- Sweden

- /

- Telecom Services and Carriers

- /

- NGM:OPT

OptiMobile's(NGM:OPT) Share Price Is Down 14% Over The Past Year.

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the OptiMobile AB (publ) (NGM:OPT) share price slid 14% over twelve months. That contrasts poorly with the market return of 20%. Because OptiMobile hasn't been listed for many years, the market is still learning about how the business performs. Unfortunately the last month hasn't been any better, with the share price down 28%. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for OptiMobile

OptiMobile recorded just kr4,893,948 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. Investors will be hoping that OptiMobile can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

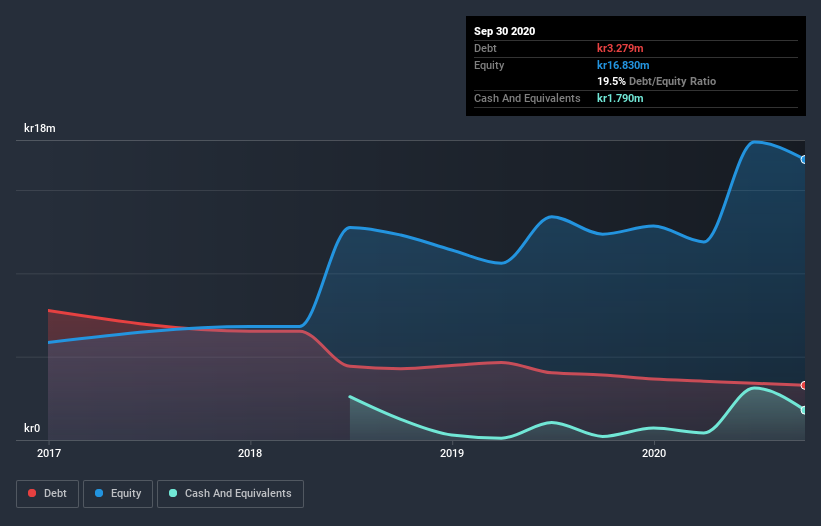

OptiMobile had liabilities exceeding cash by kr4.4m when it last reported in September 2020, according to our data. That puts it in the highest risk category, according to our analysis. But with the share price diving 14% in the last year , it's probably fair to say that some shareholders no longer believe the company will succeed. You can see in the image below, how OptiMobile's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. You can click here to see if there are insiders selling.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between OptiMobile's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that OptiMobile's TSR, at -3.1% is higher than its share price return of -14%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While OptiMobile shareholders are down 3.1% for the year, the market itself is up 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Notably, the loss over the last year isn't as bad as the 19% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 5 warning signs for OptiMobile (4 are a bit unpleasant!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you’re looking to trade OptiMobile, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NGM:OPT

OptiMobile

OptiMobile AB (publ) develops and provides software solutions to mobile operators in Sweden.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives