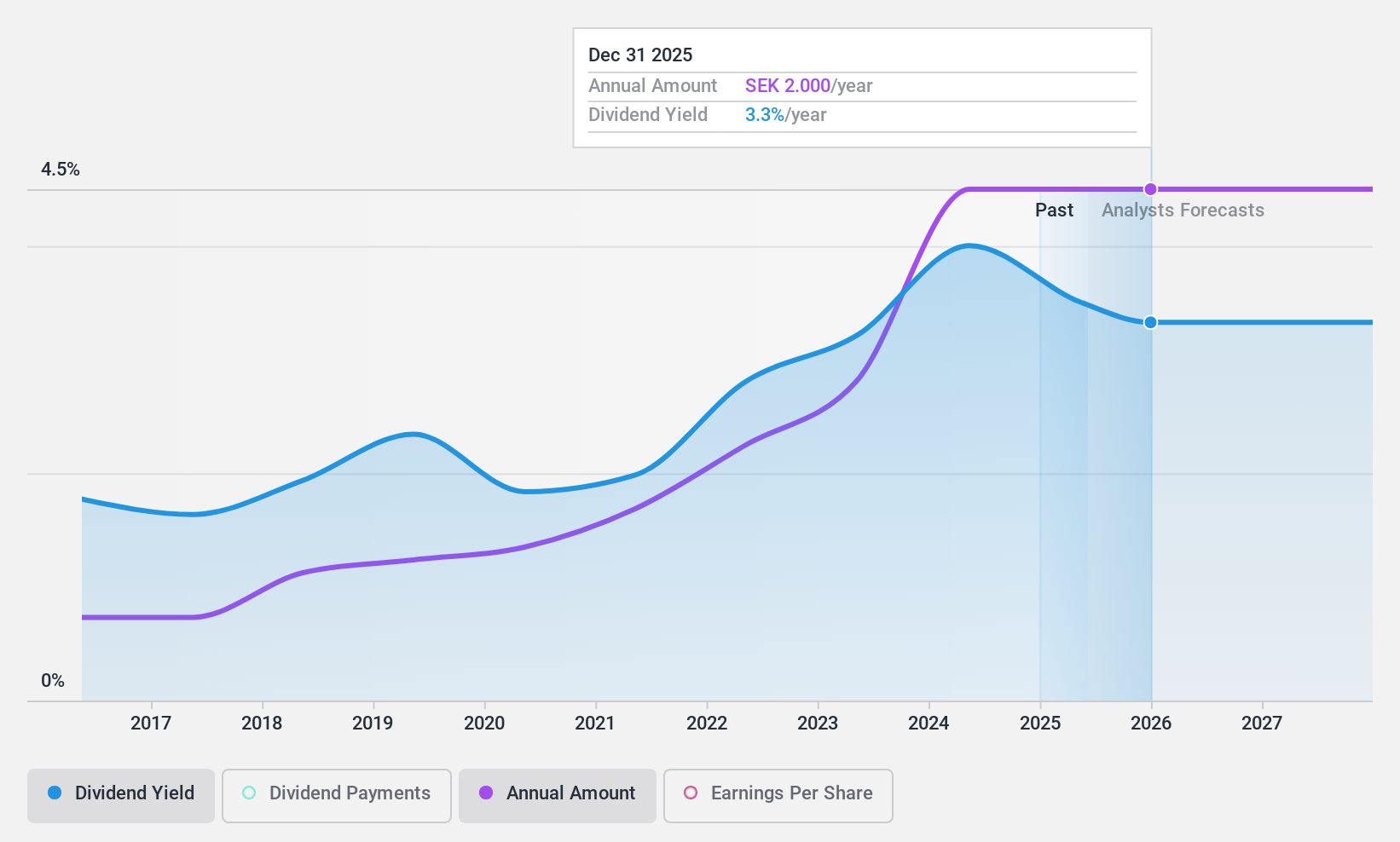

Dividend Yield: 3.8%

Bahnhof AB's dividend yield of 3.82% is below the top tier in Sweden and not well covered by earnings, with a high payout ratio of 93.8%. However, dividends have been stable and growing over the past decade. Recent earnings growth of 14.6% highlights profitability, but sustainability concerns remain due to insufficient coverage by cash flows despite a reasonable cash payout ratio of 72.6%. The stock trades significantly below its estimated fair value, suggesting potential undervaluation.

- Click here and access our complete dividend analysis report to understand the dynamics of Bahnhof.

- According our valuation report, there's an indication that Bahnhof's share price might be on the cheaper side.

Where To Now?

- Dive into all 1858 of the Top Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Roche Bobois, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RBO

Roche Bobois

Engages in the furniture design and distribution business worldwide.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives